/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

Oracle (ORCL) shares are extending losses on Monday as investors express concerns about the high costs and near-term profitability of its aggressive push into the AI cloud infrastructure business.

The company’s management raised its already ambitious long-term guidance last week at AI World 2025, but some are now questioning the company’s ability to execute its plan for rapid expansion.

Despite the recent pullback, however, Oracle stock remains up some 140% versus its year-to-date low.

Oracle Stock is Worth Buying on the Dip

While near-term concerns have triggered profit-taking in ORCL stock in recent days, those in it for the long haul may still be rewarded nicely.

At its recent AI event, the company raised its revenue guidance for FY30 by another $22 billion, reinforcing confidence in the long-term demand for its cloud and artificial intelligence offerings.

Oracle’s recently announced $65 billion deal with Meta Platforms (META) and a strategic partnership with Advanced Micro Devices (AMD) confirm it’s fully committed to becoming a dominant player in enterprise AI.

A small dividend yield of 0.71% makes for an additional reason to stick with Oracle shares for the long term.

UBS Sees Upside in ORCL Shares to $380

UBS analyst Pratyush Thakur sees Oracle’s raised forecast as an adequate reason to load up on its stock. According to him, ORCL shares are “too cheap” at 15x forward earnings (FY30).

In his latest research note, Thakur said this AI stock could print a new all-time high of $380 in the near term, indicating potential upside of over 30% from here.

“Oracle disclosed [at AI World 2025] that its deal backlog went to $500b+ and setting FY30 – well above our estimates,” Thakur told clients.

Note that Barchart’s options data also currently suggests traders are positioning for further upside in Oracle shares, with an upper bound of $330 on contracts expiring Jan. 16.

Wall Street Agrees with UBS on Oracle

Other Wall Street firms also recommend owning ORCL shares for the long term.

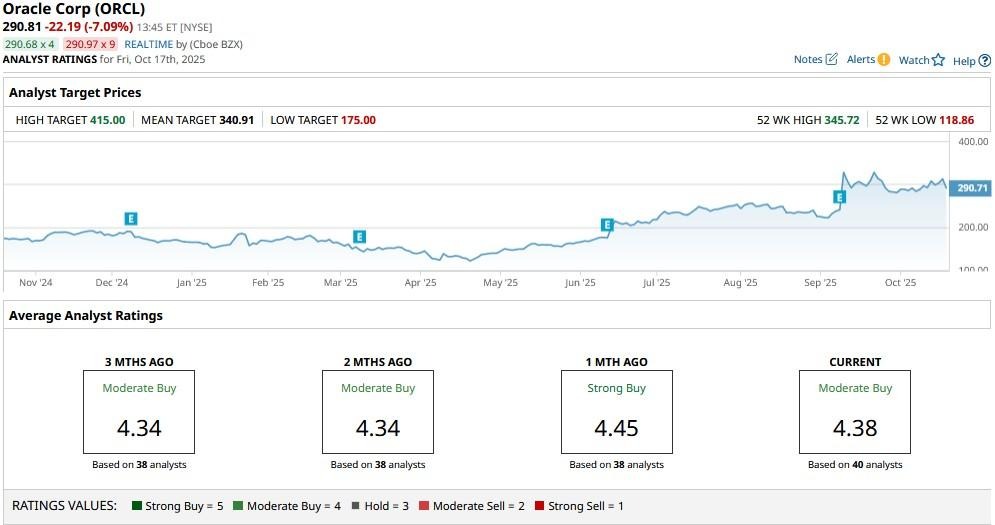

Wall Street currently has a consensus “Moderate Buy” rating on Oracle stock with the mean target of about $341 indicating potential upside of roughly 18% from here.