/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

Within the semiconductor sector, there happen to be a plethora of options for investors to consider putting fresh capital to work in.

Of course, top high-performance chipmakers like Nvidia (NVDA) and Advanced Micro Devices (AMD) often get outsized attention as ways to play the surging demand for chips, courtesy of AI and other secular trends underway. However, there are other relatively overlooked options in this sector that are starting to gain ground as ways to play growth, particularly within the AI data center space.

One such company that is starting to see a surge in investor interest is GlobalFoundries (GFS). Let's dive into why some investors are starting to sharpen their pencils on this particular AI stock, following a rather important announcement the company just put forward.

What's the Big News?

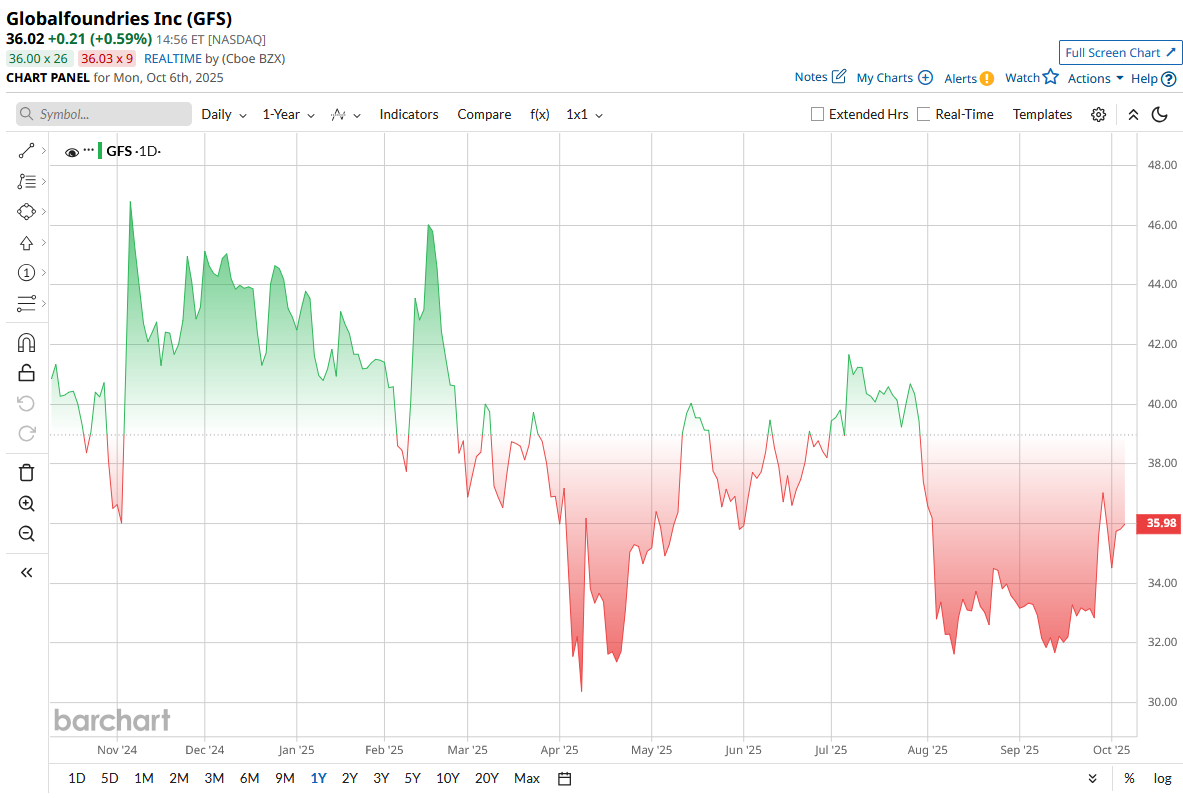

Shares of GFS stock haven't done much over the course of the past year, except maybe trend lower. There are certainly reasons for this, but again, I'd point most readers to the fact that Nvidia and other top chipmakers continue to suck up so much of the capital in this sector; valuations in other key parts of the market, such as those served by the likes of GlobalFoundries, haven't kept pace.

I think that's a fair assessment of many industries, to be honest. But I also think that looking at the chip sector as a whole is important. And GlobalFoundries' silicon photonics platform, used to create precision core alignments, does appear to be getting a boost from the company's recent partnership announcement with Corning (GLW).

In this announcement, the companies unveiled plans to create next-generation cores that minimize insertion loss and provide the highest performance options for data centers and large-scale customers of high-performance computing applications. The idea is to create a platform that is among the most powerful, with the largest bandwidth, in this sector. The companies are also looking to develop “a vertically-coupled detachable fiber-to-PIC (photonic integrated circuit) solution,” which could lead to further PIC-to-fiber connected products down the road. That's something many investors are intrigued by, given the potential for Corning's core technologies when integrated with those of GlobalFoundries.

What Do the Fundamentals Say?

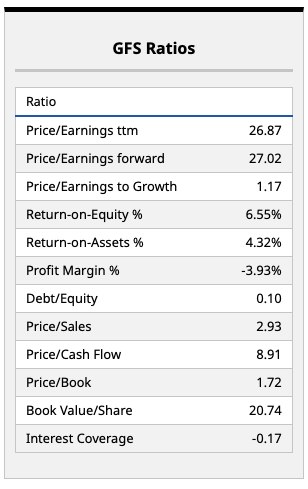

Overall, GlobalFoundries is one of the very few AI- and chip-related stocks I think is attractively valued right now. At a trailing price-earnings (P/E) multiple of less than 27 times (and a forward multiple that's much the same, suggesting investors believe this company's future growth rate should remain relatively stable), if we do see anything resembling a top- or bottom-line growth acceleration, this is a stock that does appear to be well-positioned to take off.

