Smithfield Foods, Inc. (NASDAQ:SFD) reported in-line earnings for the second quarter on Tuesday.

The company posted quarterly earnings of 55 cents per share which met the analyst consensus estimate. The company reported quarterly sales of $3.786 billion which beat the analyst consensus estimate of $3.630 billion.

For fiscal year 2025, the company has updated its financial outlook, showing increased optimism in some areas while maintaining a steady course in others.

It is reaffirming its expectation for total company sales to grow by a low-to-mid-single-digit percentage compared to fiscal year 2024. This projection specifically excludes the sales impact from the Hog Production segment's transactions with Murphy Family Farms and VisionAg.

“Our strong second quarter results demonstrate the agility and resilience of our business as we navigate a dynamic macroeconomic environment. Through our iconic and diversified brand portfolio, our Packaged Meats segment is delivering on consumers’ needs for quality protein at a great value. Our Fresh Pork segment is adeptly navigating a dynamic tariff environment, and our Hog Production segment continues to grow profitability,” said Smithfield President and CEO Shane Smith.

Smithfield Foods shares jumped 2.7% to trade at $25.17 on Wednesday.

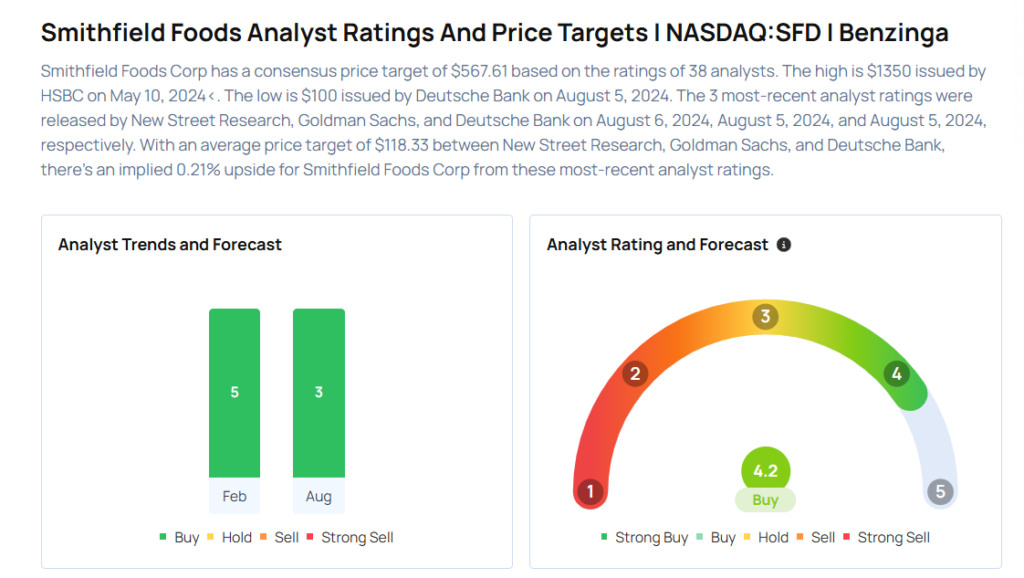

These analysts made changes to their price targets on Smithfield Foods following earnings announcement.

- UBS analyst Manav Gupta maintained Smithfield Foods with a Buy and raised the price target from $25 to $28.5.

- Barclays analyst Benjamin Theurer maintained the stock with an Overweight rating and raised the price target from $28 to $30.

- Morgan Stanley analyst Dara Mohsenian maintained Smithfield Foods with an Overweight rating and raised the price target from $29 to $30.

Considering buying SFD stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

.png?w=600)