Snap Inc (NYSE:SNAP) shares are trading higher Thursday morning after the company posted strong third-quarter results and announced a major artificial intelligence partnership. Here’s what investors need to know.

- SNAP stock is racing ahead of the pack. See the trading setup here.

What To Know: Snap beat analyst expectations with quarterly revenue of $1.51 billion versus estimates of $1.49 billion, and a quarterly loss of 6 cents per share versus estimates for a 12-cent loss. The company also announced a new $500 million stock repurchase program.

Fueling further optimism, Snap revealed a $400 million deal with Perplexity AI. The partnership will integrate Perplexity’s conversational search engine directly into Snapchat, rolling out in early 2026. Snap will receive $400 million over one year through a combination of cash and equity.

Following the news, JPMorgan raised its price target on Snap to $8 from $7, citing the Perplexity deal. However, the firm maintained its Underweight rating, pointing to user and large advertiser headwinds, as well as pressured ad spending from large North American clients. The firm stated it wants to see more consistent execution and improved user trends.

JPMorgan’s caution is also influenced by expected near-term headwinds to user growth. The note projects fourth-quarter Daily Active Users will decline due to factors including new platform-level age verification to remove users under 13 and infrastructure changes in regions with lower monetization potential.

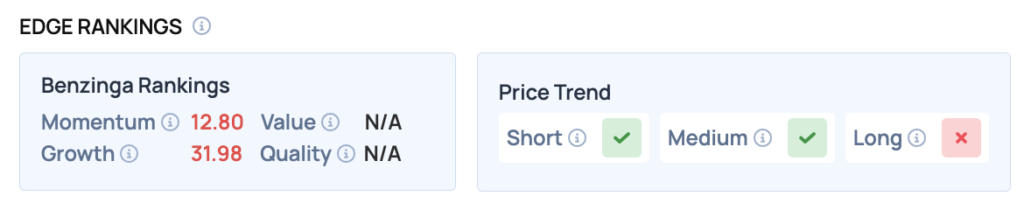

Benzinga Edge Rankings: According to Benzinga Edge rankings, Snap currently has a Growth score of 31.98 and a positive short- and medium-term price trend.

SNAP Price Action: Snap shares were up 15.89% at $8.46 at the time of publication on Thursday, according to Benzinga Pro data.

Read Also: Stock Market Today: Dow Jones, Nasdaq Futures Slide As Supreme Court Questions Trump’s Tariffs

How To Buy SNAP Stock

By now you're likely curious about how to participate in the market for Snap – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock