/Block%20Inc_%20(SQ)%20Image%20by%20Sergei%20Elagin%20via%20Shutterstock.jpg)

Block’s (XYZ) stock surge following its Q2 earnings presents a mixed picture for investors. In the June quarter, the fintech company reported revenue of $6.05 billion vs. estimates of $6.31 billion, while earnings fell short at $0.62 per share versus estimates of $0.69 per share. However, strong operational metrics told a different story.

Block’s gross profit jumped 14% to $2.54 billion, exceeding analyst estimates of $2.46 billion. More importantly, Block raised full-year gross profit guidance to $10.17 billion, representing 14% growth and above its previous forecast of $9.96 billion. Square’s payment volume grew 10% to $64.25 billion, demonstrating continued market share gains despite intensifying competition from Toast (TOST) and Fiserv’s (FI) Clover.

Net income in Q2 more than doubled to $538.5 million, showcasing improved profitability. The company’s strong guidance for Q3 gross profit growth of 16% and expectations for 20% operating margins indicate that management is confident in Block’s execution.

Is Block Stock a Good Buy Right Now?

Block’s second-quarter earnings call revealed a company hitting its stride through accelerated product development and strategic execution. CEO Jack Dorsey emphasized the transformative impact of increased shipping velocity, highlighting the rapid three-month development cycle for Cash App Pools, a complex feature enabling group money pooling that extends beyond the Cash App network to include Apple Pay (AAPL) and Google Pay (GOOG) (GOOGL) users.

The company’s artificial intelligence investments are proving transformative, as internal AI coding tools like “Goose” have accelerated developer productivity and enabled near-zero-cost experimentation. This technological infrastructure is fueling Block’s ability to deliver customer value faster while maintaining its focus on the core network effects that originally made Cash App successful.

Cash App’s banking strategy is gaining traction, with 8 million active users either depositing paychecks or spending over $500 monthly, a 16% year-over-year increase. These high-engagement customers generate over $250 in annualized gross profit per user, triple Cash App’s blended average, demonstrating the platform’s value as a primary banking relationship.

The lending portfolio continues expanding responsibly, with Borrow reaching 6 million monthly active users and $18 billion in annualized originations. Block’s proprietary credit scoring model enables approval of 38% more customers compared to traditional VantageScore metrics while maintaining loss rates under 3%. The recent migration to Square Financial Services for loan origination enhances unit economics and provides greater operational control.

Square’s go-to-market investments are delivering strong returns, with field sales teams showing 5-6 quarter payback periods and the strongest new volume growth since Q3 2021. The launch of Square Handheld hardware and Square AI dashboard tools positions the platform competitively across restaurant, retail, and service verticals.

Block’s commitment to accepting emerging payment methods, including Bitcoin (BTCUSD) and stablecoins, reinforces its strategy of enabling sellers to capture every transaction opportunity. The company’s focus on next-generation financial tools positions it well for sustained growth as product velocity continues accelerating.

Is XYX Stock Undervalued?

