The sharp 13% selloff in the shares of Zions Bancorp (ZION) seen a few days ago triggered the harsh memories of the Silicon Valley Bank crisis of a couple of years ago. The stupendous rally in AI stocks may have led to a quick forgetting of the contagion fears that the bank's collapse elicited among market participants, but the horrors of the Global Financial Crisis almost two decades prior are still fresh for many.

However, leading broker Baird has put paid to the fears about any ensuing crisis in the regional bank, which came into being after the latter found "apparent misrepresentations and contractual defaults" in two loans given out by the bank's California Bank & Trust division, leading to a $50 million hit in Q3.

Citing that minimal impact is expected on Zions' books, the broker remarked that “the provision equates to a ~$0.32 EPS impact in the upcoming report, or ~5% of 2025E EPS. The fraud-related nature of this announcement leads us to believe this is a unique borrower rather than anything systemic, and ZION's ~11% Q225 CET1 ratio should provide confidence to liquidity and loss absorption concerns.”

About Zions

Tracing its roots back to 1873, Zions Bancorp is a regional bank holding company offering a variety of banking and financial services. Its major lines include commercial banking, retail banking, capital market services, and lending to small businesses. Zions operates in 11 western U.S. states, giving it a differentiated footprint compared to many other regional banks.

With a market cap of $7.3 billion, ZION stock is down 5.4% on a year-to-date (YTD) basis. Notably, the company's stock offers a dividend yield of 3.50%, which is much higher than the sector median of 1.381%, as it has been raising dividends consecutively over the past 12 years.

So, after a strong start to the earnings season by the banks in general and fears about Zions in particular being dismissed, is this a good time to load up on ZION stock? Let's find out.

Sound Fundamentals

Zions boasts of a strong balance sheet with improving margins and operational metrics. The bank's loan has shown muted but steady growth in recent quarters. Loans held for investment, net of allowance, increased to $60.1 billion in Q2 2025 from $57.7 billion in Q2 2024. Deposits, however, remained almost unchanged from the previous year at $73.8 billion. Thus, while the presence of credit growth is a tailwind, the bank should focus on growing its deposit base as well.

Meanwhile, net interest income and noninterest income witnessed yearly rises as well to $648 million (+8.5% YoY) and $190 million (+6.1% YoY), as the company's EPS saw an even sharper rise of 27.3% in the same period to $1.63. Overall, the bank's net interest margin, a key marker of profitability, improved to 3.17% from 2.98% a year ago.

Zions' common equity tier 1 capital ratio, which reflects the quality of a bank's balance sheet, grew to 11% in Q2 2025 from 10.6% in Q2 2024. The improvement in the balance sheet was accompanied by a favorable move in the bank's return ratios as well, with the return on average assets and return on average common equity coming in at 1.09% and 15.3% versus 0.91% and 14% in Q2 2024, respectively.

Shifting focus towards valuations, ZION stock is trading at a trailing P/B of 1.12, lower than the sector median of 1.18.

Notably, Zions is set to report Q3 earnings tomorrow, Oct. 21.

Unique Positioning, but Cautions Around the Economy May Derail Growth

Zions' business approach sets it apart in the industry, bringing both distinct strengths and notable drawbacks. By centering operations in the western U.S. and holding stakes in various smaller community banks, the company fosters a distributed structure that strengthens ties with local markets. That said, it also creates overlapping expenses and heightens exposure to risks tied to one geographic area.

At the same time, the economy's uneven recovery remains a critical factor to watch for Zions. Executives noted that growth has outpaced forecasts so far, but they're holding back optimism amid signs of a cooling job market. With ongoing uncertainties in play, the outlook for loan expansion stays subdued. This wariness was especially pronounced back in April, amid heightened worries over tariffs, a reflection of the bank's longstanding prudent outlook.

To build out its lending portfolio, Zions is leaning into commercial and industrial loans, with a special emphasis at subsidiaries such as Zions Bank, Amegy Bank, and California Bank & Trust, where small and midsize business needs offer real potential. A standout example is the sharp rise in SBA 7(a) financing, where booked deals jumped 91% in the first nine months of 2025 compared to the prior year, giving a clear lift to small-business activity.

On the consumer side, Zions saw some incremental gains in the second quarter of 2025, including $119 million in originations for one- to four-family mortgages and $114 million in home equity lines of credit, complemented by gains in other retail offerings. These steps help spread risk beyond the commercial focus.

