/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Intel (INTC), which seemed like dead money just a few months back, has had a reversal of fortunes. Over the last month, SoftBank (SFTBY), the U.S. government, and Nvidia (NVDA) have announced billions of dollars in investment in the once-iconic chip giant. Think of it this way, one of the world’s largest investment funds, the country with the largest GDP, and the biggest company on the planet have all taken a stake in Intel. In this article, we’ll examine what’s driving this investment frenzy in Intel and whether the stock is still a buy.

Why Have the U.S. Government, SoftBank, and Nvidia Invested in Intel?

Despite its waning importance, Intel is still a key piece of the manufacturing onshoring story that President Donald Trump is pushing hard for. Chips are the bedrock of the artificial intelligence (AI) revolution, and as Intel CEO Lip-Bu Tan aptly put it, Intel is the “only semiconductor company that does leading-edge logic R&D and manufacturing in the U.S.” In the same statement that announced the U.S. government’s investment in Intel, Tan added, “Intel is deeply committed to ensuring the world’s most advanced technologies are American-made.”

To put it simply, the U.S. government has a stake in Intel’s success given the company’s strategic importance.

As for SoftBank and Nvidia, there could have been a nudge from the Trump administration to back Intel, even as Nvidia has denied that the administration was involved in its decision. Incidentally, SoftBank committed to invest $100 billion in the U.S. following a meeting with Trump last year, and the Intel investment is part of that. Commenting on Nvidia’s investment in Intel, CEO Jensen Huang said that it “tightly couples NVIDIA’s AI and accelerated computing stack with Intel’s CPUs and the vast x86 ecosystem,” terming it “a fusion of two world-class platforms.”

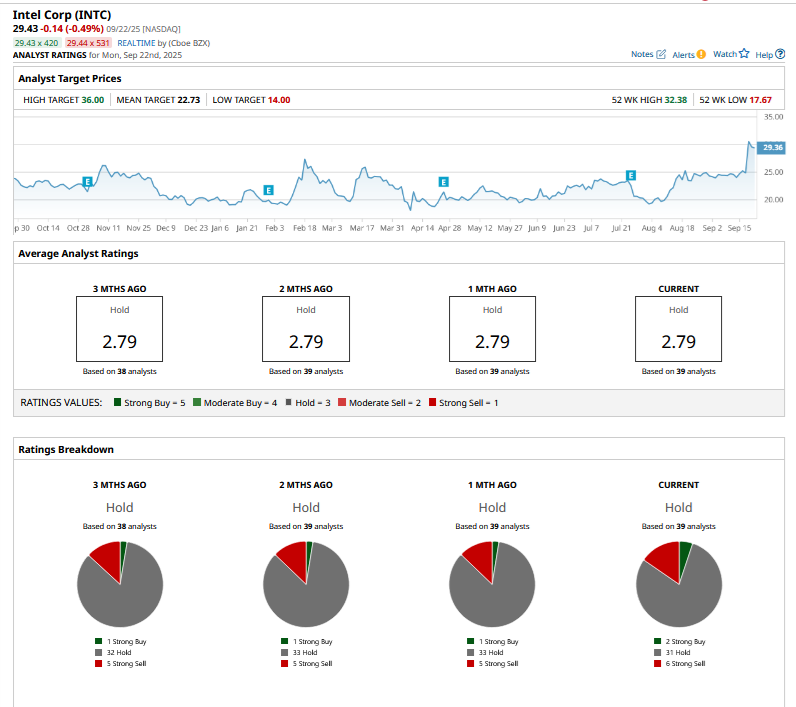

INTC Stock Forecast

Several analysts have raised Intel’s target price over the last month. Looking at the most notable ones, UBS raised its estimate from $25 to $35 while Barclays revised its from $19 to $25. However, Citi and Benchmark have conflicting opinions over INTC, and while the former downgraded the stock to a “Sell” equivalent, Benchmark upgraded Intel to a “Buy,” raising its target price to a Street-high of $43.

The divergence is driven by how these companies perceive the Intel-Nvidia partnership unfolding. While Citi does not believe that the partnership will move the needle much for Intel and argues that the current valuations bake in a turnaround in the company’s foundry business, Benchmark sees the partnership as a “watershed” moment for Intel.

The overall Street sentiment remains quite somber, though, and the majority of analysts rate INTC as a “Hold” or some equivalent while the stock continues to trade above what the average sell-side analyst believes it is worth.

Should You Buy INTC Stock Despite the Surge?

I won’t harp much on SoftBank’s investment in Intel, as while it does bring much-needed cash to the company’s coffers, it is not a strategic investment. However, the backing from the U.S. government and Nvidia is quite strategic in nature. While Intel won't be making top-end AI chips for Nvidia in its foundries yet, it’s a possibility that cannot be ruled out in the future.

The market’s reaction to the flurry of investments that Intel has bagged, particularly from Nvidia, is not out of place, as they will be enablers in Intel’s turnaround. As for valuations, Intel’s forward price-to-earnings ratio won’t tell the complete picture, as the company’s profitability is currently depressed. It, however, trades at an enterprise value-to-sales multiple of 3.3x, which, while being higher than the average multiple over the last three years, is not exorbitant. Also, Intel trades at just under 1.3x its book value, which gives some comfort in its valuations.

Overall, Intel now has nearly everything it could have reasonably asked for in its turnaround – plenty of fresh cash, a supportive U.S. government, and a partnership with Nvidia. The ball is now in the company’s court to show visible progress, as so far, the measures haven’t really helped buoy sentiment much.

I continue to stay invested in Intel and find it fairly priced given the recent developments. I, however, expect some selling pressure in the days ahead as the momentum from the flurry of investments loses steam – unless, of course, we get more good news on that front. The stock, however, is a “buy on dips” story as the transformation could now get into top gear with the fresh investments.