It's been more than eight and a half years since Dish Network came up with the idea, then novel, to package a skinny bundle of pay TV channels in a cheap, easy-to-sign-up-for, even-easier-to-quit OTT package.

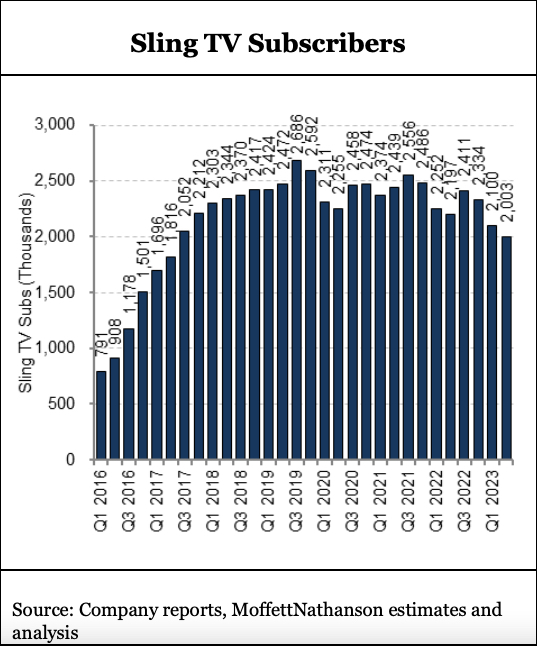

By the fall of 2017, despite a UX that even Dish conceded was pretty terrible, Sling TV had surpassed 2 million paid users.

And that's when the growth story pretty much ended.

Also read: Dish Network Loses 284,000 Subs as Second-Quarter Profits Drop

On Tuesday, Dish revealed that Sling TV had lost another 97,000 subscribers in the second quarter -- a performance worse than the 55,000 lost customers in Q2 2022.

That puts Sling TV at just over 2 million remaining users. Hulu + Live TV, which launched more than two years after Sling TV, finished March with 4.4 million subscribers. (Disney will report updated Hulu quarterly customer numbers Wednesday.)

Google doesn't often break out subscriber numbers for YouTube TV, which also arrived two years following Sling's February 2015 debut. But with the addition of NFL Sunday Ticket, the equity analysts at Lightshed Partners estimate that the virtual MVPD has amassed around 6.6 million subscribers.

This scale, of course, matters -- it's the only real hedge operators have in terms of negotiating down spiraling content carriage and retransmission costs.

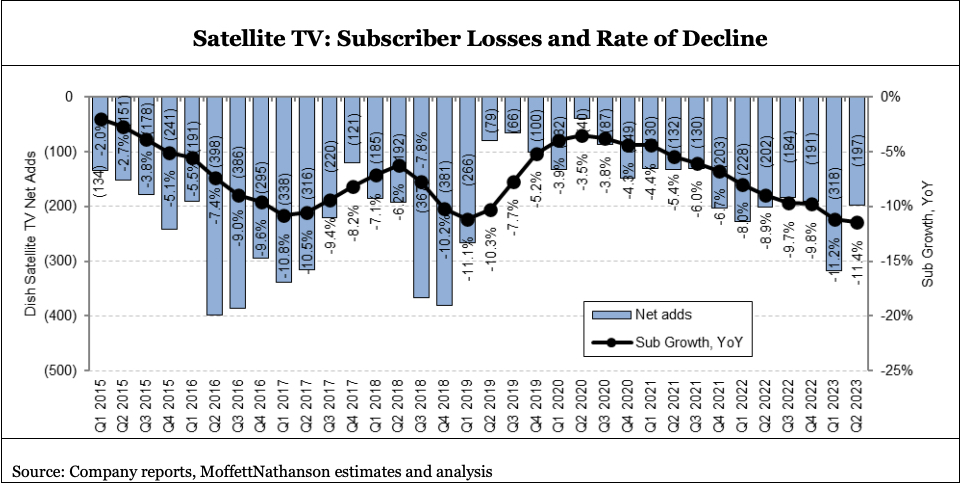

Sling TV negotiations are tied into the existing scale of Dish satellite TV, but that base is eroding pretty fast. Dish linear satellite lost another 197,000 users in the second quarter, and the platform is now decaying at a rate of 11.4% annually.

That's an acceleration from the all-time high rate of 11.2% registered in Q1.

All told, Dish has less than 9 million remaining pay TV subscribers across both satellite and vMVPD platforms. Dish remains the fourth biggest supplier of pay TV in America, trailing Comcast, Charter Communications and DirecTV ... with YouTube TV threatening to ultimately surpass it.

For its part, Dish is scrambling to complete the pricy buildout of its 5G network and stay out of bankruptcy court. Tuesday's announcement that Dish Chairman Charlie Ergen is recombining Dish with his infrastructure division, EchoStar, means Dish will have access to the EchoStar's balance sheet ... and $1.7 billion in cash on hand.

Pay TV is merely a (failing) cash-generating part of that equation.

The $1.7 billion "is not enough because… well, there’s a hole in the bucket," wrote equity analyst Craig Moffett Tuesday.

"Dish’s free cash flow, even with slower capital spending, is now firmly in negative territory," he added. "The once-core satellite TV business is imploding. The once-savior Sling TV is shrinking. The springboard-to-wireless Boost pre-paid business is unraveling. The transition-to-post-paid Boost Infinite is years delayed and nowhere to be seen. Consolidated EBITDA cratered by more than 40% YoY."