/The%20CoreWeave%20logo%20displayed%20on%20a%20smartphone%20screen_%20Image%20by%20Robert%20Way%20via%20Shutterstock_.jpg)

As we enter October, CoreWeave (CRWV) finds itself at a pivotal inflection point. Once a scrappy crypto-miner turned artificial intelligence (AI) infrastructure play, the company has rapidly repositioned itself as a central node in the GPU-powered cloud ecosystem. Its latest multi-billion dollar deals with OpenAI and Nvidia (NVDA) inject further opportunities into its path forward.

But surging revenue is accompanied by soaring costs and concentration risk. So, should you buy, sell, or hold CoreWeave this October?

About CoreWeave Stock

Headquartered in Livingston, New Jersey, CoreWeave was founded in 2017 and has evolved from its beginnings in cryptocurrency mining into a leading provider of GPU-optimized cloud services for AI training and inference. Now boasting a market capitalization of $62.9 billion, the company is steadily expanding its footprint in the AI infrastructure space.

Since its public debut in March 2025, CRWV stock has attracted significant investor attention, driven by the explosive growth in AI demand and marquee partnerships with major players, including OpenAI, Microsoft (MSFT), and Nvidia.

CoreWeave made its public debut at $40 per share and quickly rallied to a high of $187 on June 20, fueled by retail investors eager for AI plays. Since then, however, the stock has pulled back sharply, ending the most recent session at $139.98.

Nevertheless, over the past month, CoreWeave stock has staged a rally, climbing around 50% and recapturing much of its earlier gains. The surge comes amid a backdrop of renewed contract momentum, including a headline $6.5 billion expansion with OpenAI as well as fresh analyst upgrades.

That said, the strong short-term rebound also raises the specter of near-term profit taking and volatility, especially given CRWV stock’s steep valuation.

The stock is currently trading at 19.38 times forward sales, which is a premium compared to its peers.

Deepening Ties With AI Juggernauts Are Broadening Horizons

CoreWeave’s strategic momentum is now turbocharged by two blockbuster deals this month that strengthen both its core AI infrastructure role and its financial resiliency. Most recently, it expanded its OpenAI pact with a fresh $6.5 billion contract, raising the cumulative value of their collaboration to $22.4 billion.

CEO Michael Intrator called this phase “the quarter of diversification,” emphasizing CoreWeave’s shift toward a more balanced mix of marquee clients rather than overreliance on any single partner.

CoreWeave also locked in a $6.3 billion cloud-capacity agreement with Nvidia, under terms that guarantee the chipmaker will purchase any unsold capacity through April 2032. This arrangement not only cements Nvidia’s alignment with CoreWeave’s infrastructure ambitions, but also gives CoreWeave a built-in demand floor — a rare safety buffer in a capital-intensive, demand-driven business.

CoreWeave's Strong Revenue Growth

CoreWeave released its second-quarter 2025 results on Aug. 12, highlighting strong momentum fueled by surging AI demand. Revenue jumped 207% year-over-year (YOY) to $1.2 billion, beating expectations, while the company’s backlog swelled to $30.1 billion as of June 30.

Yet, profitability remained under pressure. Rising expenses drove a net loss of $290.5 million or $0.60 per share, although that was narrower than the $323 million or $1.62 per share loss reported a year earlier. On an adjusted basis, net loss widened significantly to $130.8 million, up from just $5.1 million last year.

Offsetting some of these concerns, adjusted EBITDA climbed to $753.2 million with a 62% margin. Adjusted operating income rose to $199.8 million with a 16% margin.

Management expressed confidence in sustained growth, raising full-year revenue guidance to between $5.15 billion and $5.35 billion and projecting Q3 revenue between $1.26 billion and $1.3 billion.

However, analysts expect losses to deepen in fiscal 2025, with loss per share increasing 100% YOY to $2.68 in fiscal 2025, before improving by 53% to reach a loss of $1.26 in fiscal 2026.

What Do Analysts Expect for CoreWeave Stock?

