Fannie Mae and Freddie Mac may sound like funny names, but there’s nothing silly about the pivotal role they play in the U.S. housing market. The two government-sponsored enterprises have been operating under federal conservatorship for nearly two decades in the aftermath of the 2008 housing bubble and crash. But now President Donald Trump’s administration is reportedly considering a public offering that would allow investors to buy a 5% stake.

The two companies play similar roles, with Fannie Mae historically buying from large commercial banks and Freddie Mac working with smaller lenders and credit unions. The stocks for both companies are up big in the last year. While it’s unclear how a shift toward privatization could happen or when the offering would occur, it’s time for investors to start considering if they should buy Freddie Mac or Fannie Mae stock.

About Fannie Mae Stock

Fannie Mae is the commonly held name of the Federal National Mortgage Association (FNMA). The government-sponsored enterprise, along with Freddie Mac, is the backbone of the U.S. mortgage industry because it buys mortgages from banks and bundles them into mortgage-backed securities. Fannie Mae and Freddie Mac guarantee the securities, so investors buy them knowing that they’ll still get paid even homeowners default on their loans.

Fannie Mae and Freddie Mac needed a government bailout in 2008 after the housing bubble popped, leaving both on the hook for risky loans and securities that included subprime loans. The entities lost billions of dollars before Congress created the Federal Housing Finance Agency and placed them under conservatorship.

Fannie Mae and Freddie Mac have paid billions in dividends to the U.S. government as part of the conservatorship – more than they received as part of the bailout, in fact – and are now profitable.

Fannie Mae is larger of the two, with a market capitalization of $14.6 billion. Trading at nearly $14 at the time of this writing, FNMA stock is near the top of its 52-week range and has risen more than 1,000% in the last year. That includes a 21% jump in the last week after the Trump administration announced it was considering the public offering.

Fannie Mae was created in 1938 during the Great Depression to help banks finance long-term fixed-rate mortgages with low down payments. The company today is the largest guarantor of residential mortgage debt in the U.S., handling 25% of single-family home loans and about 21% of multifamily residential properties.

Revenues in the quarter were $7.24 billion, down 1% on a year-over-year basis. Net income was $3.31 billion, a sharp 26% drop on a year-over-year basis. CEO Priscilla Almodovar attributed the drop to a higher provision for credit losses.

Fannie Mae’s net worth now stands at $101.6 billion, which is up $3.3 billion in the last quarter.

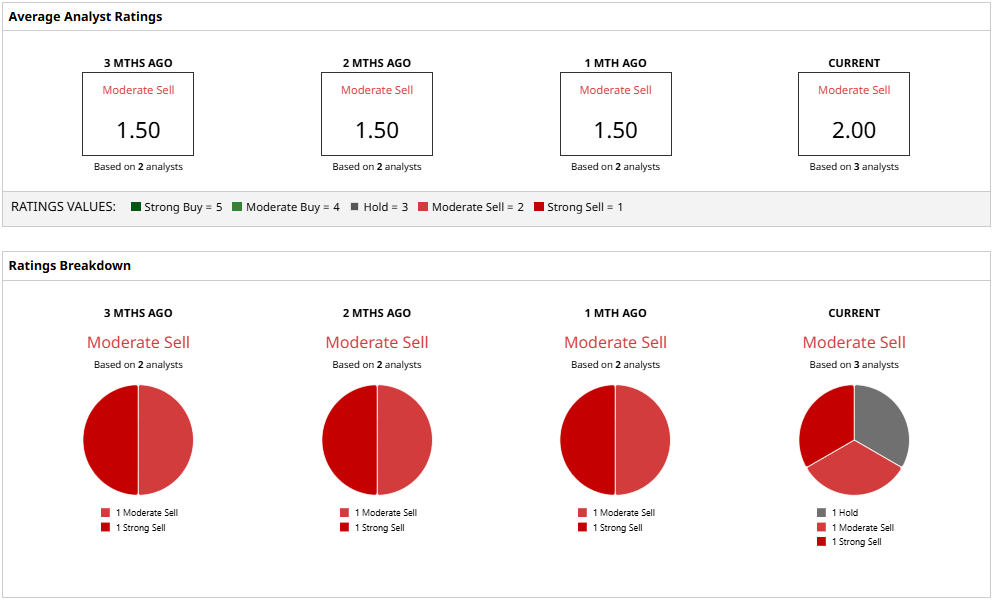

However, analysts aren’t as bullish on Fannie Mae as investors have been in recent weeks. The most bullish analyst has a price target of only $4, which implies 71% downside from current levels. Three analysts tracking FNMA stock have a consensus Moderate Sell rating for Fannie Mae.

