After popular pet products supplier Chewy (CHWY) reported its second-quarter results for fiscal 2025 on Sept. 10, CHWY stock declined more than 16% intraday, as investors were expecting more growth from the company.

The stock has received attention from retail investors, which makes it somewhat volatile. However, with significant market prospects, should you consider investing in Chewy stock’s dip?

About Chewy Stock

Based in Plantation, Florida, Chewy is a top online destination for pet supplies and food. Serving pet owners throughout the U.S., the company offers an extensive range of products through its user-friendly digital platform. Chewy is widely recognized for its strong customer service, which includes convenient features such as scheduled auto-shipments and around-the-clock access to licensed veterinarians via its telehealth offerings.

Chewy's operational strength lies in a well-organized network of fulfillment centers across the country, ensuring fast and dependable delivery. By combining technology, logistics, and a customer-first approach, Chewy has streamlined its supply chain and focused on satisfaction, helping it grow into a significant force in the pet retail e-commerce space. The company has a market capitalization of $15.3 billion.

Chewy has seen a surge in interest with meme stocks, sparked by online speculation and retail investor hype. This attention has triggered sharp price movements, driven more by market sentiment than the company’s actual financial performance.

CHWY stock has also experienced a surge over the past year, driven by steady revenue growth, increased auto-ship subscriptions, and the expansion of higher-margin services. Over the past 52 weeks, the stock has gained 17%. Meanwhile, it is up 14% year-to-date (YTD).

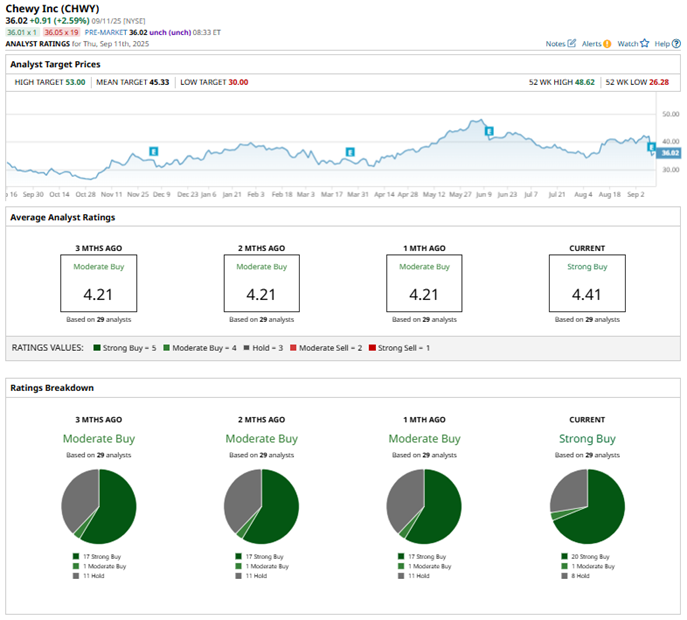

The stock had reached a 52-week high of $48.62 back in June, but shares are down 21% from this high. After Chewy reported its Q2 results on Sept. 10, CHWY stock declined by 16.6% intraday.

Chewy currently has an eye-watering valuation. Its price sits at 67 times forward earnings, which is significantly higher compared to the industry average.

Chewy Closely Matched Q2 Expectations

On Sept. 10, Chewy reported its second-quarter results for fiscal 2025. For the period, net sales increased 8.6% year-over-year (YOY) to $3.1 billion. This was marginally higher than the $3.08 billion that Wall Street analysts were expecting.

The company reported that its active customer count also increased by 4.5% YOY, while net sales per active customer grew 4.6% from its year-ago value to $591. Chewy generates the majority of its top line from its Autoship program. In Q2, Autoship customer sales made up 83% of overall sales. Autoship customer sales grew 14.9% from the prior-year period to $2.58 billion.

On the other hand, Chewy’s net margin declined from 10.5% in Q2 fiscal 2024 to 2% in Q2 fiscal 2025. This was primarily related to the release of the valuation allowance on its federal and certain state deferred tax assets during the year-ago period, which resulted in a $275.7 million tax benefit. Basically, the net margin figure looks subdued due to tougher comparisons.

On an adjusted basis, Chewy’s EPS was $0.33, up 37.5% YOY. This figure aligned with what the Wall Street analysts were expecting.

Analysts are highly optimistic about Chewy’s future earnings. For the current quarter, EPS is expected to climb 1,100% YOY to $0.12. For the current fiscal year, EPS is projected to increase 93% annually to $0.52, followed by 44% growth to $0.75 in the next fiscal year.

What Do Analysts Think About Chewy’s Stock?

Wall Street analysts are still significantly bullish about Chewy’s prospects. Recently, CHWY stock received two notable upgrades. After reporting Q2 results, analysts at Seaport Research upgraded CHWY from “Neutral” to “Buy,” citing momentum in its topline, while giving a $47 price target. Seaport also posited that investments in initiatives like the Chewy+ membership and fresh food should lead to share gains.

Analysts at Deutsche Bank also upgraded CHWY stock to “Buy” following the Q2 earnings and assigned a $45 price target, citing the company's solid investment strategy. Deutsche Bank analyst Lee Horowitz believes that Chewy could record “more levers for accelerative revenue growth in 2026.”

Moreover, JPMorgan analyst Doug Anmuth maintained an “Overweight” rating on the stock, but also showed caution by lowering the price target from $47 to $45. Morgan Stanley analysts maintained their “Overweight” rating while reducing the price target from $50 to $48.

Chewy remains highly sought after on Wall Street, with analysts awarding it a consensus “Strong Buy” rating overall. Of the 29 analysts rating the stock, a majority of 20 analysts rate it a “Strong Buy,” one analyst suggests a “Moderate Buy,” and eight analysts play it safe with a “Hold” rating. The consensus price target of $45.38 represents 19% potential upside from current levels. The Street-high price target of $54 indicates 41% potential upside from here.

Key Takeaways

Although CHWY stock dipped after Chewy reported Q2 earnings, the results aligned mainly with what analysts were expecting for the period. Moreover, analysts are still bullish about the company’s prospects. Americans’ love for pets continues to grow. Last year, U.S. households spent about $40 billion on pet healthcare. With that in mind, Chewy’s foray into veterinary care creates significant runway for revenue growth and increased market share. Therefore, it might be wise to consider CHWY stock now.