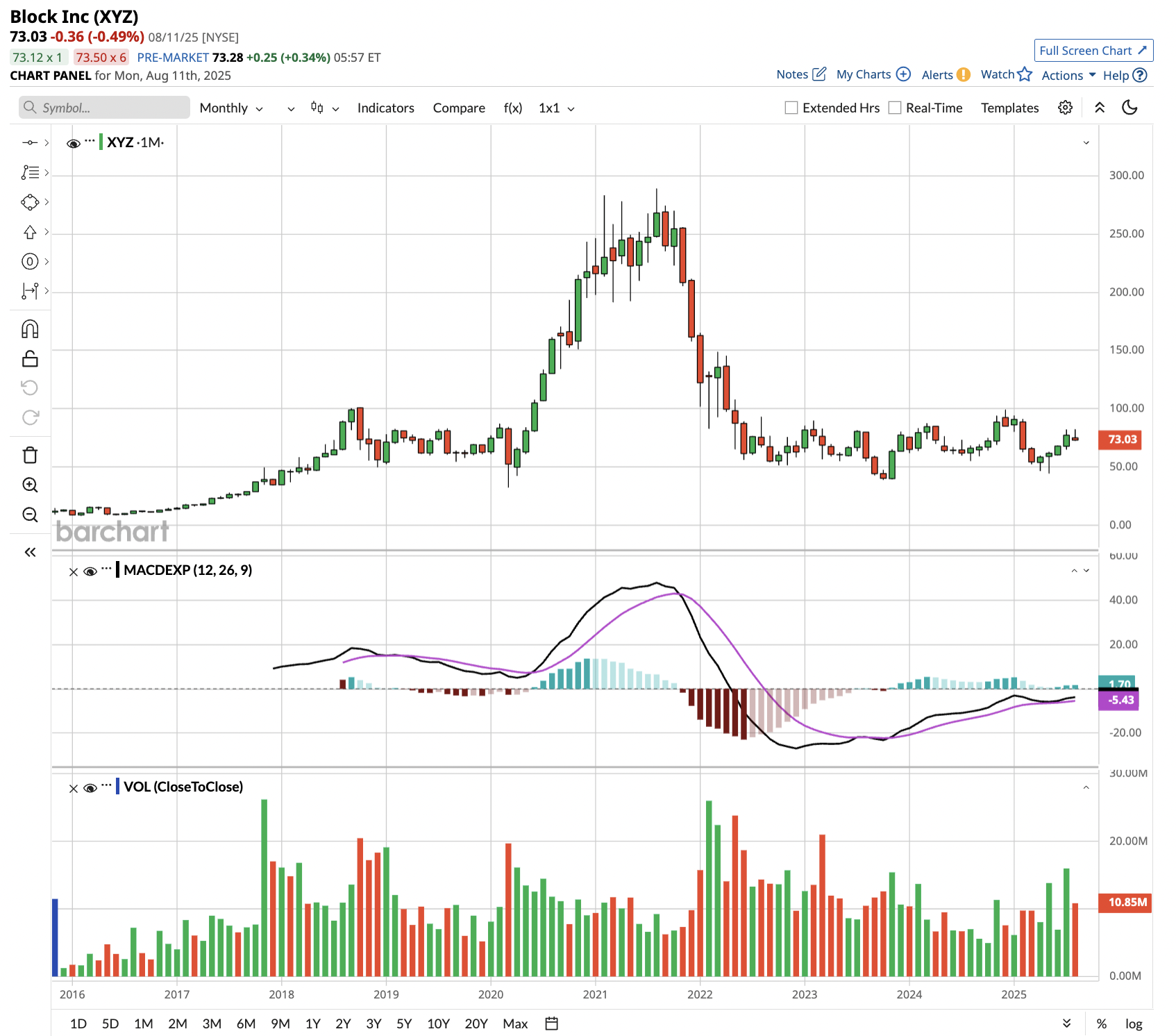

While the earnings pop reflects optimism about raised guidance, Block stock still faces revenue headwinds and competitive pressures. XYZ stock’s year-to-date 9.5% decline suggests market skepticism, but improving profitability metrics and market share gains in key verticals provide reasons for cautious optimism.

Analysts tracking Block stock forecast sales to rise from $24.1 billion in 2024 to $39.55 billion in 2029. In this period, free cash flow is forecast to improve from $1.55 billion to $5 billion. If XYZ stock is priced at 20 times forward FCF, which is reasonable, it could gain over 120% from current levels over the next four years.

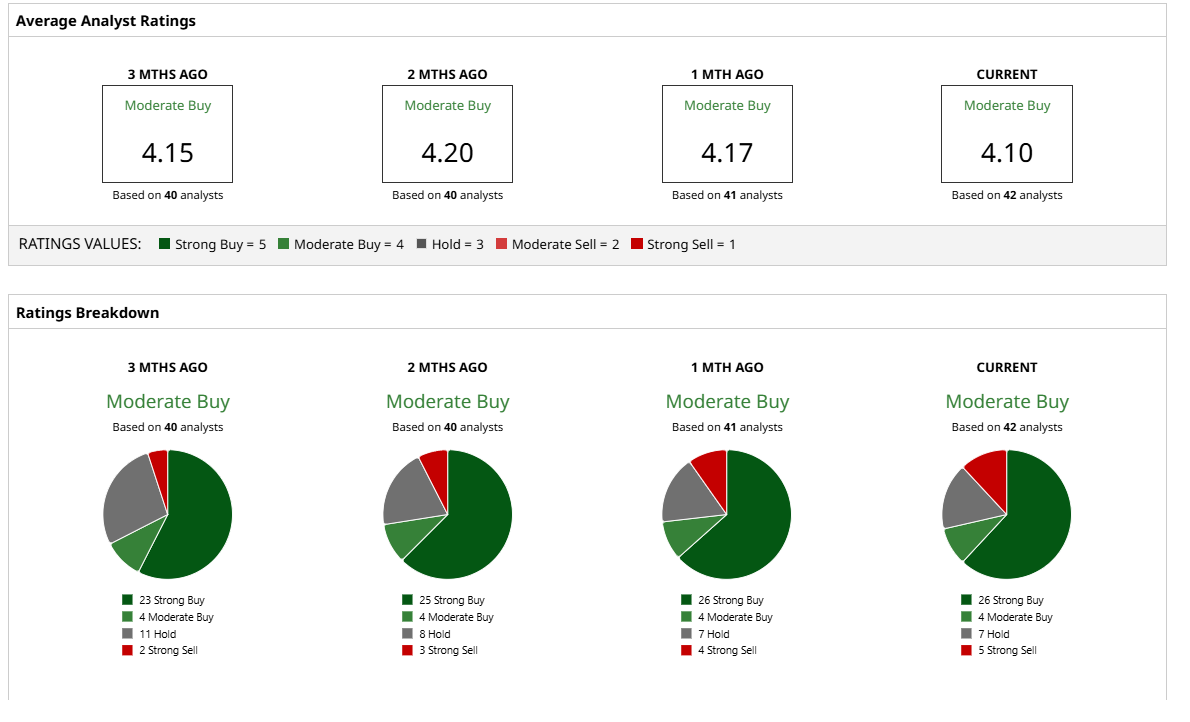

Of the 42 analysts covering XYZ stock, 26 recommend “Strong Buy,” four recommend “Moderate Buy,” seven recommend “Hold,” and five recommend “Strong Sell.” The average Block stock price target is $80.61, roughly 5% above the current price.