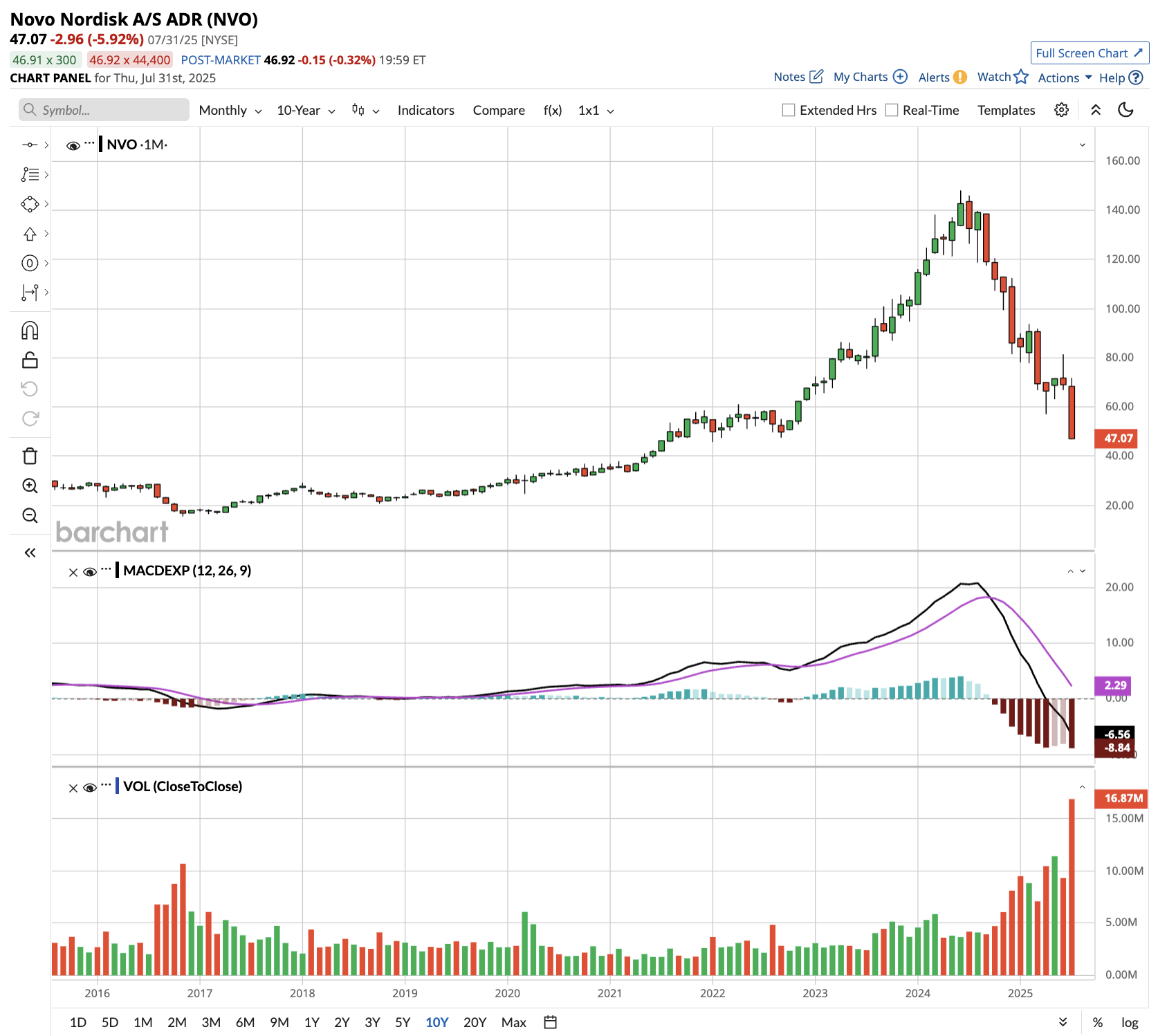

Novo Nordisk (NVO) stock shed over 21% on Tuesday after the Danish pharmaceutical giant slashed its guidance for the second time this year, leaving investors questioning whether the obesity drug pioneer has lost its edge or presents a compelling value opportunity.

