/Quantum%20Computing/A%20concept%20image%20with%20a%20brain%20on%20top%20of%20a%20blue%20circuit%20board_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)

Rigetti Computing (RGTI) says its net loss more than tripled on a year-over-year basis to roughly $40 million in the second quarter.

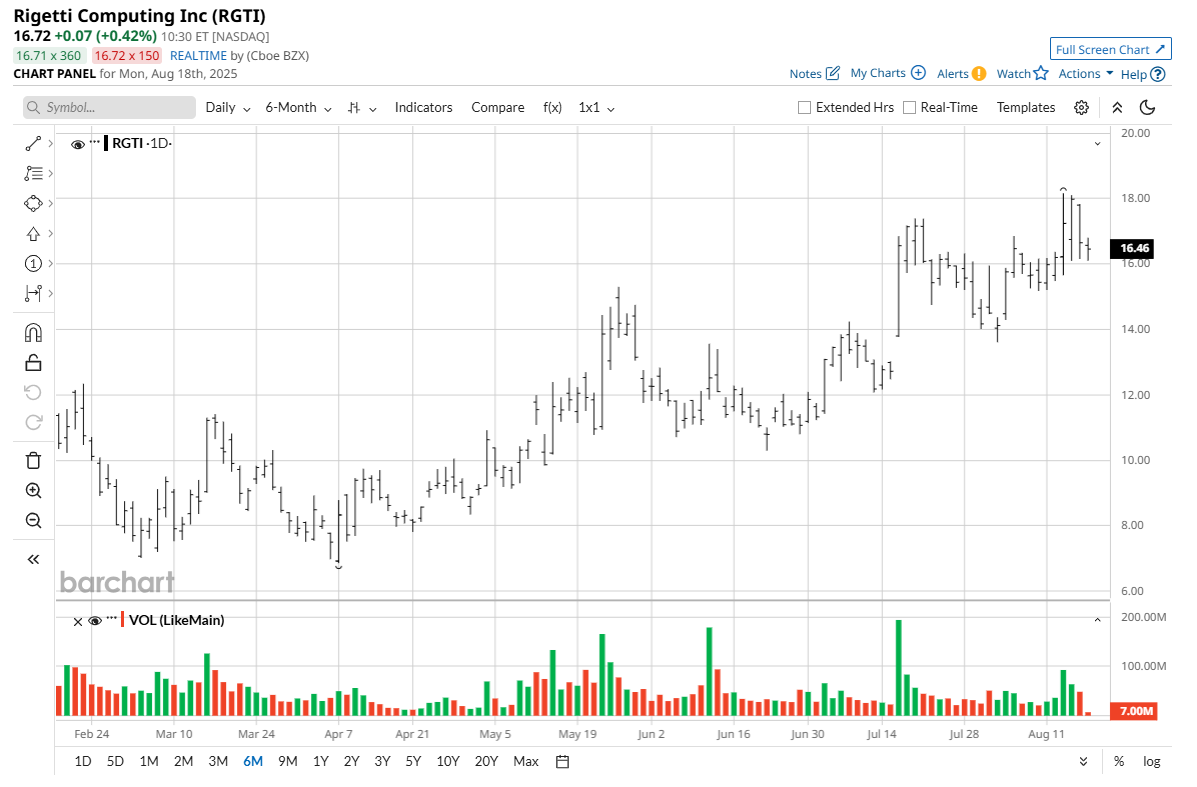

Shares of the quantum-tech specialist tanked nearly 8% on Friday also because its revenue came in down over 40% on a year-over-year basis as well.

Rigetti Computing stock has been a lucrative investment over the past four months. Despite the recent plunge, it’s up more than 100% versus its April low.

Should You Avoid Buying RGTI Stock on the Post-Earnings Decline?

According to Subodh Kulkarni, the chief executive of Rigetti Computing, quantum technology could evolve into a trillion-dollar-per-year market in the long term.

In the next four to five years, however, “our view is still very much in the R&D stage,” he told Barron’s in a recent interview.

