/Alibaba%20by%20testing%20via%20Shutterstock.jpg)

Alibaba (BABA) shares have pushed higher in recent sessions after coming in handily above Street estimates in its fiscal second quarter on rising momentum in the giant’s e-commerce business.

Robust growth in the cloud-computing business and divestment of Trendyol (a Turkish e-commerce platform) also helped strengthen the company’s Q2 as well, according to its earnings release.

Alibaba stock has been in a sharp uptrend over the past two months. At writing, the China-based company is trading more than 30% above its July low.

Alibaba Stock Stands to Benefit From AI Mania

Investors have responded positively to BABA earnings because they confirm the giant is investing prudently in artificial intelligence without compromising on the core e-commerce business.

The e-commerce segment came in meaningfully up on a year-over-year basis, not just in China but internationally as well, while the cloud business posted an exciting 26% growth in Q2.

“Driven by robust AI demand, [our] Cloud Intelligence Group experienced accelerated revenue growth, and AI-related product revenue is now a significant portion of revenue from external customers,” Eddie Wu, the company’s chief executive officer said in the earnings release.

Wu’s remarks are significant since the cloud unit is broadly viewed as Alibaba’s key to monetizing artificial intelligence and, therefore, a key driver of future growth for BABA shares.

BABA Shares Could Rally Further to $170

JPMorgan analyst Alex Yao maintained his “Buy” rating on Alibaba shares following the earnings and raised his price target to $170, indicating potential upside of another 25% from current levels.

According to him, the Chinese company’s quick commerce operations have adequate scale to drive efficiency gains, which could unlock meaningful further upside in its share price moving forward.

Note that Alibaba’s management is committed to gross merchandise value (GMV) of 1 trillion for quick commerce within the next three years.

Additionally, the NYSE-listed firm is reportedly developing a new AI chip that Yao believes could prove a tailwind for BABA stock as well. Alibaba also currently pays a dividend yield of 0.77%.

Alibaba Is a ‘Buy’-Rated Stock Among Wall Street Analysts

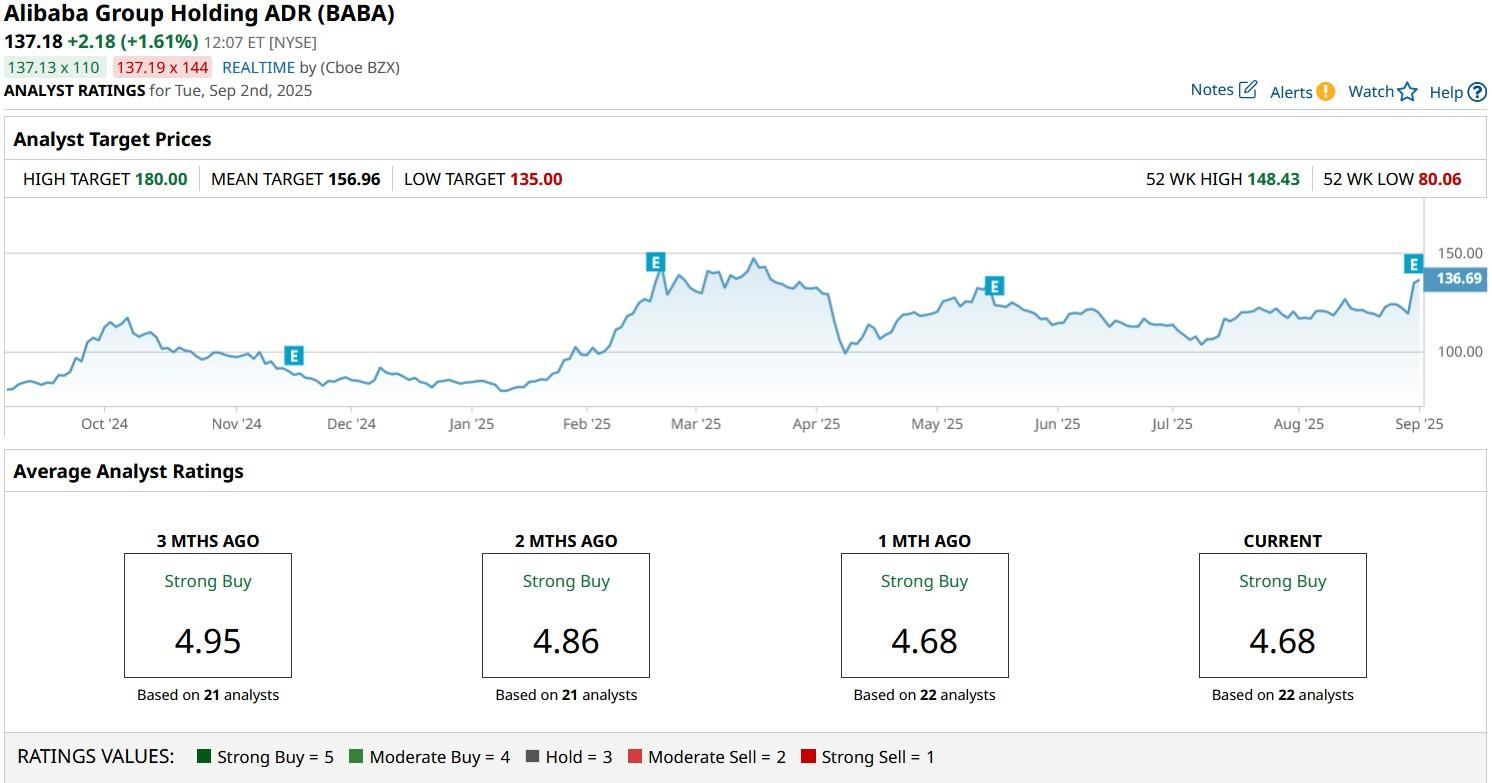

Wall Street is largely bullish on Alibaba stock after its Q2 earnings release on Aug. 29.

The consensus rating on BABA shares currently sits at “Strong Buy” with the mean target of about $157 indicating potential upside of another 15% from here.