/Tesla%20Inc%20elon%20musk%20by-%20Frederic%20Legrand-CO%20via%20Shutterstock.jpg)

Tesla (TSLA) released its Q3 2025 earnings after the market closed on Wednesday, Oct. 22. It was a mixed report as while the Elon Musk-run company beat on the top line, it missed the bottom-line estimates. In this article, we’ll discuss whether it makes sense to buy the post-earnings dip in Tesla shares.

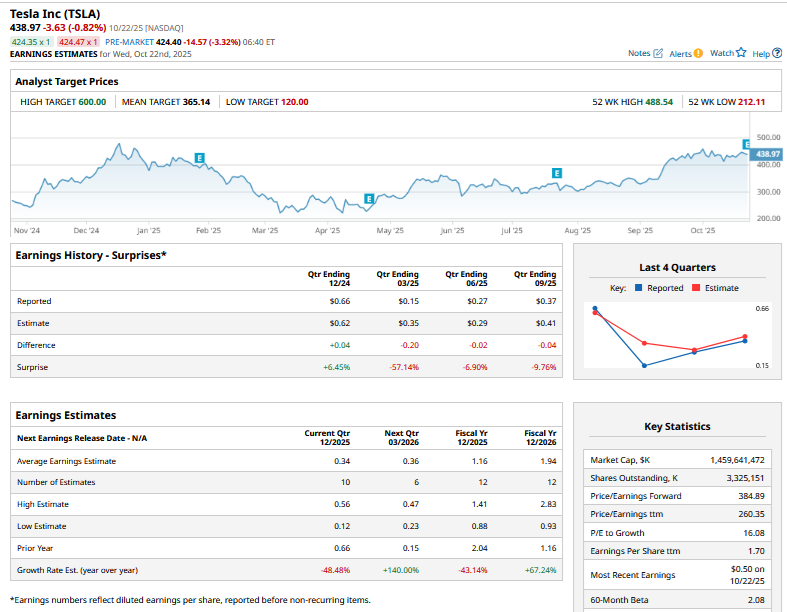

Tesla’s Q3 revenues rose 12% to $28.1 billion, which was well ahead of the estimates, led by a 44% year-over-year rise in the company’s Energy business. That segment, which once accounted for single digits of Tesla’s total revenues, contributed over 12% to its Q3 revenues. While Tesla’s revenues came in ahead of estimates as I had noted in the pre-earnings analysis, its per-share earnings fell to $0.39, trailing estimates due to higher expenses.

Key Takeaways From Tesla's Q3 2025 Earnings

Here are some of the other key takeaways from Tesla’s Q3 earnings

- Delivery Guidance: While Tesla did not provide delivery guidance, Musk talked about reaching an annual nameplate capacity of 3 million units within 24 months and increasing “production as fast as we can and as fast as our suppliers can sort of keep up with it,” listing the Cybercab, production of which is expected to commence in Q2 2026, as a key driver of incremental volumes.

- Profitability Drivers: Tesla had a tariff impact of $400 million in Q3 that was equally split between its automotive and energy business. Tesla’s automotive margins ex-regulatory credits rose from 15% to 15.4% sequentially, led by better fixed cost absorption on higher volumes and lower material costs. Sales of regulatory credits declined 43% to $417 million, even as the quarter-over-quarter decline was just about 5%. Meanwhile, despite all the headwinds, Tesla generated record free cash flows of nearly $4 billion and ended the quarter with $41.6 billion in cash and cash equivalents. The cash pile is crucial for Tesla as the company expects 2026 capex to “increase substantially” from the $9 billion that it guided for 2025.

- FSD Adoption Rates: Tesla said that the total paying base of its full self-driving (FSD) is 12% of its fleet, and it has seen “decent progress” in adoption. Notably, Tesla had lowered prices from $15,000 to $8,000 to boost adoption. During the earnings call, Tesla said that it is in talks with regulators in markets like China and Europe for approvals.

- Robotaxi Expansion: Tesla said that its robotaxi fleet in Austin has covered 250,000 miles so far, while the corresponding number for the Bay Area, where it still has a person sitting in the driver’s seat, has surpassed 1 million miles. Musk touted the possibility of launching the service “in about 8 to 10 metro areas by the end of the year,” subject to approvals.

- Tesla Is Doubling Down on Chips: Tesla said that its AI5 chip, which is 40x better than the AI4 chip, will be made by both Samsung and Taiwan Semiconductor Manufacturing Company (TSM) at their Texas and Arizona facilities, respectively. The world’s richest person said that Tesla was looking for “excess production” of these chips while adding, “If we have too many AI5 chips for the cars and robots, we can always put them in the data center.” Musk said that the company intends to use in-house and Nvidia (NVDA) chips in tandem and that the company is “not about to replace Nvidia.”

- Optimus Production to Begin in 2026: Tesla expects the production of its Optimus humanoid to commence by the end of 2026, with Musk reiterating his previous stance of production eventually reaching an annualized rate of 1 million units.

- Musk’s Compensation: Musk spent considerable time discussing the mammoth $1 trillion pay package that the board has proposed for him and reiterated his previous stance that he needs enough voting power at Tesla so that he can comfortably build AI products at the company.

Meanwhile, there was little new in Tesla’s Q3 earnings call, and as has been the case in the previous few earnings calls, there were bold predictions related to artificial intelligence (AI) products, with Musk predicting Optimus to be an “incredible surgeon.” As we have seen in recent earnings calls, there wasn’t much on the near-term outlook for deliveries, which is consistent with the company’s strategy of positioning itself as an AI play rather than an automaker.

However, even on that front, there was little on the near-term monetization potential of FSD and the robotaxi fleet. Overall, Tesla’s Q3 confessional does not change my investment case for Tesla, and I don’t find it attractive enough to add to my existing positions on the post-earnings dip.