/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

AST SpaceMobile (ASTS) is pioneering the only space-based cellular broadband network designed to connect standard, unmodified smartphones directly via low-Earth orbit (LEO) satellites. The company aims to close mobile coverage gaps globally by working with mobile network operators and leveraging an extensive portfolio of over 3,300 patents. Its innovative technology promises to deliver affordable, high-speed internet access to underserved communities and remote areas, marking a major step forward in universal connectivity.

Founded in 2017, the company is based in Midland, Texas.

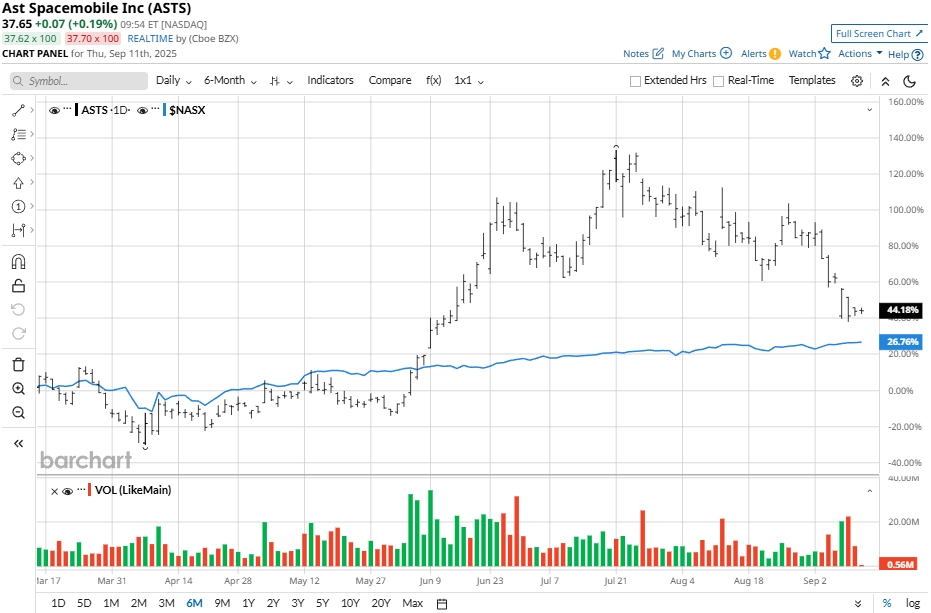

ASTS Outperforms Benchmark

ASTS stock has experienced significant volatility, declining approximately 16% over the past five days and 20% in the last month, despite delivering a robust 29% rise over six months and a strong 78% year-to-date (YTD) gain. The stock has provided multibagger gains with an over 850% rise in two years. The stock substantially outpaced the Nasdaq Composite ($NASX), which posted a steadier advance this year.

Despite its recent dip, ASTS continues to outperform its benchmark on a 6- and 12-month horizon.

AST SpaceMobile Results

AST SpaceMobile reports its second-quarter results on Aug. 12, 2025, posting a loss per share of $0.41, wider than analyst expectations of a $0.12–$0.21 loss. Revenue for the quarter came in at $1.16 million, well below estimates ranging from $6.4 million to $8.7 million, highlighting a substantial top- and bottom-line miss. The disappointing figures underscore the company’s current pre-commercial phase, with revenue still extremely limited as it ramps up for broader service launches.

Key financial metrics for Q2 illustrated deepening investment: operating expenses grew to roughly $74 million, up $10 million year-over-year (YoY), while capital expenditures surged to over $320 million as satellite production and deployment accelerated. The net loss for the quarter reached approximately $135 million.

Despite the losses, AST SpaceMobile’s liquidity remains robust, with over $1.5 billion in pro forma cash, cash equivalents, and restricted cash as of June 30, 2025, boosted by recent financing activities.

