/A%20concept%20image%20showing%20binary%20code%20with%20the%20ERROR%20message_%20Image%20by%20Danich%20Marmai%20via%20Shutterstock_.jpg)

Most investors are amped up about the rise of artificial intelligence (AI), and rightfully so. However, there are other pockets of the tech sector that are flying right now and are worth covering.

One such sector that's seen plenty of love lately is quantum computing. Most investors are aware of the big players in this space. But there are some under-the-radar plays within the quantum computing realm I think are important to touch on.

In this article, I'm going to highlight Arqit Quantum (ARQQ) and why this is a stock investors should pay attention to.

Why Is Arqit Worth a Look?

News this past week that J.P. Morgan (JPM) is looking to make direct venture capital and equity investments in key quantum computing stocks, including Arqit, led to a sharp rally in shares of this relatively undiscovered quantum computing name.

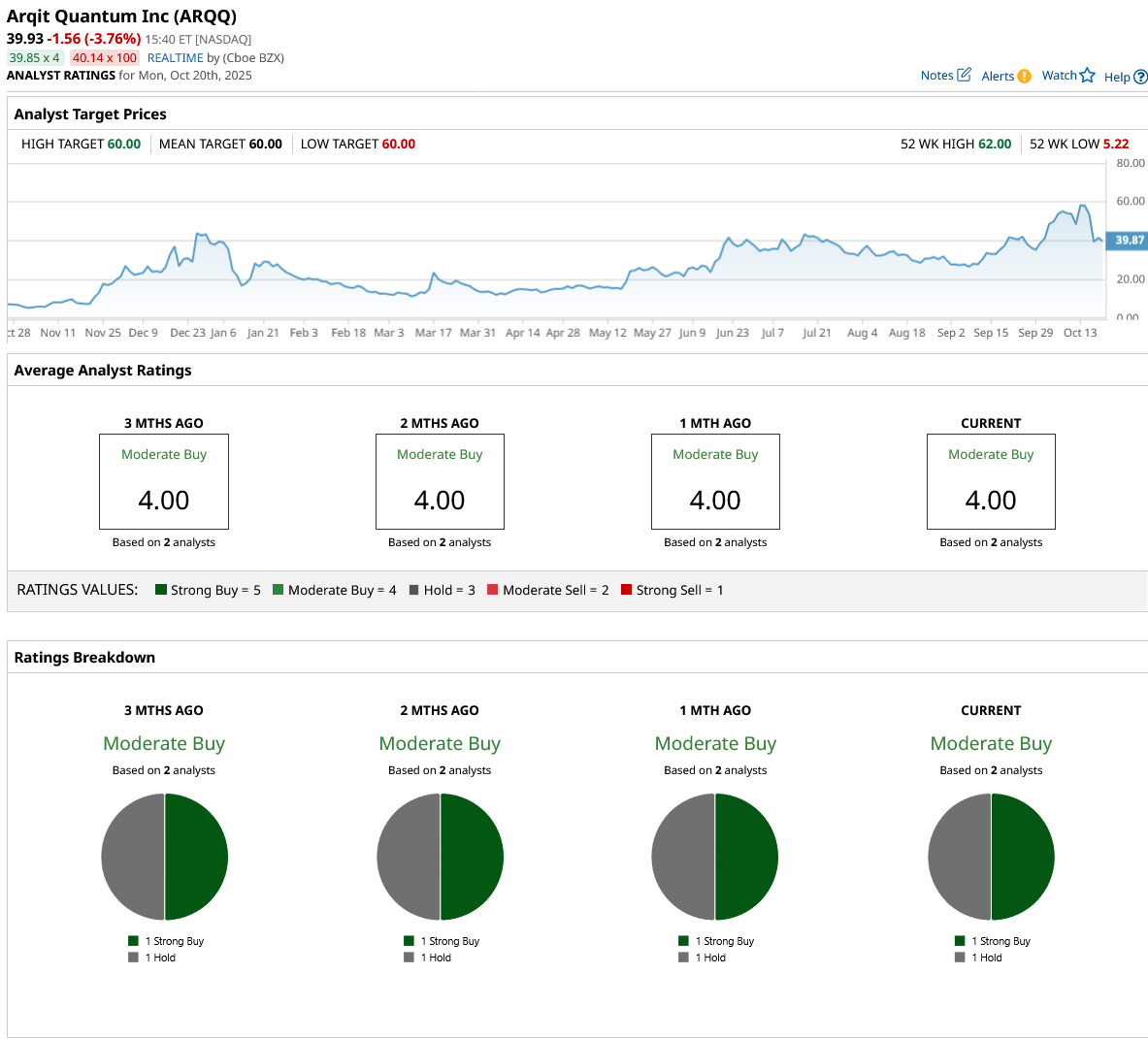

This chart above shows just how violent the move up and down has been following this news. Now, shares of Arqit are still trading much higher than their Q1 and Q2 levels. But the roughly 50% drawdown we've seen in recent days may be concerning to some.

I think some of this has to do with the relatively low volume for shares of ARQQ stock. With roughly one million shares traded daily, it's clear that only a fraction of the company's shares are trading hands. That said, volume has been picking up as this company gets more attention, and I'd think this trend will continue.

The fact that J.P. Morgan is among the leading institutional investors stepping into the quantum computing space in a big way and tapping Arqit as a name they're specifically calling out is good news for investors considering this stock. The question will be whether J.P. Morgan and other banks and institutional money managers choose to follow suit and add exposure to this stock over time. For now, at least, the jury remains out on this front.

What Do the Fundamentals Say?

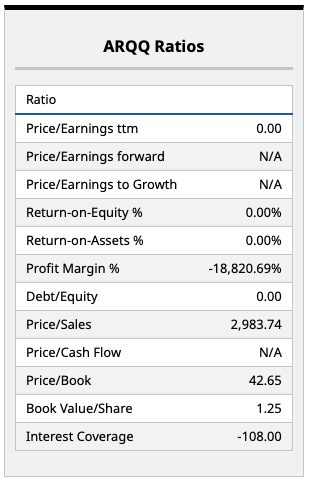

In terms of Arqit's fundamentals, it's apparent that this company is a ways away from profitability. Indeed, that profit margin number alone is one that investors are clearly ignoring. Most who understand the quantum computing sector (at least at a high level) know that there's going to need to be a tremendous amount of capital deployed before real progress takes hold. And while Arqit has made some interesting breakthroughs, this company won't likely buck the spending trend we're seeing in this space, at least not for a few years.

The company's price/sales (P/S) ratio is also astronomical, given the fact that the company's overall revenue is so small. That said, investors today are buying these stocks for a decade or two down the road. Over such a time frame, it's entirely likely that Arqit (valued at a little more than $600 million at the time of writing) could turn out to be a bargain. That is, if this technology is what everyone is making it out to be, perhaps picking up shares of this profitless company before it really turns heads could be the best move.

What Does Wall Street Think?

What's interesting about the consensus price target below is that the two analysts covering this stock both came to the same conclusion—that ARQQ stock should be worth roughly 50% more than it is today.

This kind of upside isn't new for companies in the quantum computing space. But what is different for a company like Arqit is the relative lack of analyst coverage. Having only two analysts covering this name, both of whom put a price target on this stock right around where it was trading after the J.P. Morgan announcement, may seem like not enough upside for some investors. Fair enough on that sentiment.

That said, I still happen to think that 50% upside in any given stock deserves a look, particularly from investors who have a long-term investing time horizon and an appetite for risk. On those metrics, ARQQ stock is one to put on the watchlist. That's precisely what I've done after my initial dive into this name.