DuPont (DD) is accelerating its breakup strategy in 2025 as the U.S. Securities and Exchange Commission (SEC) has declared the registration effective for the spin-off of its electronics segment, Qnity, now officially set for November 1, 2025. The timing lines up with rapid growth in semiconductors, where global revenue is projected to reach $789.28 billion in 2025. AI demand is a big driver, with the AI chip market projected to reach $92 billion in 2025.

DuPont, a blue-chip dividend stock with 55 consecutive years of dividend payments, sits in the middle of this trend. Trading at $80 with a $32.7 billion market cap, the company reported net sales of $3.26 billion in its latest results, helped by higher volumes across ElectronicsCo and IndustrialsCo.

With the record date approaching and semiconductor demand building, could this be the right time to add shares in this Dividend Aristocrat before the restructuring aims to unlock value? Let’s find out.

DuPont’s Financial Strength Ahead of the Breakup

DuPont has long run a broad materials business, spanning specialty chemicals and advanced solutions across electronics, water, and healthcare.DD stock has been uneven this year. Over the past 52 weeks, shares are down about 8%, reflecting broader caution around the separation, while year-to-date (YTD) they’re up 5%, pointing to a modest rebound in sentiment.

On valuation, the forward price-to-earnings (P/E) sits near 17.9x, a touch above the sector’s 16.6x average, suggesting a small premium for earnings quality and potential growth.

For income-focused holders, the dividend case is straightforward. The yield stands at 2.06% with a 35.33% payout ratio, and the company has raised its dividend for four straight years, with a recent quarterly payment of $0.41 per share.

Operationally, results are solid. Net sales were $3.3 billion, up 3% year-over-year (YoY), with 2% organic growth driven by 4% higher volume offset by 2% lower price, showing demand is improving even as pricing remains a headwind. Strength was led by electronics and healthcare, aligning with where the portfolio is headed post-spinoff.

GAAP income from continuing operations was $238 million, operating EBITDA reached $859 million, GAAP EPS was $0.54, and adjusted EPS was $1.12, highlighting underlying margin health. Cash from operations came in at $381 million, and transaction-adjusted free cash flow was $433 million, supported by $116 million of capex and $168 million of separation costs, which shows the company is funding the split while still converting earnings to cash.

The Fundamentals Driving Future Growth

DuPont’s growth setup going into the Qnity spinoff comes from specific, practical moves that push the business into faster-growing niches. The FilmTec Hypershell XP RO-8038 launch targets dairy processing with a reverse osmosis element built to lift productivity by up to 50% or cut energy use by up to 50% at the same flux, which helps lower operating costs while keeping quality high in milk, whey, and lactose streams. That ties directly to demand for efficient food processing and gives DuPont a clear performance edge in a high-utility market.

The company is also expanding where demand is strongest. The agreement to acquire Sinochem Ningbo RO Memtech adds reverse osmosis manufacturing capacity in China and the Asia Pacific region, bringing production closer to end customers. Localizing the footprint should shorten lead times, improve logistics reliability, help manage supply risk, and reduce emissions tied to transport, all while meeting growing regional demand for FilmTec elements in industrial water purification and reuse.

Sustainability-driven healthcare packaging is another key leg. Through a new collaboration with Olympus, Tyvek with Renewable Attribution will be used in sterile packaging for over 100 single-use endotherapeutic device categories starting in 2026. This move supports more environmentally responsible packaging across a broad device set and leans on DuPont’s materials science strength to scale solutions that meet healthcare quality and sustainability needs.

What Wall Street Is Saying About DuPont

For the third quarter of 2025, management expects net sales to land right around $3.32 billion, with operating EBITDA at about $875 million and adjusted earnings per share close to $1.15. This also includes an estimated $20 million hit from new tariffs, working out to a $0.04 per share drag for the full year, which shows the company is trying to be open about the headwinds it faces.

