/AI%20(artificial%20intelligence)/Image%20of%20Cloud%20Computer%20Engineer%20Coding%20In%20Server%20Room%20In%20Data%20Center%20by%20Andrey%20Popov%20via%20Shutterstock.jpg)

Cloudflare (NET) finds itself in the news again, although this time not because anyone prefers it. Indeed, the company faced an outage on Tuesday that stopped the most popular websites on the internet from being accessible. These websites include X, Zoom (ZM), Canva, Grindr, (ironically) Down Detector, and even ChatGPT. This problem occurred due to an incorrectly set up threat traffic file that caused the software to fail. As a result, connectivity issues were experienced on its global network. Cloudflare lost approximately 3% of its value during the first trading hour and is still down about 3% for the day as of late afternoon trading.

About Cloudflare Stock

Cloudflare is one of the leading companies offering internet security, edge computing, and network infrastructure that serves around 20% of the internet infrastructure of the world. Cloudflare’s parent company, Cloudflare Inc., is headquartered in San Francisco. Its products include DDoS protection, zero-trust security solutions, traffic routing services, and AI-optimized edge delivery. Cloudflare’s market cap stands at a large-cap company due to its burgeoning growth.

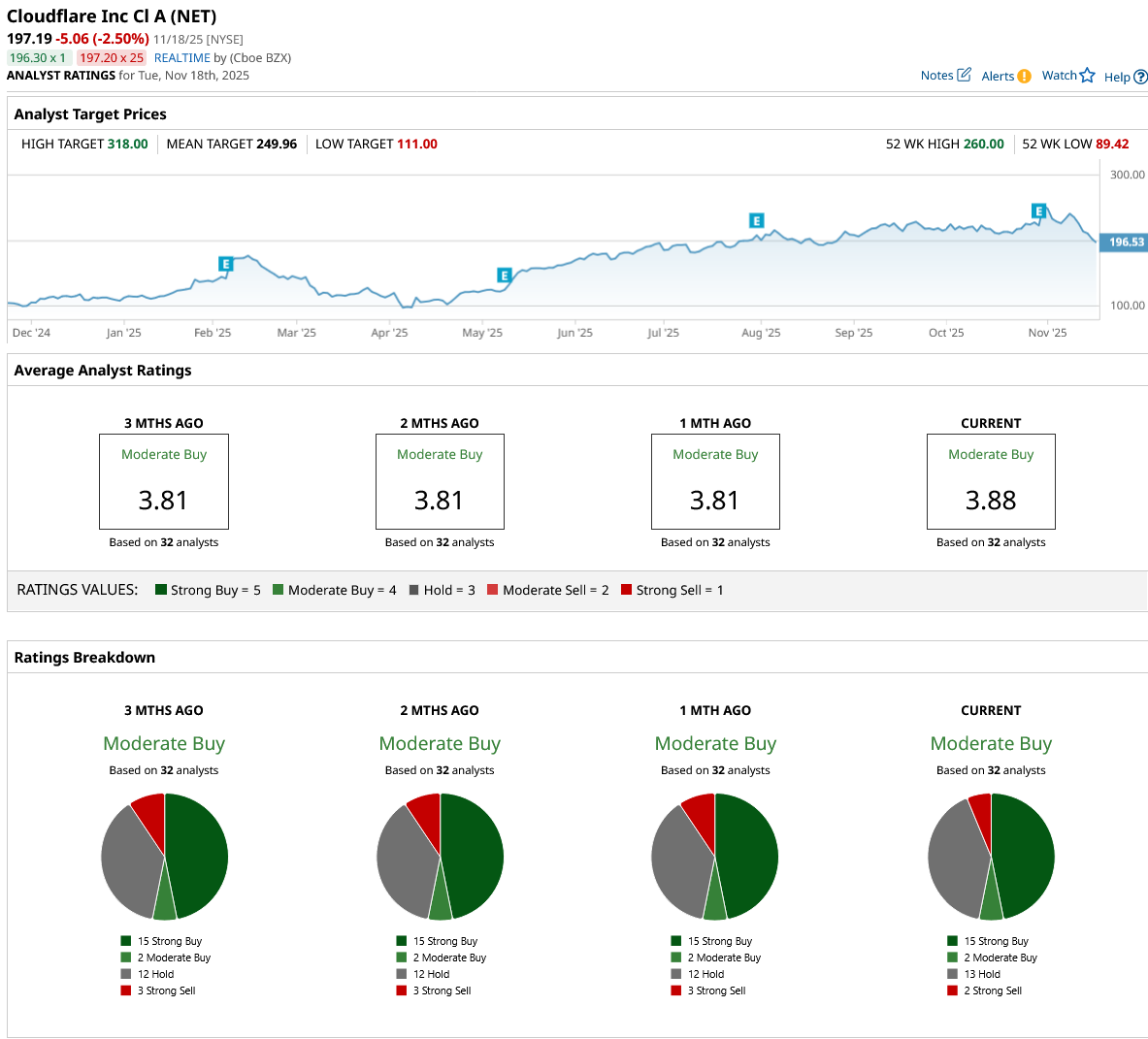

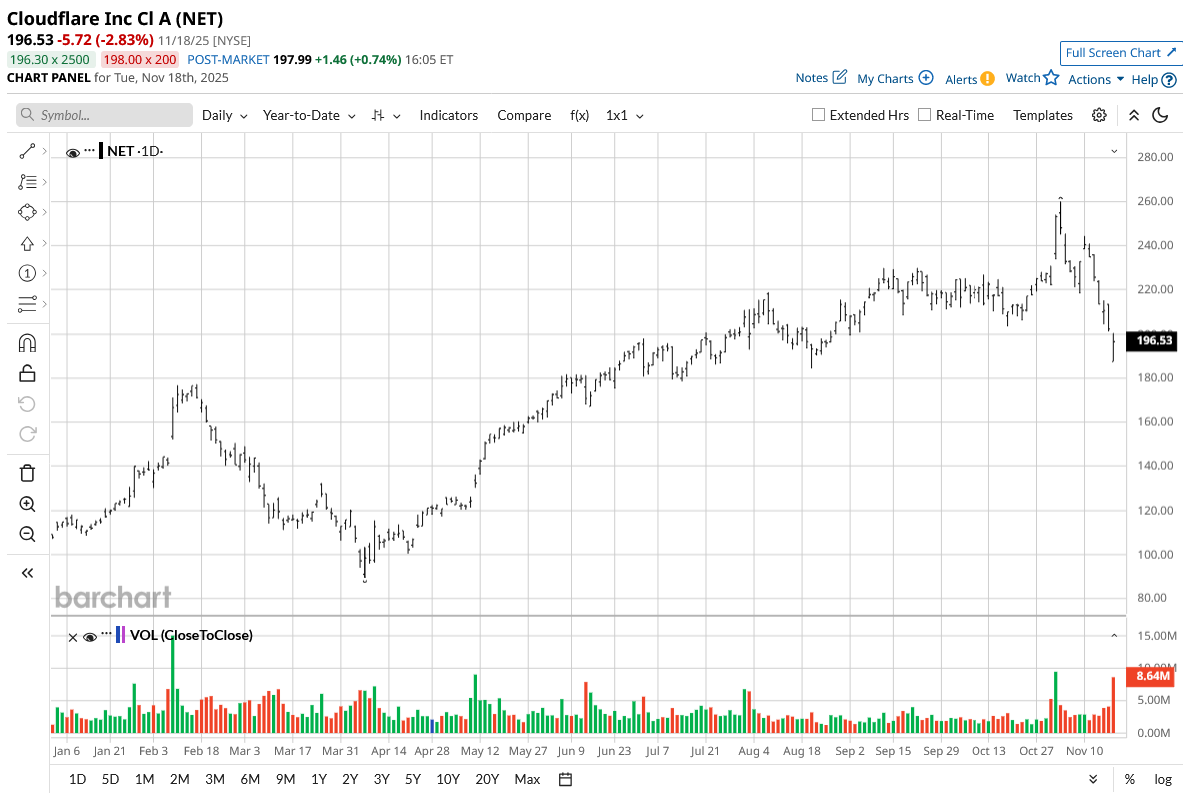

NET stock's price over the last 52 weeks ranges between a low of $89.42 and a high of $260. The stock currently sells at approximately $197 per share and has performed badly over the last five trading days with a decline of 16%, underperforming the S&P 500 Index ($SPX) significantly. However, Cloudflare’s stock still enjoys a positive weighted alpha of +74.46.

Cloudflare appears highly valuable relative to most peers in the software industry. Having a price/sales of 44.18 and a price/CF above 450x makes the stock highly expensive only on companies that have the scalability power with multi-year runway potential. Though this may not be unusual with the very best security networking company with edge power on the Internet security and networking landscape, execution seems extremely hard with very little margin of error.

