Constellation Brands (STZ), best known for marquee beer brands like Corona and Modelo, recently issued a sobering fiscal 2026 earnings forecast that sent shares tumbling to their lowest levels since the height of the Covid-19 pandemic. This was a result of a tough economic backdrop that is weighing on alcohol demand.

CEO Bill Newlands noted that high-end beer sales have slowed in recent months, with fewer shopping trips and lower spending per visit. The company earlier this year had projected that higher U.S. tariffs on beer would impact sales and overall consumer demand.

So, now let’s analyze whether this pullback represents a value opportunity with long-term potential or signals deeper headwinds ahead.

About STZ Stock

Constellation Brands is a Fortune 500 American producer and marketer of beer, wine, and spirits, operating in the U.S., with operations spanning the U.S., Mexico, New Zealand, and Italy. The company is headquartered in Rochester, New York, with its market cap standing at $26.7 billion.

Constellation Brands has experienced a sharp decline in recent trading sessions amid a downturn in its operating outlook. On Sept. 2, the stock tumbled 6.6% intraday and then another 3% today to hit a 52-week low of $146.6 during the session, driven by disappointing consumer demand, especially within its core Hispanic demographic, heightened tariff-related cost pressures, and a cautious fiscal 2026 guidance cut.

The company’s stock has already plunged 33.5% on a year-to-date (YTD) basis and 40.5% over the past 52 weeks.

The stock is trading at a discounted valuation compared to industry peers and the historical average at 12.86 times forward non-GAAP earnings.

Constellation Brands Is Demonstrating Weak Quarterly Performance

Constellation Brands reported its Q1 Fiscal 2026 results on July 1 for the quarter ending May 31, 2025. The company faced notable pressure across its segments, and net sales dropped 6% year-over-year (YoY) to $2.5 billion, with a comparable organic net sales decline of around 4%. Comparable operating income declined 11% YoY, while net income slipped 41% to $516 million. On a comparable basis, EPS was $3.22, down 10% from the prior year quarter.

The company’s beer business saw a 2% decrease in net sales driven by a 3.3% decline in shipment volumes amid socioeconomic headwinds affecting consumer demand. Also, Wine and Spirits net sales declined 28%, driven by a 30.4% decrease in shipment volumes.

On Sept. 2, Constellation Brands significantly downgraded its fiscal 2026 outlook amid weaker-than-expected consumer demand, particularly for its premium beer portfolio, and elevated tariff pressures. The company now forecasts comparable EPS of $11.30 to $11.60, a sharp reduction from the prior range of $12.60 to $12.90. On the revenue front, enterprise organic net sales are now expected to decline 6% to 4%, worsening from an earlier forecast of a 2% decline to 1% growth.

The beer segment, the core engine of the business, is driving much of the revision, as its net sales are now expected to fall 4% to 2%, compared to the prior view of flat to 3% growth. The wine & spirits segment guidance remains unchanged, with expected organic sales declines of 17% to 20%.

Analysts predict EPS to be around $11.45 for fiscal 2026, down 16.9% YoY, before surging by 19% annually to $13.62 in fiscal 2027.

What Do Analysts Expect for STZ Stock?

Recently, Bank of America analyst Peter Galbo lowered Constellation Brands’ price target to $142 from $150, reaffirming an “Underperform” rating following the company’s revised FY 2026 outlook.

On the other hand, while Jefferies lowered its 12-month price target for Constellation Brands to $179 from $205 on Sept. 3, it reaffirmed its “Buy” rating on the stock. This adjustment comes amid continued weakness in the Hispanic consumer segment, more pronounced than previously expected, which has eroded the outlook for the beer business.

