Wayfair (W) shares soared about 20% on Oct. 28 after the Boston-headquartered online home goods retailer reported a strong Q3 on market share gains and improved cost discipline.

The company saw its total net revenue increase by 8.1% on a year-over-year basis to $3.12 billion, on $0.70 of adjusted earnings per share (EPS), both handily above Street estimates.

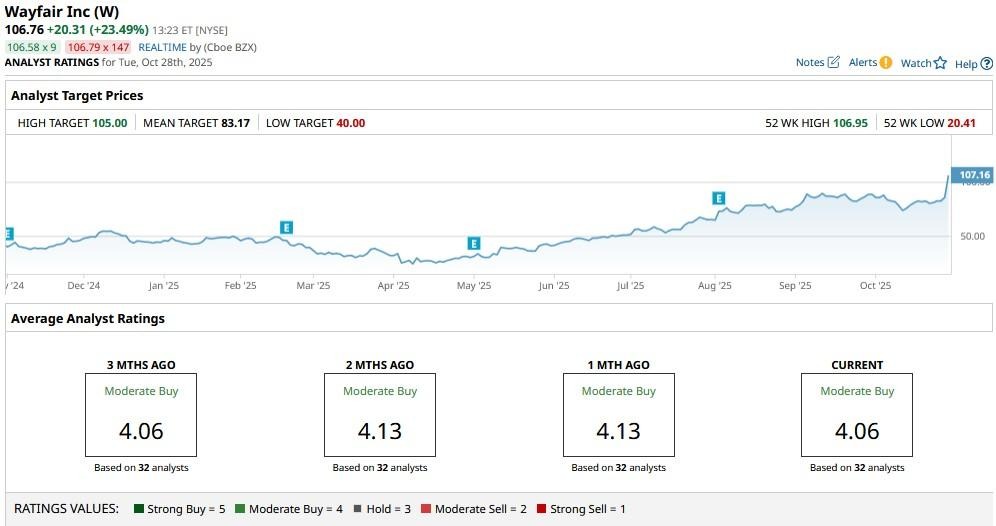

Following the post-earnings surge, Wayfair stock is up a remarkable 420% versus its April low.

Why You Shouldn’t Buy W Stock into the Post-Earnings Strength

Despite earnings momentum, several macroeconomic concerns warrant caution in playing W stock at current levels.

For starters, higher tariffs under President Donald Trump remain a key overhang on Wayfair since the company sources significant inventory from China.

This could hurt its margins and pricing power moving forward. Moreover, the U.S. housing market may remain subdued in 2026, further affecting demand for home furnishings and decor.

For Wayfair, these are meaningful headwinds given it’s already burning cash at a rapid pace.

Beyond the headline numbers, the NYSE-listed firm lost $99 million in its fiscal Q3, which was actually higher than $74 million net loss it posted in the same quarter last year.

Other Risks Surrounding Wayfair Shares Heading into 2026

Investors should keep on the sidelines in Wayfair shares also because their valuation appears rather stretched following an explosive rally over the past six months.

More importantly, insiders have predominantly been selling the stock since early April, indicating lack of confidence in the company’s long-term prospects and valuation upside.

In its third financial quarter, the online home goods retailer saw 2.3% year-over-year decline in active customers, which signals customer retention risk as well.

How Wall Street Recommends Playing Wayfair

Wall Street estimates also currently warrant treading with caution on Wayfair stock following the post-earnings rally.

According to Barchart, the consensus rating on W shares remains at “Moderate Buy” but even the highest price target of $105 no longer indicates meaningful further upside from here.