This company does not pay dividends.

Cloudflare Beats on Earnings

Cloudflare continued its strong performance with its financial results in Q3 of 2025, with the company reporting a revenue of $562 million, a sharp increase of 31% on a year-over-year (YoY) basis. The company marked its second straight quarter with an acceleration of its results growth. Additionally, the company’s non-GAAP operating income of $85.9 million reported a margin of 15.3%, with its free cash flow at $75 million and a margin of 13% during the reported quarter.

Additionally, the company’s GAAP net loss showed a sharp reduction of only $1.3 million during the reported quarter; this marked a sharp recovery from the loss of $15.3 million reported during the same quarter last year. To this end, the company’s management guided that Q4 revenue will come in between $588.5 million and $589.5 million, with consistent operating income of around $83 and $84 million on a non-GAAP basis. This indicates that the company’s performance remains strong despite the outage that occurred this week. This was reflected in the company’s strong 43% increase in its RPO over the last year.

Other than the numbers announced, Cloudflare still introduces new functionalities regarding security and AI-fueled edge computing. Cloudflare CEO Matthew Prince further reinforced that the company ships new functionalities at an unprecedented pace and that the company builds the "rails of the next decade of Internet growth." No official announcement on the next earnings release yet.

What Do Analysts Expect for NET Stock?

Analysts maintain a broadly positive outlook on NET stock, with a “Moderate Buy” rating consensus and a mean price target of $249.96, representing potential upside of roughly 27% from current levels. The highest analyst target sits at $318, while the lowest is $111, underscoring the degree of uncertainty tied to growth-stock multiples and execution consistency.