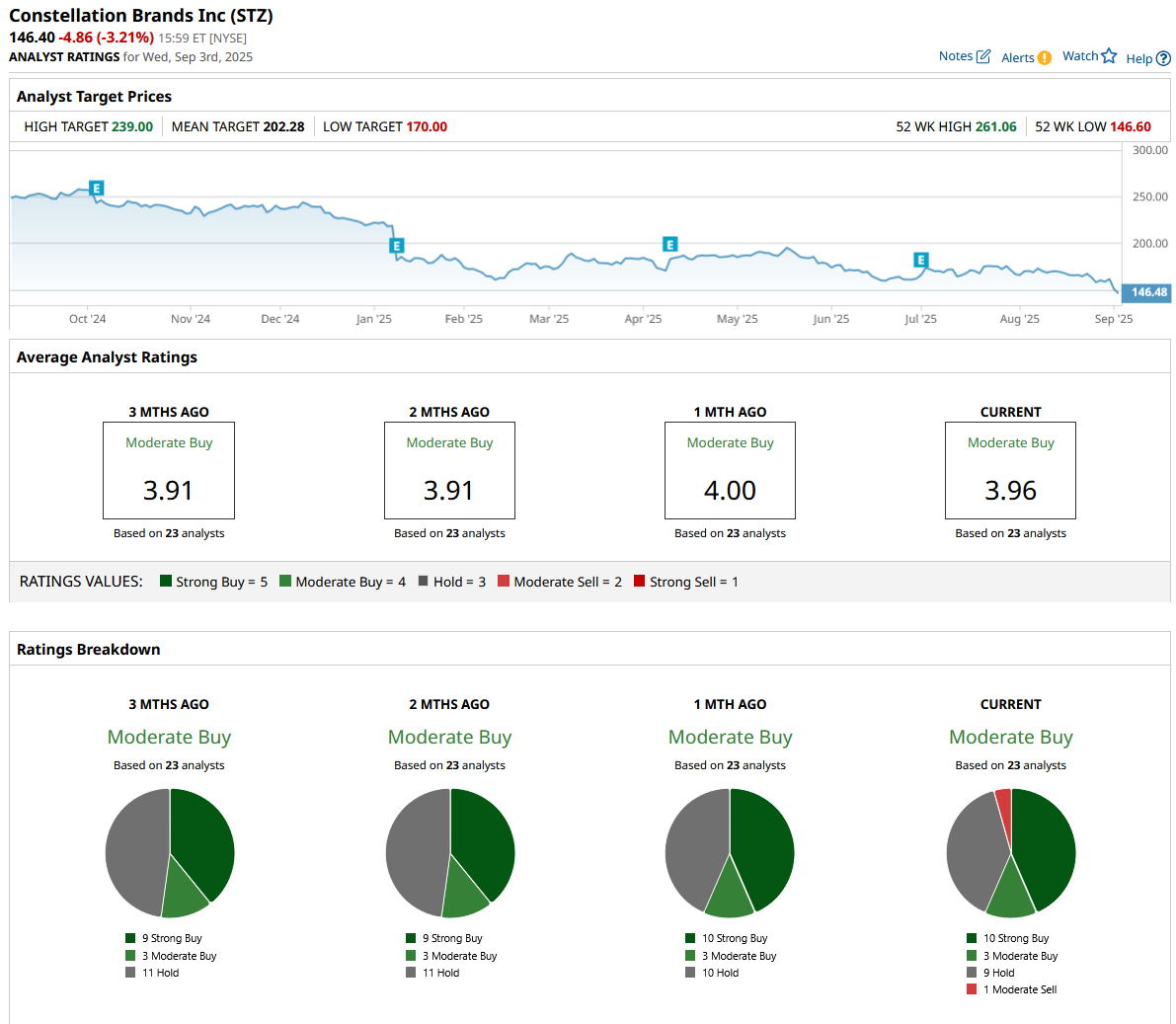

Wall Street is cautiously bullish on STZ. Overall, STZ has a consensus “Moderate Buy” rating. Of the 23 analysts covering the stock, 10 advise a “Strong Buy,” three suggest a “Moderate Buy,” nine give a “Hold,” and the remaining one recommends a “Moderate Sell” rating.

The average analyst price target for STZ is $202.28, indicating a potential upside of 38%. The Street-high target price of $239 suggests that the stock could rally as much as 63%.