Silver has always been global, but it has not always been governed. For decades, the market functioned on openness and assumption. Supply moved freely, refiners were trusted, and documentation was sufficient to keep trade efficient. That framework held because silver, while important, was rarely treated as strategic infrastructure.

That reality is shifting. As silver becomes more deeply embedded in energy systems, electronics, data infrastructure, and advanced manufacturing, oversight naturally follows. Materials that matter tend to attract governance, not because markets want restriction, but because scale demands coordination. The silver market is now entering that phase.

This transition is not about scarcity. It is about structure.

From Open Flow to Managed Markets

As governance increases, silver can no longer be treated as a single, uniform global pool. Fragmentation simply means silver is no longer fully interchangeable, but instead moves through multiple parallel supply streams governed by different regulatory and commercial rules. Export-approved silver, domestically retained silver, recycled silver, and silver designated for specific end uses may all coexist, but they do not move under identical conditions.

This kind of differentiation is not unusual. Similar dynamics appear whenever materials become strategically important. Oil grades trade differently based on quality and delivery constraints. Semiconductors are segmented by export eligibility and node size. Silver is now following a comparable path.

China’s role in this process is best understood through scale rather than politics. As one of the world’s most significant silver processors and refiners, any clarification of oversight or export frameworks naturally draws market attention. The response is mechanical, not adversarial. Market participants recalibrate assumptions that had long gone unchallenged.

The same recalibration would occur if the United States applied tighter frameworks to semiconductors, aerospace alloys, or advanced battery materials. Markets adapt by differentiating supply, not abandoning it.