About Freddie Mac stock

Freddie Mac is the popular name of the Federal Home Loan Mortgage Corporation (FMCC). Like Fannie Mae, it’s also a government-sponsored enterprise under federal conservatorship. While Fannie Mae was created during the Great Depression and works primarily with the major banks, Freddie Mac was created in 1970 to work with smaller banks to expand liquidity and give smaller lenders more access to real estate sales.

It’s smaller than Fannie Mae, with a market capitalization of $7.7 billion. And it’s trading close to its 52-week high, with the stock also up 1,000% in the last year.

Net revenues in the second quarter were $5.9 billion, down 1% from a year ago, and net income was $2.4 billion, down 14% from the same quarter a year ago. Like Fannie Mae, Freddie Mac said the drop was due to an increase in the provision for credit losses.

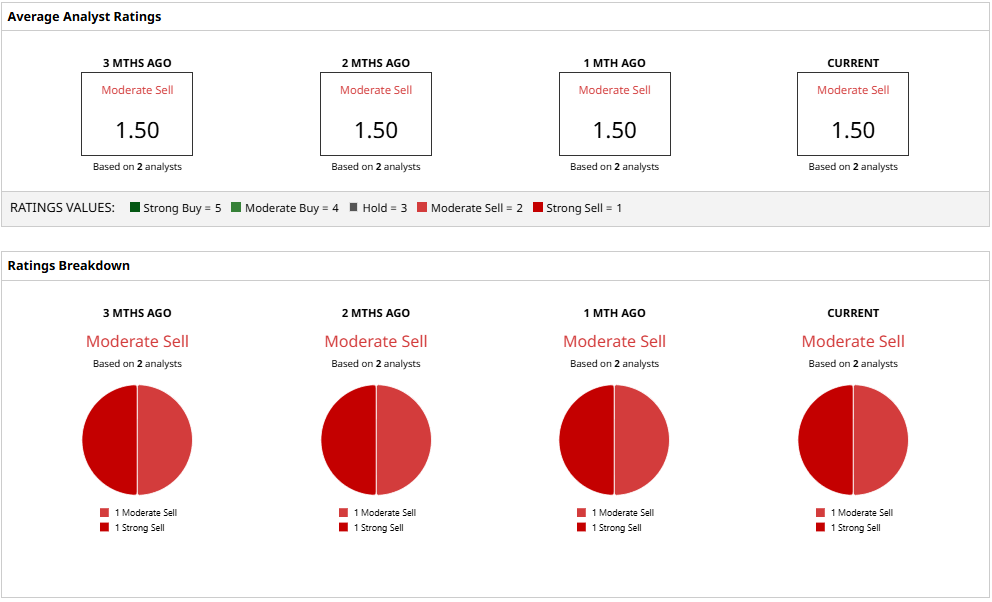

Analysts also have a bearish stance on the Freddie Mac stock, with the consensus sentiment being “Moderate Sell.”

The Bottom Line

Bill Pulte, the director of the Federal Housing Finance Agency that oversees Freddie Mac and Fannie Mae, says that the government’s stake in the two enterprises are between $500 billion and $700 billion. But any move to sell stakes in the companies may face pushback in Congress on concerns that privatization could push mortgage rates higher or destabilize the housing market.

While analysts are not enthusiastic about either stock right now, there appears to be plenty of time before the Trump administration moves forward, allowing investors an opportunity to get clarity before taking a stake in stocks trading at prices analysts consider inflated.

On the date of publication, Patrick Sanders did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.