Beauty Health Company (NASDAQ:SKIN) stock witnessed a 20.75% surge during after-hours trading on Thursday.

Check out the current price of SKIN stock here.

What Happened: The stock of Beauty Health, the parent company of the Hydrafacial brand, soared to $1.92 during after-hours trading, following the release of its second-quarter financial results. The company’s stock had closed at $1.59 earlier in the day, according to Benzinga Pro data.

The California-based company’s financial results for the second quarter, which ended on June 30, achieved $78.2 million in the quarter. Though the revenue decreased 13.7% from the previous year, it surpassed the estimated $74.50 million. The company’s gross margin and adjusted gross margin showed significant improvement, primarily due to a shift toward consumable net sales, according to the company's press release..

Beauty Health’s net income for the quarter was $19.7 million, a substantial increase from $0.2 million in the same quarter of the previous year. The company’s adjusted EBITDA also improved significantly, reaching $13.9 million compared to a loss of $5.2 million in the second quarter of 2024.

See Also: Just In: Crypto.com Suspends These Withdrawals, Deposits On Solana Chain

Attributing to the revenue model, Marla Beck, Beauty Health CEO, stated, " With over 35,000 active devices now in the field and consumables driving more than 70% of revenue, we're seeing the power of our recurring revenue model."

With a volume of 2.57 million shares, above its average of 1 million, the stock held a market cap of $200.33 million today. SKIN traded between $0.78 and $2.38 over the past 52 weeks.

Why It Matters: The company’s strong financial performance in the second quarter of 2025, along with its successful launch of the HydraFillic with Pep9™ Booster, has instilled confidence in its long-term prospects. Following the impressive second-quarter results, Beauty Health has raised its full-year guidance, projecting net sales of $285 – $300 million and an adjusted earnings before interest, taxes, depreciation, and amortisation (EBITDA) of $27 to $35 million for fiscal year 2025.

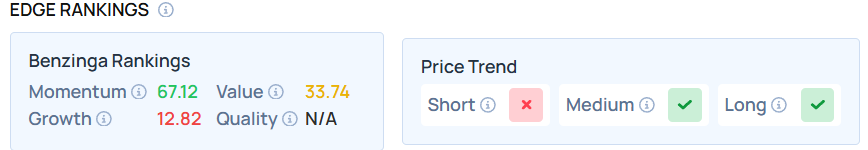

Benzinga’s Edge Stock Rankings indicates SKIN has a Value score of 33.74. Find out the stock value of skin-care brands.

Read Next:

Photo Courtesy: PeopleImages.com – Yuri A on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.