/Semiconductor%20close%20up%20by%20Yosi%20Azwan%20via%20iStock.jpg)

Cadence Design Systems (CDNS) is in focus this Monday ahead of its upcoming Q2 2025 earnings report, scheduled for release after today’s closing bell. Analysts project non-GAAP earnings per share (EPS) of $1.57 and revenues between $1.25-1.27 billion, representing an impressive 18.7% year-over-year growth.

Ahead of earnings, the specialized semiconductor design stock set an all-time high price at $335.16 on July 25, reflecting widespread investor optimism going into the Q2 results. CDNS is up 10% year-to-date, outpacing the broader S&P 500 Index ($SPX). The stock ended last week perched above its upper Bollinger Band, suggesting that CDNS shares could be somewhat overbought going into tonight’s earnings.

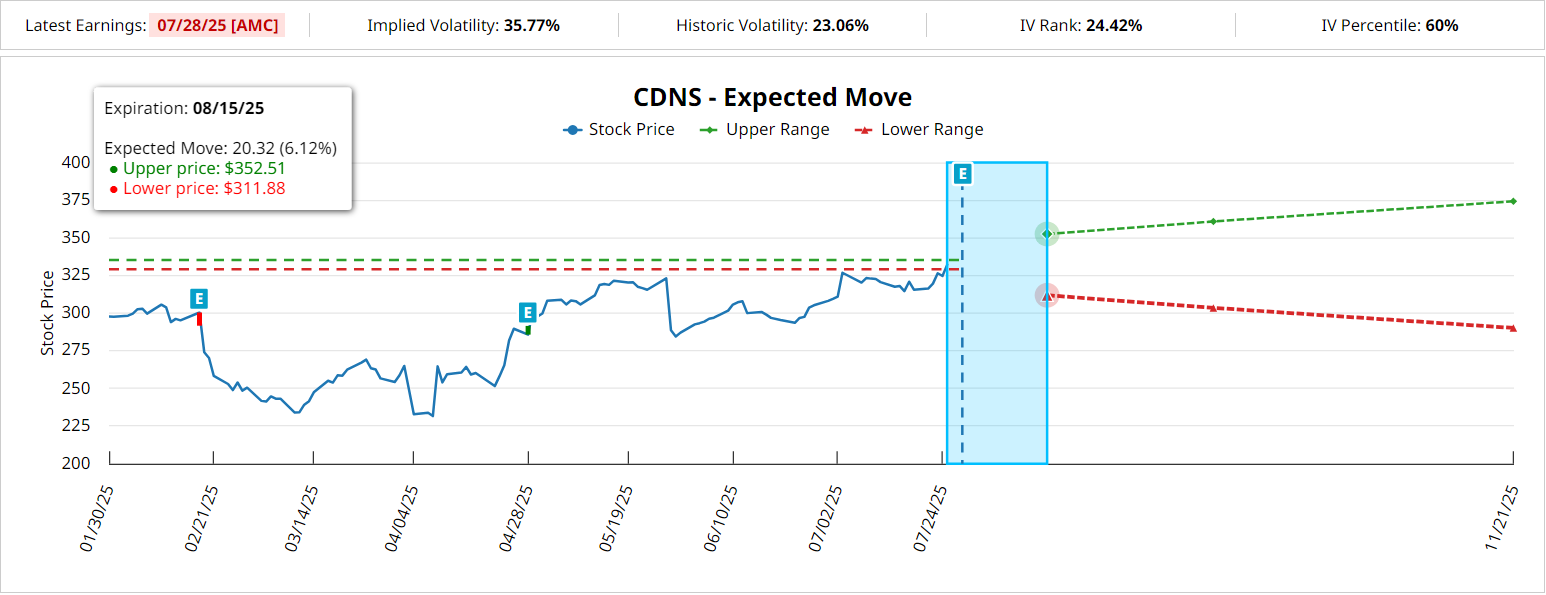

Overall, the options market is pricing in a post-event price swing of 6.12% in either direction for Cadence stock, which is less dramatic than its average earnings reaction of 7.41% over the past four quarters.

Inside the Chip Business at CDNS

While the rally in CDNS raises the odds for a “sell the news” earnings reaction, the stock’s strength has been driven by positive results in its core electronic design automation (EDA) business, which boasts exceptional gross profit margins of 86%. The EDA business has been booming amid increasing demand in the artificial intelligence (AI), hyperscale, and automotive markets.

Cadence's AI portfolio, which includes Cerebrus, Verisium AI, and Allegro X AI solutions, has experienced rapid adoption as system companies develop next-generation AI products. The System Design and Analysis division shows promising momentum, driven by solutions like Allegro X and AI-powered Substrate Router, while the IP business division is projected to achieve 26.5% year-over-year growth due to rising demand for AI and chiplet solutions.

However, there are over potential distortions to Q2 results due to U.S.-China tech tensions and export restrictions, with Cadence and peer Synopsys (SNPS) cleared to resume exports to the mainland as recently as July 3.

Is CDNS Stock a Buy?

Recent analyst upgrades for CDNS have boosted investor confidence, with Loop Capital raising its price target to $370 and Goldman Sachs initiating coverage with a “Buy” rating and ambitious $380 target. The company's strategic partnerships with industry leaders like Nvidia (NVDA), Taiwan Semiconductor (TSM), Qualcomm (QCOM), and Intel (INTC) position it favorably for continued growth in the rapidly growing semiconductor space, and the stock boasts a “Strong Buy” rating overall from the 19 analysts in coverage.

With a substantial backlog of $6.4 billion and current remaining performance obligations (RPO) of $3.2 billion as of the most recent quarter, the company demonstrates strong business momentum despite macroeconomic uncertainties. The ratable software model and expanding relationships with foundry partners further strengthen Cadence's market position.

That said, ongoing macroeconomic uncertainties and export control issues with China warrant monitoring - and at current prices, investors should be particularly wary of jumping on the CDNS bandwagon ahead of earnings. In addition to the typical event risk associated with quarterly earnings, the stock’s rally appears somewhat stretched right now, which raises the odds for a negative post-event reaction.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Elizabeth H. Volk had a position in: NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.