It sounds nuts, but you could donate money to the Social Security trust funds if you're searching for a charitable tax write-off or have extra cash. Why?

Social Security is a critical income source for millions of retired Americans. However, that stream of income is set to shrink in the coming years as a growing number of older workers exit the workforce and draw benefits, and the number of younger replacement workers paying into the system dwindles.

Once Social Security’s trust funds run out of money, which could happen as soon as 2033, according to trustees’ estimates, benefit cuts of 21% may have to be implemented. And although lawmakers could take action before then to prevent this from happening, by adjusting the program’s wage cap, for example, or raising the full retirement age for younger workers, it’s by no means certain they will.

But what if there were a way to bolster the program’s trust funds and buy lawmakers more time to figure out a solution to Social Security’s impending financial shortfall? Technically, there is. You can donate money to the Social Security trust funds. After all, people donate to the U.S. Treasury to reduce the national debt; in 2024, Americans donated almost $3 million. But whether it’s worth donating to Social Security is debatable.

The purpose of Social Security's Trust Funds

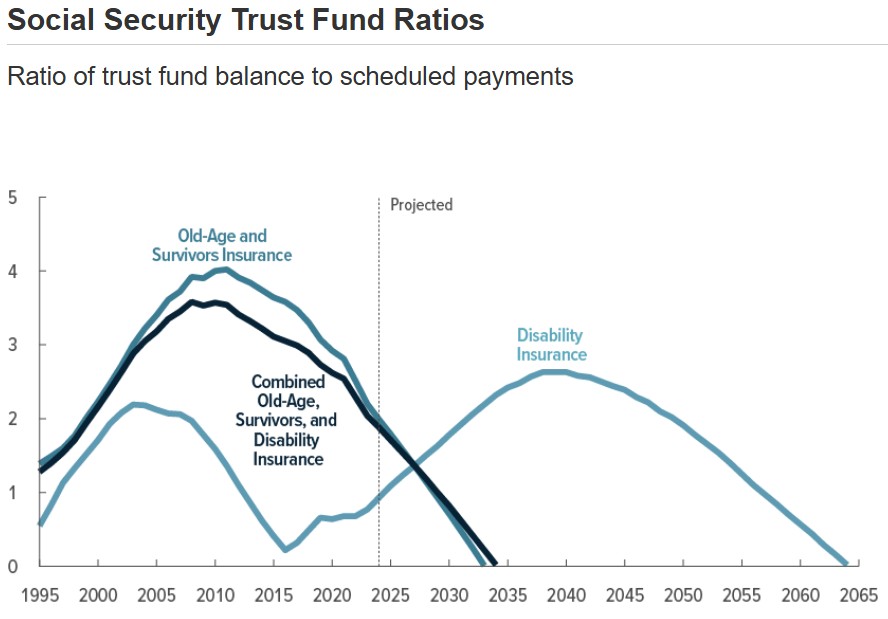

Social Security has two distinct trust funds: the Old-Age and Survivors Insurance (OASI) Trust Fund, which pays retirement and survivor benefits, and the Disability Insurance (DI) Trust Fund, which pays disability benefits. The chart above shows how the OASI fund reaches zero in 2033. That doesn't mean benefits won't be paid; it indicates instead that the amount going into the fund is not keeping up with the amount paid out.

Social Security taxes and other income the program receives are deposited into these accounts, and that money is used to pay benefits and program administrative costs. Any money not used is invested in special Treasury bonds that the U.S. Government guarantees.

How to donate to Social Security

It’s incredibly easy to donate to these trust funds. To do so, write a check to the “Social Security Administration” and include a letter stating that the donation you're giving is unconditional. Be sure to save your records if you plan to claim the donation when you file your taxes.

You can specify which trust fund you want your money to go into. If you don't, your donation will automatically be designated to the OASI fund. You're able to mail your donation to your local Social Security office, deliver it in person, or mail it straight to the SSA Office of Finance, P.O. Box 17042, Baltimore, Maryland 21235. You can also leave a gift to Social Security in your will.

So, should you donate to Social Security?

As you can imagine, donations to Social Security's trust funds are uncommon. Chad Gammon, CFP and Owner at Custom Fit Financial, says: "I have not seen anyone do this and I would think that it would be very rare."

As Gammon explains, donating to Social Security will not increase your future benefits. Rather, the monthly benefits you're entitled to in retirement will depend on your wage history and when you decide to start receiving them.

As he says, "I would gather the reason someone might do this would be that they feel like they would have some social responsibility, and it could be a gift given in their will if they didn't have someone to give to. But even then, I think that would be very rare."

Tyler Meyer, CFP and founder of RetireToAbundance.com, agrees that there's little benefit to donating to Social Security and advises against it.

"There is absolutely no personal gain, and the societal benefit is negligible at best," he says. "The funds don’t increase your own future benefits or have a meaningful impact on the program’s solvency."

Of course, this doesn’t mean that you can’t include charitable giving as part of your estate planning. It also doesn’t mean you can’t be charitable during your retirement years.

Meyer says, “If you’re looking to donate money, there are many great charitable organizations that would be far more worthy of your contribution and can create a tangible, positive impact.”

On a positive note, the Social Security program has never missed a benefit payment due to a lack of funds (administrative errors are a different story). However, the reality is that the clock is ticking down toward an insolvency date unless lawmakers can reach a sustainable solution. And it will certainly take more than a few generous individuals to bail the system out of trouble.