Kulkarni’s remarks make RGTI shares materially less attractive to own especially when they’re up well over 150% versus their year-to-date low despite revenue decelerating at an alarming rate.

Rigetti Computing Shares Are Egregiously Overvalued

Rigetti Computing raised some $350 million via a stock offering in its second financial quarter, effectively wiping its balance sheet of all debt.

But it’s hardly a positive for the Nasdaq-listed firm since the offering nearly doubled the number of its shares outstanding, raising dilution risks.

More importantly, Rigetti Computing is trading at a price-sales (P/S) ratio of more than 480x at writing, which indicates gross overvaluation.

Investors should also note that RGTI has not yet achieved quantum supremacy, which theoretically makes peer D-Wave (QBTS) a better investment than Rigetti Computing stock for exposure to quantum technology.

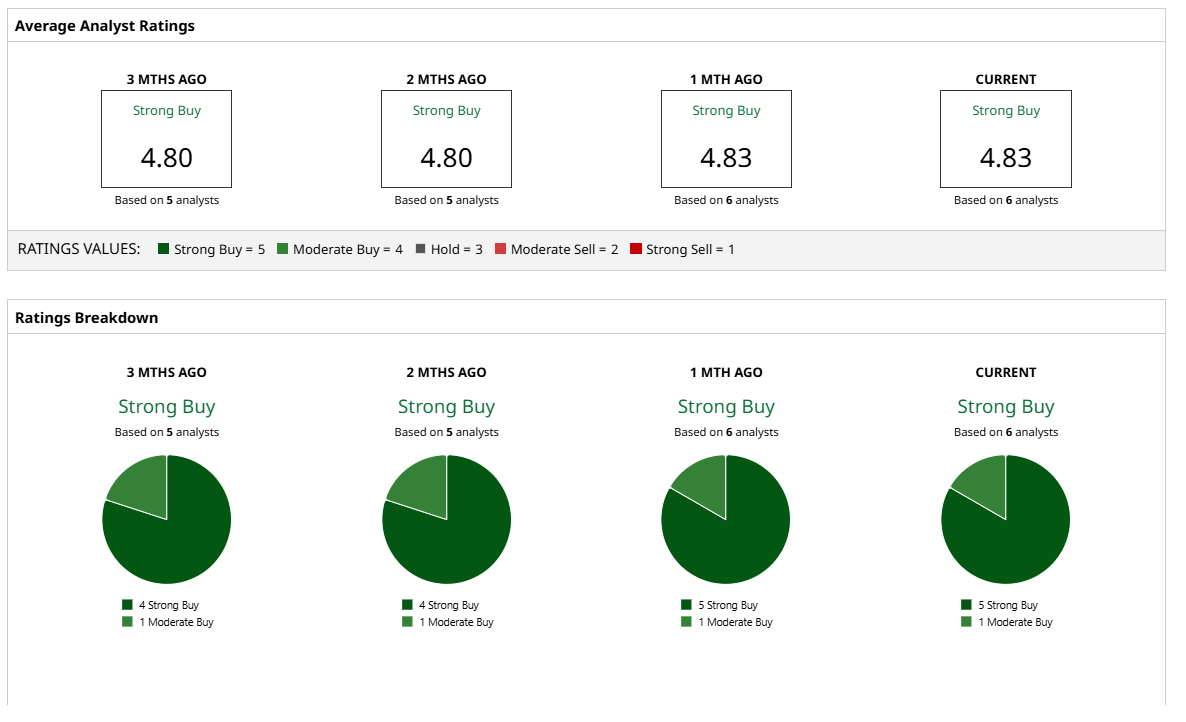

How Wall Street Recommends Playing Rigetti Computing

Investors should also note that Wall Street no longer sees meaningful further upside in RGTI shares from current levels.

While the consensus rating on Rigetti Computing stock remains at “Strong Buy,” the mean target of roughly $17.80 indicates potential for only about 6.7% upside.