The company's valuation multiples shown above also highlight the discrepancy between mega-cap names in the chip sector and those in the middle of the range in terms of overall market capitalizations. One could argue that GlobalFoundries should likely have a much larger multiple than where it trades right now (seeing where other top stocks are trading on this front). But even at its current valuation, there's of course still the potential for downside if investors broadly look to eventually shift some of their capital out of this sector and into others.

It's also worth pointing out that GlobalFoundries' overall return on equity and return on assets metrics aren't as attractive as other companies in this space, and the company's negative profit margin does stick out like a sore thumb. But overall, it's expected GlobalFoundries will indeed turn a hefty profit this year and next, so estimating the magnitude of these numbers is really what most investors are clearly trying to do right now.

What Do the Analysts Think?

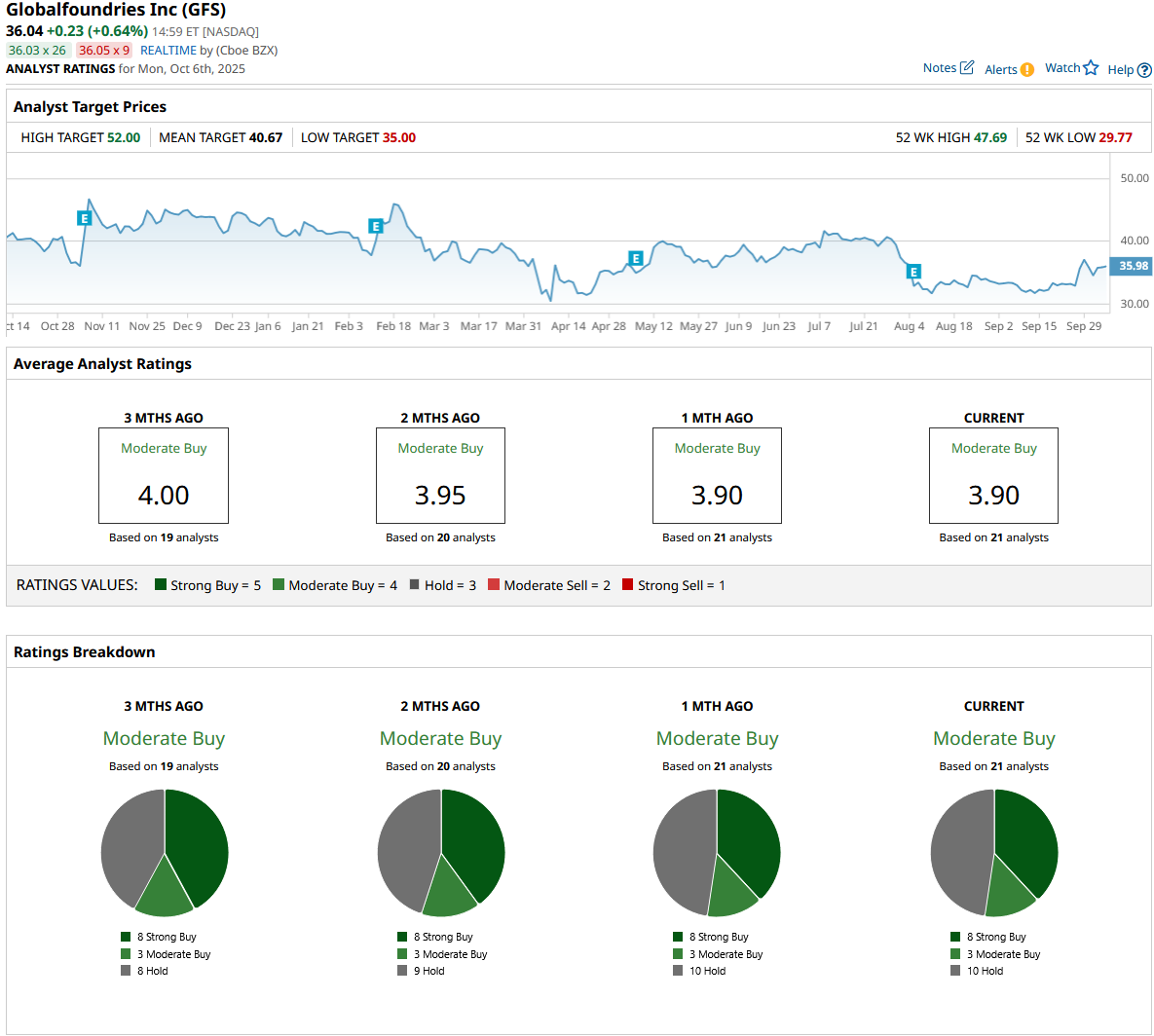

The good news for investors who are on the fence with the whole growth versus valuation discussion is that Wall Street analysts do appear to be broadly bullish on the name.

As investors will note from the shot above, GlobalFoundries' consensus price target of $40.67 per share does imply upside of around 11% from current levels. That's not bad. But given the degree to which this stock has been beaten down in recent weeks, I'd really like to see more upside being priced in by analysts as a security blanket of sorts to consider jumping in. My feeling is that plenty of other market participants feel the same way.

That said, the time to buy a given long-term holding is when no one else really wants to own such a stock. And considering the low price target on GFS stock on the Street ($35.00) sits just below where the company is trading right now, that's at least some consolation for investors wondering whether this stock is reasonably priced right now.

I do think GFS stock could turn out to be a great long-term pick. That said, this is a company I'm going to monitor from here and provide updates as they come moving forward.