Beyond Meat (BYND) shares more than doubled on Monday as meme stock enthusiasts piled into the El Segundo-headquartered plant-based meat alternatives specialist.

As of writing, more than 800 million BYND shares have traded hands on Oct. 20, significantly higher than the firm’s average daily trading volume of nearly 20 million only.

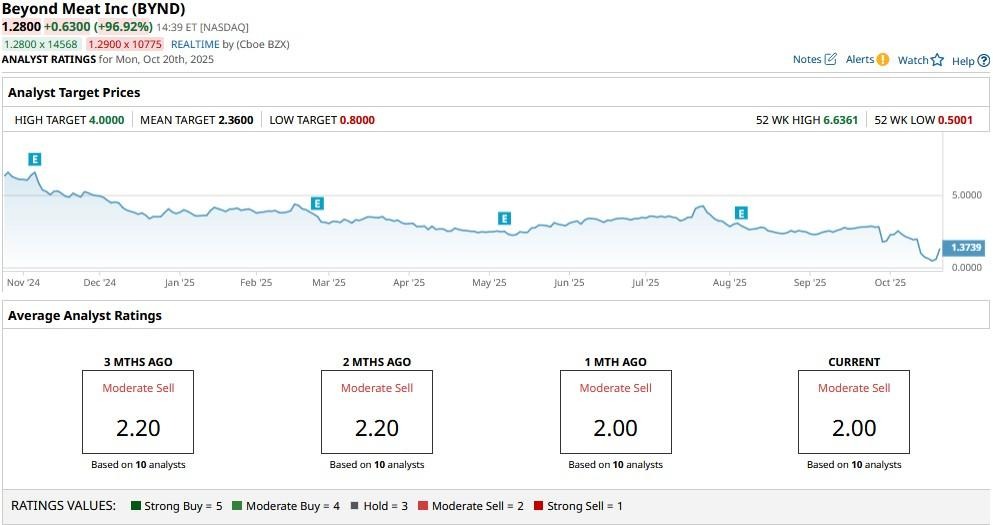

Following today’s explosive rally, Beyond Meat stock is up nearly 200% versus its recent low of $0.50.

Beyond Meat Stock Is Disconnected From Fundamentals

Investors are recommended against chasing the momentum in BYND stock on Monday primarily because the Nasdaq-listed firm remains fundamentally weak heading into 2026.

It’s unprofitable, burning cash, and seeing revenue decline amid waning consumer interest in plant-based meat.

Moreover, meme stock rallies are often short-lived, driven by speculative momentum rather than business strength. History shows that those arriving late to these frenzies often suffer steep losses once the dust settles.

Without a clear turnaround strategy or meaningful institutional support, Beyond Meat’s share price rally looks more like a trading anomaly than a sustainable recovery.

Investors should tread carefully since this may just be more sizzle than substance.

BYND Shares Flag Other Risks as Well

Beyond Meat remains unattractive to own for seasoned investors also because of its penny stock status.

Trading around or below the $1 level is a glaring red flag as it signals severe market skepticism, potential delisting risk, and a lack of confidence in the company’s long-term viability.

BYND’s balance sheet is strained, with mounting losses and limited cash runway. Plus, competitive pressure from traditional meat producers and newer alt-protein startups further clouds its outlook.

In short, retail-driven volatility may offer short-term pops, but the underlying fundamentals remain broken. For long-term investors seeking growth or stability, Beyond Meat shares offer neither.

This isn’t a turnaround story – it’s a cautionary tale.

Wall Street Has a ‘Strong Sell’ Rating on Beyond Meat

Investors should remain wary of loading up on Beyond Meat stock also because it remains out of favor with Wall Street firms.

The consensus rating on BYND shares is currently pegged at “Moderate Sell,”with no dividend either to sweeten the deal for income-focused investors.