Where SMX Becomes Essential

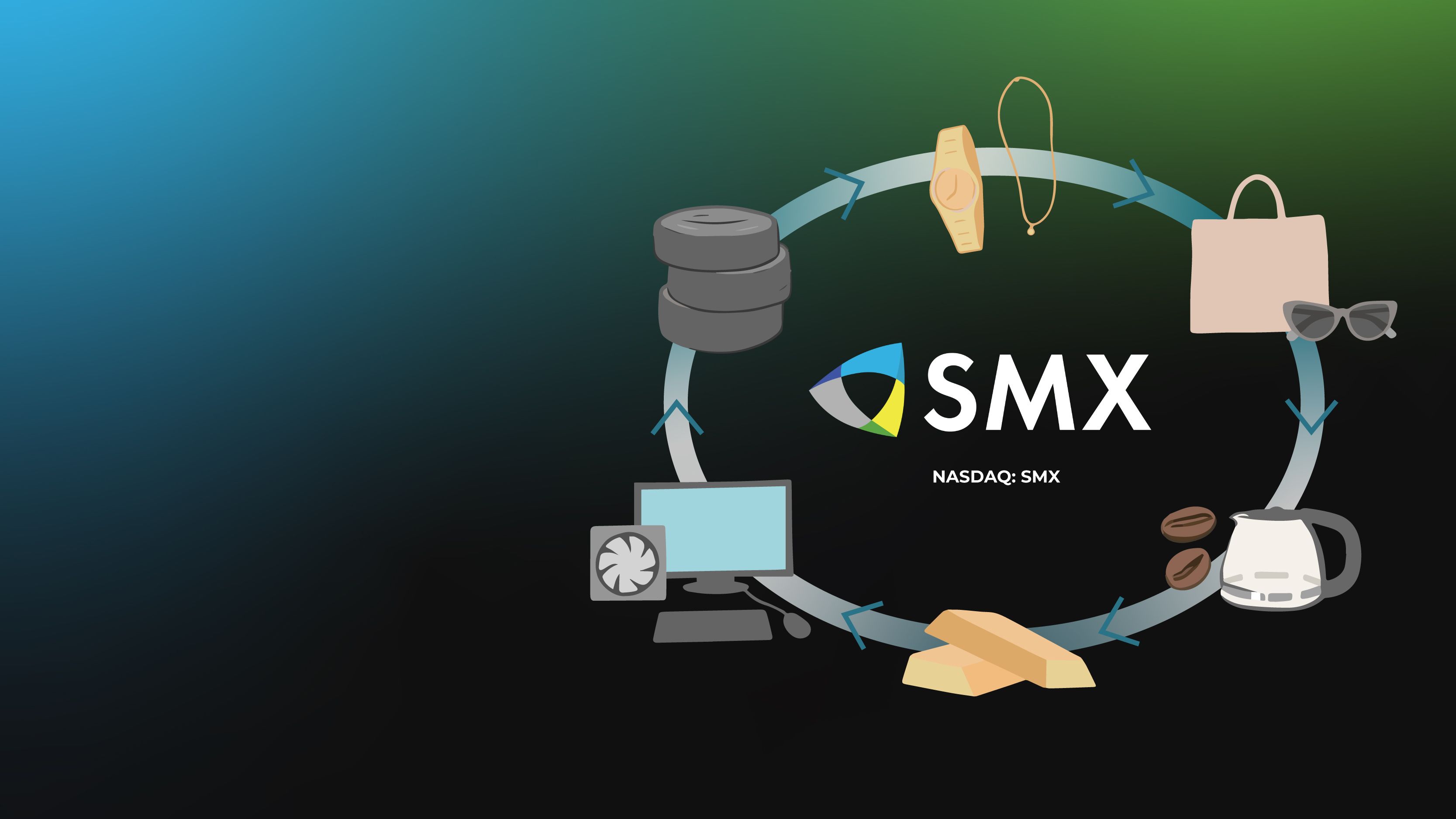

This is where companies like Nasdaq-traded SMX (NASDAQ: SMX) enter the picture as infrastructure, not narrative.

SMX embeds molecular-level identifiers directly into physical materials. Once embedded, that identity becomes inseparable from the metal itself. Origin, processing pathway, compliance status, and custody history travel with the silver, allowing verification without relying solely on documentation or counterparties.

In governed markets, that capability becomes foundational. Trust alone stops scaling once oversight increases. Paper trails still matter, but they are no longer sufficient on their own. Regulators, financiers, and industrial buyers increasingly require proof that can be independently and consistently verified.

SMX does not attempt to override regulation or bypass oversight. It enables regulated markets to function more efficiently by reducing ambiguity rather than adding friction.

Why Verification Creates Winners

As silver supply chains differentiate, market behavior changes. Industrial buyers begin to favor silver that moves predictably and clears regulatory hurdles without delay. Financiers prefer silver that qualifies cleanly for collateral. Insurers price risk more accurately when provenance is clear. Regulators gain confidence when enforcement does not depend on interpretation.

This does not create exclusivity through restriction. It creates preference through clarity.

SMX does not benefit from silver being scarce. It benefits from silver being important enough to manage thoughtfully. By embedding verification into the material itself, SMX supports broad participation rather than artificial bottlenecks.

Recycling further reinforces this need. As primary supply tightens and secondary silver flows increase, ambiguity becomes a liability. Without verification, recycled silver raises questions that buyers and regulators are increasingly unwilling to accept. With embedded identity, recycled silver retains its history, allowing virgin and secondary supply to coexist within regulated frameworks without guesswork or double-counting.

This is not about sustainability messaging. It is about admissibility in systems that require proof.

The Long Arc of Governance

Markets often misunderstand governance as a constraint. In practice, governance is what allows scale to persist. Silver’s recent volatility is not the most important signal. The more durable signal is structural. Silver is transitioning from open flow to managed movement, reflecting its growing importance across modern economies.

Once proof becomes a requirement, it tends to endure. Systems do not revert to assumption once verification is in place. SMX is built for that permanence, positioning its technology squarely within the long arc of how critical materials markets evolve.

Disclaimer: This article is provided for informational purposes only and does not constitute investment advice. The author makes no representation regarding future market performance or the financial prospects of any company mentioned.