That progress, though, comes against a backdrop of persistent worries over credit problems, extending beyond the most recent disclosure that sent shares tumbling. Details emerging about second-lien positions on assets within the syndicated loan book underscore weaknesses in the commercial space, sparking lawsuits and fueling wider questions around the rigor of credit reviews.

Analyst Opinion on ZION Stock

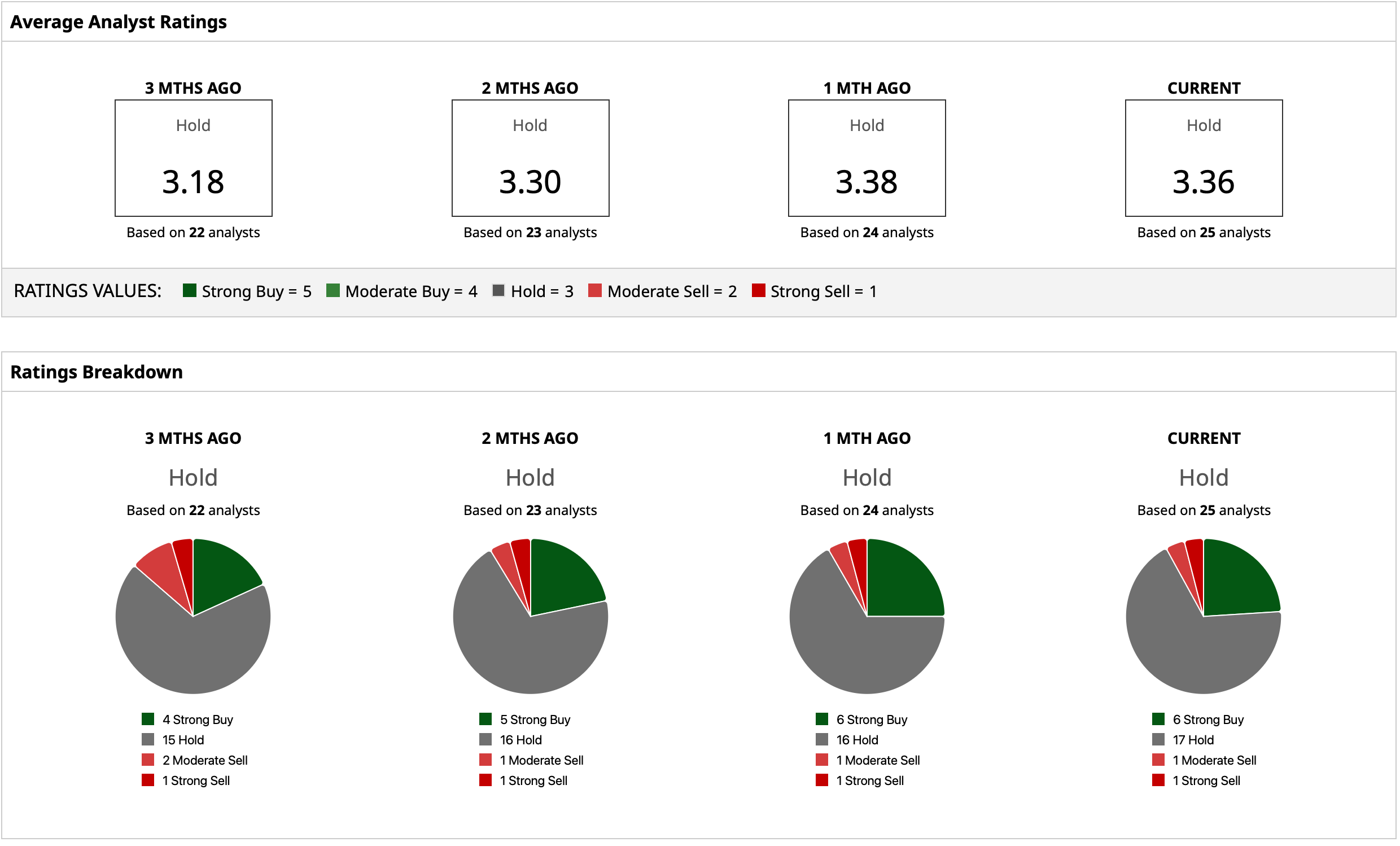

Overall, analysts have attributed a rating of “Hold” for ZION stock, with a mean target price of $62.32. This denotes an upside potential of about 21% from current levels. Out of 25 analysts covering the stock, six have a “Strong Buy” rating, 17 have a “Hold” rating, one has a “Moderate Sell” rating, and one has a “Strong Sell” rating.