Earlier this week, Wells Fargo upgraded CoreWeave to “Overweight” from “Equal Weight,” raising its price target to $170 from $105, citing strong AI-driven demand and ongoing industry supply shortages. Wells Fargo also lifted fiscal 2026 and fiscal 2027 revenue forecasts, highlighting growing partnerships with companies like Microsoft, persistent hyperscaler supply constraints, and Nvidia’s commitment to purchase all unused capacity through 2032, giving CoreWeave a multi-year runway for expansion.

Citizens JMP reaffirmed its “Market Outperform” rating and $180 price target on CoreWeave, following the company’s expanded $6.5 billion agreement with OpenAI. Citizens JMP highlighted rising GPU-as-a-Service demand, expecting the market to scale from $3 billion to $ 4 billion today to $300 billion.

However, some analysts are still on the sidelines. Barclays reiterated its “Equal Weight” rating and $140 price target on CoreWeave.

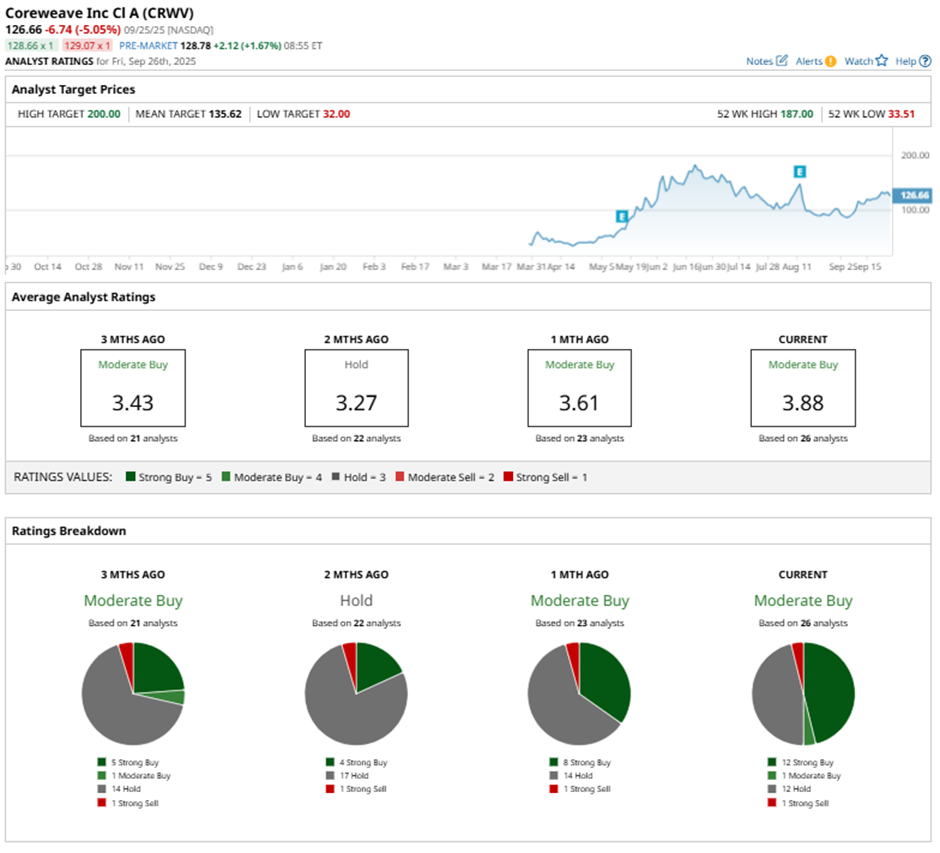

CRWV stock has a consensus “Moderate Buy” rating overall. Out of 27 analysts covering the stock, 13 recommend a “Strong Buy,” one gives a “Moderate Buy,” 12 analysts stay cautious with a “Hold” rating, and one has a “Strong Sell” rating.

CRWV stock’s average analyst price target of $140.52 indicates minimal upside potential from here. However, the Street-high target price of $200 suggests 43% upside ahead.