With the S&P 500 Index ($SPX) and Nasdaq-100 Index ($IUXX) hitting all-time highs, and Bitcoin (BTCUSD) climbing sharply, it might feel like 2021 again. Meme stocks are back, optimism is high, and earnings have smashed expectations — with 83% of S&P 500 companies beating Q2 forecasts.

But history tells us that this is when markets get vulnerable.

August & September: The Danger Zone

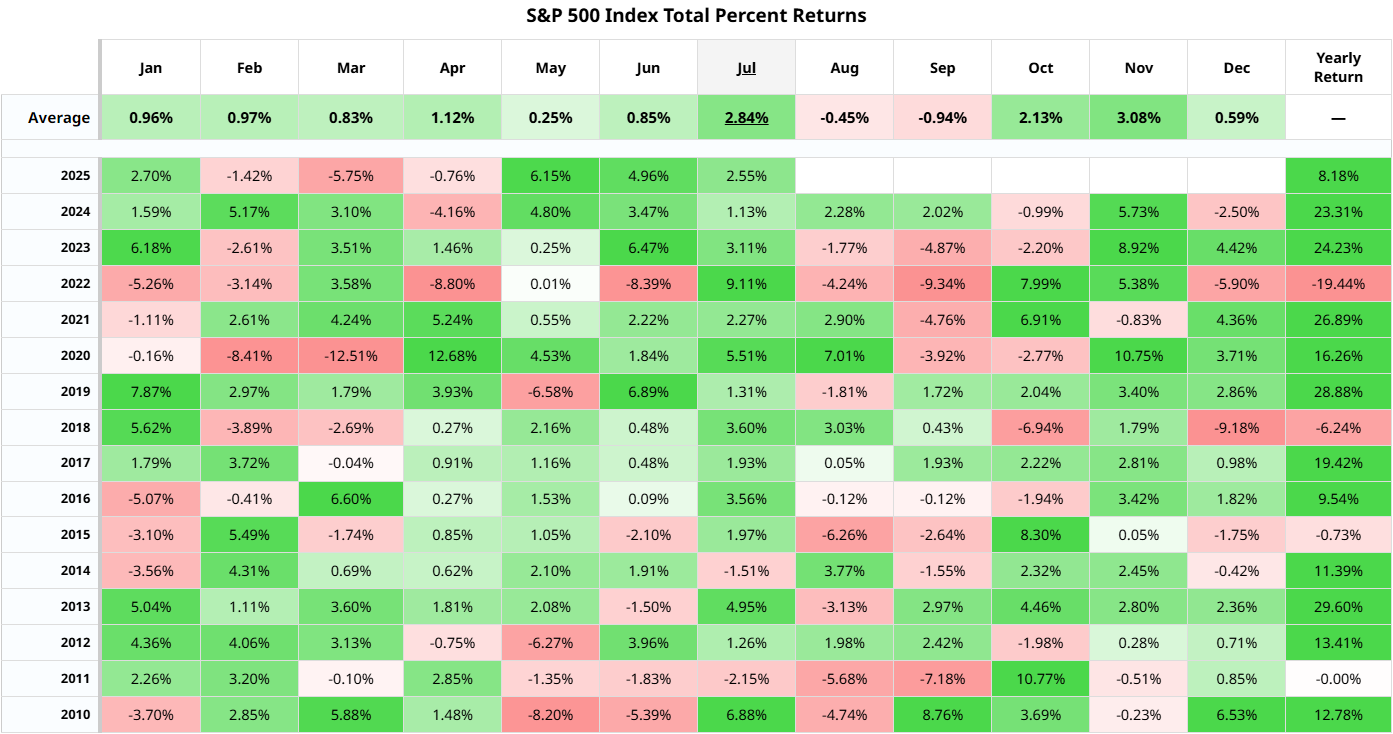

According to seasonal returns data, August and September are the worst-performing months for the S&P 500 since 2010:

- August average return: -0.45%

- September average return: -0.94%

And as we roll into these months, several red flags are emerging.

Mixed Market Signals

Two Charts, Two Very Different Outcomes

A popular chart making the rounds that compares 2025 to 2008 suggests a looming 35% market crash.

Another compares today’s market to 1998, which kicked off a final explosive bull run leading into the dot-com peak.

How will the current bull market play out? No one knows — but here’s what we do know:

Buffett’s Cash Hoard

Warren Buffett isn’t buying stocks; he’s sitting on $347.7 billion in cash at Berkshire Hathaway (BRK.A) (BRK.B).

That’s not fear. It’s discipline. And it may signal fewer stocks worth chasing at current valuations.

Executive Selling

Chairman Jeff Bezos has sold over $5.7 billion in Amazon (AMZN) stock this summer. Nvidia (NVDA) CEO Jensen Huang has unloaded roughly $260 million in shares just during July.

Both execs made their stock sales under prearranged plans, but it’s still notable timing as markets stretch deeper into overbought territory.

Meme Stocks Return

Kohl’s (KSS) rallied nearly 50% in a week and Opendoor (OPEN), previously at risk of delisting, has surged more than 290% in July alone.

Fundamentals? Weak. Hype? Strong. And that mismatch feels eerily familiar.

Watch the Clip + Get Ahead of the Crowd

So is this the continuation of the summer rally… or the start of a bigger reversal? Watch our quick breakdown, and decide for yourself.

What Should Investors Do?

While some argue this rally has more legs, others are trimming positions and watching the macro environment, Fed policy, and geopolitics carefully.

This isn’t a time to panic, but it’s definitely a time for investors to be mindful of their positioning.

Use these Barchart tools to stay one step ahead:

- Technical Indicators: RSI, Put-Call Ratios, Trend Seeker®

- Barchart Screeners: Find strong trends and spot potential reversals

- Barchart Opinions & Top Trade Alerts: View automated technical signals