/AI%20(artificial%20intelligence)/Businessman%20touching%20the%20brain%20working%20of%20Artificial%20Intelligence%20(AI)%20Automation%20by%20Suttiphong%20Chandaeng%20via%20Shutterstock.jpg)

Artificial intelligence application software company C3.ai (AI) is experiencing a dip in its stock price due to a restructuring that has weakened its top-line growth, as well as a CEO transition. With that news in mind, would it be prudent to invest in AI stock now?

Let's take a closer look.

About C3.ai Stock

Based in Redwood City, California, C3.ai is a prominent player in the enterprise AI software sector. The company focuses on building advanced AI and machine learning solutions to support businesses in streamlining operations, improving analytics, and accelerating digital transformation. At the heart of its offerings is the C3 AI Platform, a robust framework designed to simplify the creation and deployment of complex AI applications.

Serving industries like energy, finance, defense, healthcare, and manufacturing, C3.ai combines IoT, big data, and predictive analytics to deliver powerful automation and insights. In addition to its platform, the company provides ready-to-use AI applications tailored to specific business needs. These range from predictive maintenance to fraud detection. The company has a market capitalization of about $2 billion.

AI stock has not performed well on Wall Street for some time. Over the past 52 weeks, the stock has declined by 26%. Meanwhile, on a year-to-date (YTD) basis, shares are down 55%. C3.ai stock had reached a six-month high of $30.24 back in late May, but it is down 48% from this high. On news of the firm's weak report and the appointment of a new CEO, AI stock retreated 7.3% intraday on Sept. 4.

Despite this selloff, C3.ai’s price-to-sales (P/S) ratio sits at 5.34 times, which is stretched compared to the industry average.

C3.ai Reported Weak Q1 Results

On Sept. 3, C3.ai reported weak results for the first quarter of fiscal 2026. Total revenue decreased by 19.4% year-over-year (YOY) to $70.26 million. Subscription revenue, which constitutes the majority of the company’s topline, declined by 18% from the prior-year period to $60.30 million. The company's adjusted net loss per share also climbed significantly from $0.05 in Q1 fiscal 2025 to $0.37 in Q1 fiscal 2026.

The company cited its reorganization, accompanied by new leadership in sales and services, as the reason for this decline. In addition, C3.ai’s former CEO, Thomas Siebel, is suffering from health issues, which was also cited as a reason for the results. The company has chosen to appoint Stephen Ehikian as the new CEO, effective Sept. 1.

It remains to be seen what comes out of this leadership change. Ehikian is a seasoned tech leader with expertise in building and scaling AI companies. The executive also served as President Donald Trump’s appointee as Acting Administrator of the U.S. General Services Administration.

For the second quarter of fiscal 2026, C3.ai expects total revenue to be in the range of $72 million to $80 million, while its adjusted loss from operations is projected to be in the range of $49.5 million to $57.5 million. Given the leadership change and reorganization, the company has withdrawn its previous full-year guidance for the current fiscal year.

Wall Street analysts expect losses to deepen in the near term. They foresee the company’s loss per share increasing 23% YOY to $0.64 in Q2 fiscal 2026. For the current fiscal year, loss per share is projected to increase 37% annually to $3.02, followed by a 25% reduction in loss per share to $2.25 in the next fiscal year.

What Do Analysts Think About C3.ai Stock?

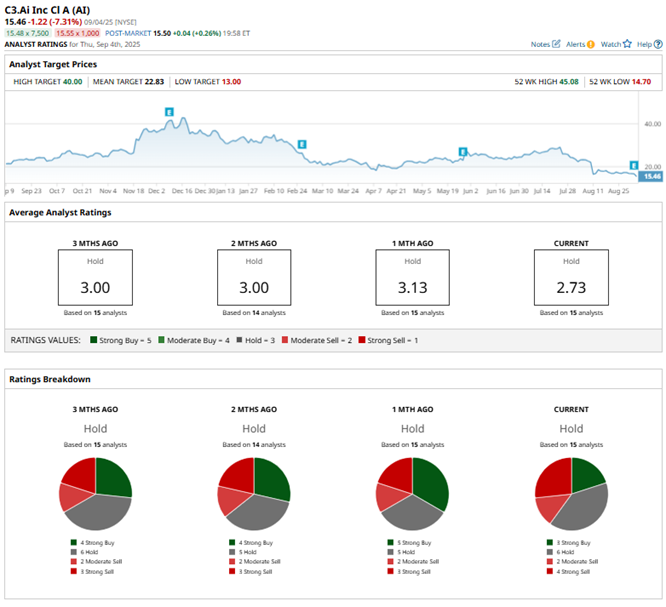

Wall Street analysts have become lukewarm on C3.ai stock. Analysts at UBS maintained a “Neutral” rating on C3.ai, while lowering the price target from $23 to $16. The downgrade is based on the firm's weak results and conservative outlook.

Analysts at Keybanc also lowered the price target from $18 to $10, while keeping an “Underweight” rating on AI stock. The price target downgrade followed the company's announcement of Q1 fiscal 2026 results. Finally, Needham analyst Mike Cikos maintained a “Hold” rating on C3.ai as well.

Wall Street analysts are recommending caution now when it comes to C3.ai stock, with analysts giving it a consensus “Hold” rating overall. Of the 15 analysts rating the stock, three have a “Strong Buy” rating, six provide a “Hold” rating, two issue a “Moderate Sell” rating, and four give it a “Strong Sell” rating. The consensus price target of $19 represents 22% potential upside from current levels.

Key Takeaways

C3.ai’s stock performance has been in the red for quite some time. The CEO transition is also creating some uncertainty at the moment, in addition to the firm's weak Q1 results. Moreover, analysts have become unsure about AI stock's prospects. Therefore, it might be wise for investors to wait for a better entry point when it comes to C3.ai.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.