/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

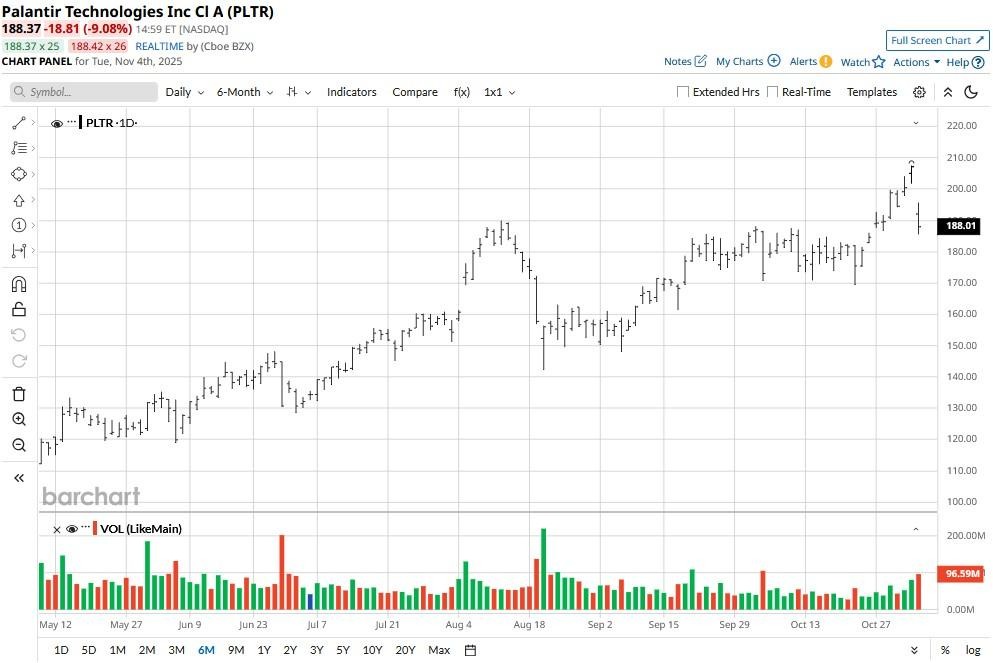

Palantir (PLTR) shares closed sharply lower on Tuesday, Nov. 4, even though the AI-enabled data analytics company posted another strong quarter and raised its guidance for the full year. Shares are down another 3.6% in Wednesday morning trading.

Investors bailed on PLTR primarily because of valuations concerns. At a forward price-earnings (P/E) multiple of nearly 465x, it’s among the most expensive S&P 500 Index ($SPX) names heading into 2026.

Despite the post-earnings decline, Palantir stock remains up over 145% versus the start of this year.

Palantir Stock Could Crash to $70

Jefferies’ senior analyst Brent Thill recommends against buying PLTR shares on the post-earnings dip since the multiple on them is still “extreme.”

According to him, the company’s current valuation can’t be justified even if it “accelerates to 60% 4-year compound annualized growth rate (CAGR).”

Thill reiterated his “Underperform” rating on Palantir Technologies, saying its share price could crash as soon as the artificial intelligence hype cycle flashes signs of a downtick.

His upwardly revised price target of $70 signals potential downside of over 60%, reinforcing that the Nasdaq-listed firm is currently trading at an unsustainable valuation.

PLTR Shares Are Egregiously Overvalued

Investors should also note that Nvidia (NVDA), which is broadly viewed as the AI leader, is currently going for about 48 times forward earnings only.

In fact, even if it achieved a market cap of $8.5 trillion, as Loop Capital analysts projected in their latest research note, while adhering to its current earnings trajectory, its P/E multiple would still be significantly lower than PLTR’s today.

And that’s when NVDA is superior to it in terms of both earnings power and market dominance. This comparison further illustrates just how overvalued PLTR shares really are heading into 2026.

Note that Palantir Technologies doesn’t currently pay a dividend to offset valuation risks either.

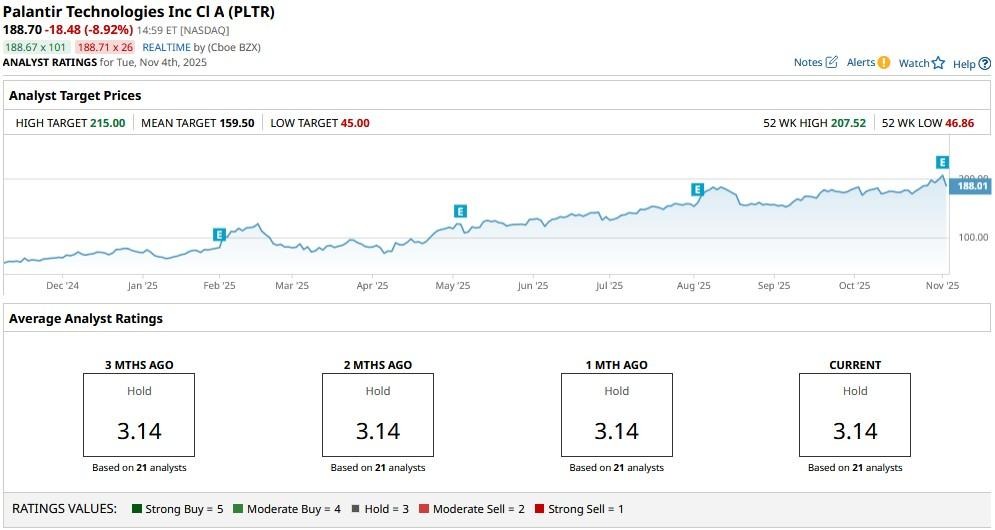

What’s the Consensus Rating on Palantir?

Despite a blockbuster earnings release, Wall Street analysts continue to favor staying on the sidelines with Palantir shares at current levels.

According to Barchart, the consensus rating on PLTR stock sits at “Hold” only with the mean target of about $160 indicating potential “downside” of more than 15% from here.