Novo Nordisk’s latest guidance cut was brutal. Full-year sales growth expectations dropped to 8%-14% from the previously forecasted 13%-21%, while operating profit growth was reduced to 10%-16% versus prior estimates of 16%-24%. This marks the second guidance cut in just three months, signaling deeper structural challenges than initially anticipated.

The reduced forecast was tied to Wegovy's disappointing U.S. performance, where persistent competition from compounded GLP-1 alternatives and slower market expansion have undermined growth assumptions. The FDA's drug shortage ruling inadvertently opened the door for copycat competitors, creating pricing pressure on Novo's flagship obesity treatment.

The appointment of company veteran Maziar Mike Doustdar as CEO, effective Aug. 7, follows the surprise ouster of Lars Fruergaard Jørgensen in May. Doustdar's 32-year tenure and international operations experience suggest continuity, though his promise of "fierce determination" implies significant strategic changes ahead.

With NVO stock down 45% year-to-date and facing ongoing headwinds from compounded drug competition, negative sentiment from disappointing CagriSema trial results, and now a second guidance cut, the pain may not be over - especially as the competitive landscape in obesity treatments is intensifying rapidly.

Is Novo Nordisk Stock a Good Buy Right Now?

Novo Nordisk’s latest outlook cut centers on the ongoing impact of compounded GLP-1 alternatives in the U.S. market. Despite the May 22 expiration of the FDA's grace period for mass compounding, management confirmed that approximately 1 million patients remain on unlawful compounded semaglutide treatments.

This persistent use of what CEO-designate Doustdar called unsafe knockoff alternatives continues, undermining Wegovy's market penetration. The company has escalated its response with over 120 lawsuits and 1,000 cease-and-desist letters, while engaging congressional leaders to pressure the FDA on illicit imports of active pharmaceutical ingredients (APIs). However, these efforts have yet to materially reduce compounding activity, forcing management to acknowledge that previous assumptions about second-half improvement were overly optimistic.

Novo's New CEO Steps In

Doustdar, who internally led International Operations at Novo to double its sales over the past decade, takes the helm with promises of operational urgency and commercial execution improvements. His mandate appears clear: accelerate growth through enhanced pipeline progression and more aggressive market capture strategies.

The leadership change coincides with organizational restructuring, including merging research and development functions under new Chief Scientific Officer Martin Holst Lange. These moves signal recognition that current execution strategies require fundamental adjustments.

While U.S. operations face headwinds, International Operations continue delivering robust growth with successful Wegovy launches across multiple new markets. The division maintains approximately two-thirds market share in GLP-1 treatments globally, with management expressing confidence in defending this position despite increasing competition.

Management also emphasized that the guidance reduction is volume-driven rather than pricing-related, though gradual average price declines for Wegovy are expected as market penetration expands.

Is NVO Stock Undervalued?

The obesity drug market remains enormous and under-penetrated, and Novo retains significant technological advantages. For risk-tolerant investors, the current valuation may reflect overly pessimistic assumptions about the company's long-term prospects in a transformative healthcare market.