The company reaffirmed its prior full-year revenue guidance of $50–$75 million for the second half of 2025, projecting major contributions from the commercial launch and expanded satellite deployments. AST SpaceMobile remains on track to begin intermittent U.S. service by year-end and targets 45–60 satellites in orbit by 2026, with commercial ambitions underpinned by its strong cash reserves.

ASTS Down on Ratings

AST SpaceMobile’s shares fell nearly 8% in early trading on Tuesday after UBS downgraded the stock from “Buy” to “Neutral,” citing rising competitive pressures in the space-based cellular broadband sector.

Despite recognizing AST SpaceMobile’s advanced technology and strategic mobile carrier partnerships, UBS warned that SpaceX’s Starlink has strengthened its competitive position by acquiring EchoStar’s (SATS) S-band spectrum in a $17 billion deal, creating new challenges for AST as it seeks to grow its satellite network and market share.

UBS analyst Christopher Schoell lowered the firm’s price target for ASTS stock from $62 to $43, reflecting an upside of just 14% from market rate, and emphasized the tougher landscape as Starlink pushes deeper into direct-to-cellular capabilities.

Should You Buy ASTS Stock?

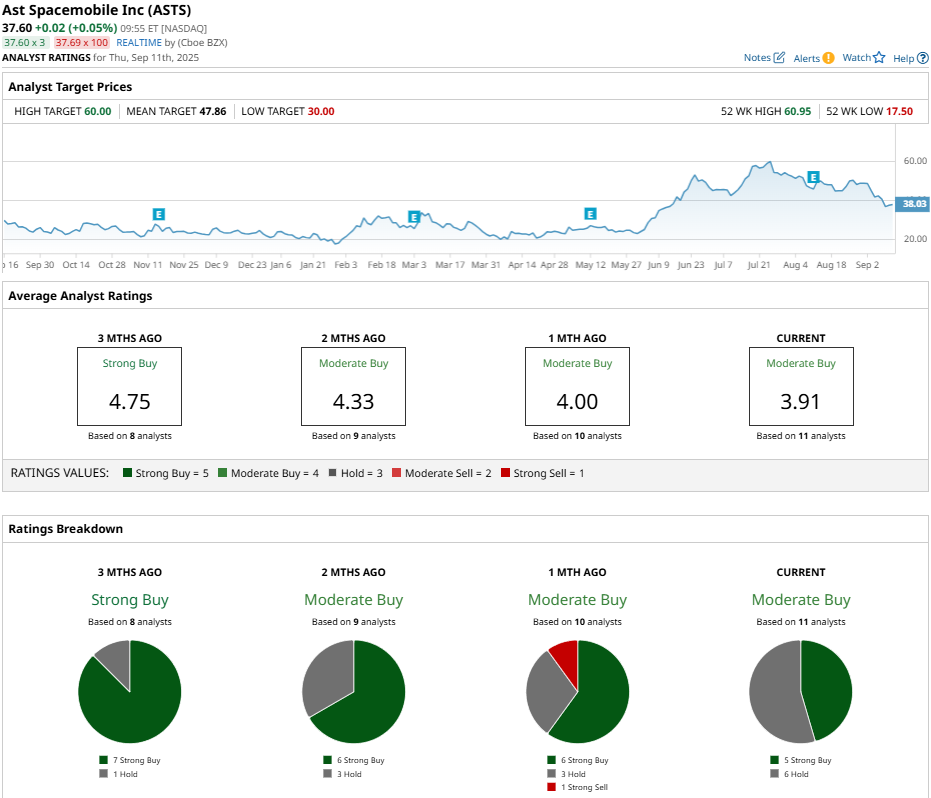

AST SpaceMobile is experiencing a decline in analyst confidence, as ASTS stock has fallen from a consensus “Strong Buy” rating to “Moderate Buy” in the past three months. The stock has a mean price target of $47.86, representing a 27% upside from the current market price.

Out of the 11 analysts who have reviewed ASTS stock, five have given it a “Strong Buy” rating and six have a “Hold” rating on the stock.