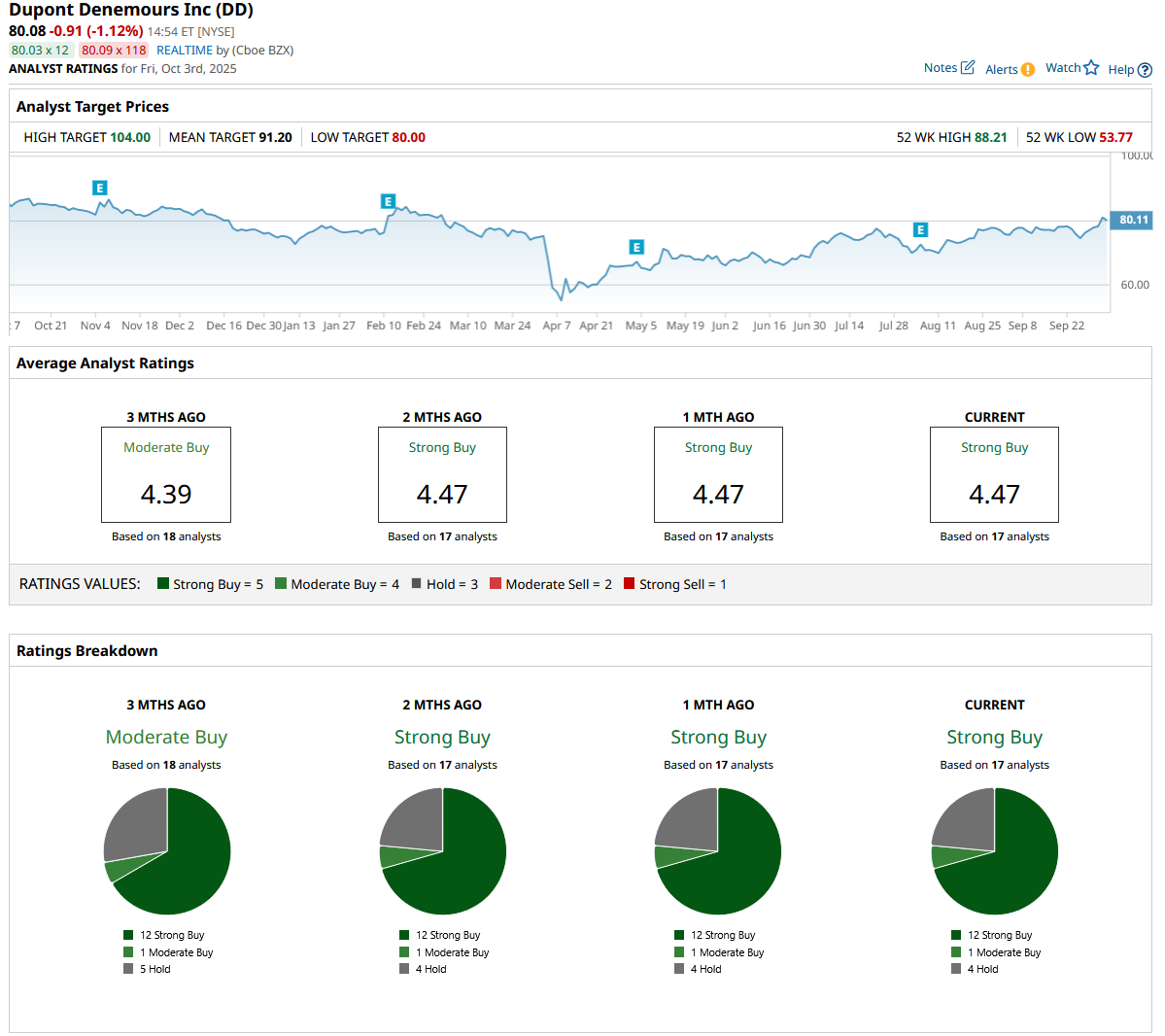

RBC Capital’s Arun Viswanathan recently affirmed his trust in DuPont by repeating a “Buy” call and setting a $90 target for the stock. He points out that the spinoff could leave DuPont a leaner and sharper business, focused more on growing areas like advanced materials and better margins, rather than spreading itself too thin. By moving on from Qnity, DuPont aims to get more efficient and profitable as it keeps its eyes on areas with strong demand.

This bright view is pretty common among analysts. The 17 tracking the stock rate it a consensus “Strong Buy,” and the average target is $91.20. That points to a 14% potential upside from here.

Conclusion

With the Qnity spinoff set for Nov. 1, DuPont looks like a blue-chip dividend stock at an inflection point. The company is more focused, its fundamentals are solid, and Wall Street clearly believes it has upside left in the tank. Trading at just $80 with analysts targeting the low-$90s, investors stepping in now could see both short-term momentum and longer-term value creation as the breakup unlocks efficiencies. While near-term volatility can’t be ruled out, the odds favor DuPont shares grinding higher into and after the spin, making a pre-November entry look more like an opportunity than a risk.