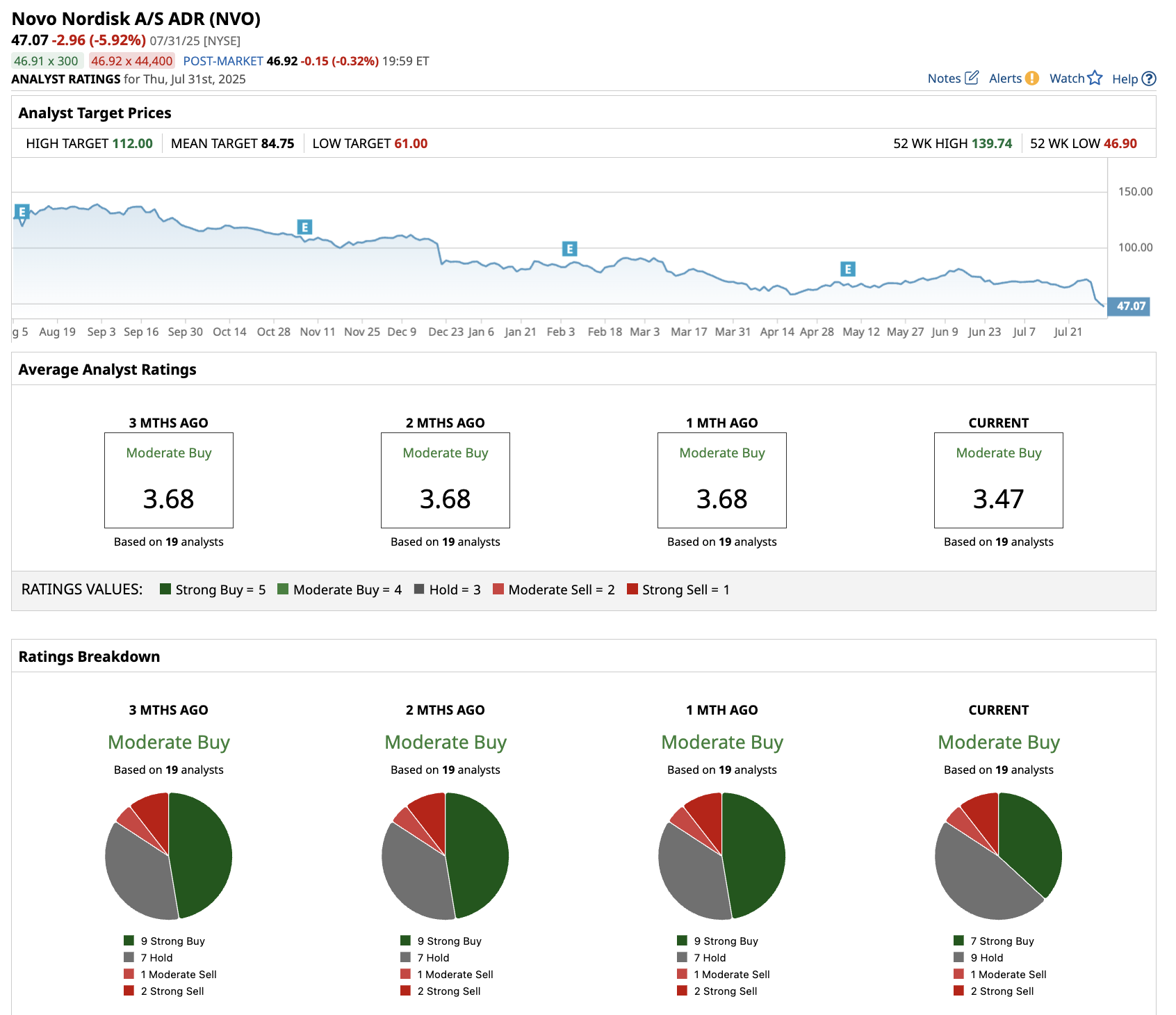

Of the 19 analysts tracking Novo Nordisk stock, seven recommend “Strong Buy,” nine recommend “Hold,” one recommends “Moderate Sell,” and two recommend “Strong Sell.” The average NVO stock price target is $84.75, well above Thursday's close around $47.

Analysts tracking NVO stock expect revenue to rise from $40.50 billion in 2024 to $71.4 billion in 2029. Comparatively, adjusted earnings are forecast to expand from $3.16 per share to $5.88 per share in this period.

Today, NVO stock trades at 12x forward earnings, below its 10-year average multiple of 25x. If it continues to trade at 12x earnings, NVO stock should gain 50% from current levels over the next four years. If we adjust for dividends, cumulative returns could be closer to 60%.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.