/Apple%20logo%20on%20store%20front%20by%20frantic00%20via%20iStock.jpg)

Apple (AAPL) shares have been pushing higher ahead of the behemoth’s much-anticipated product launch event scheduled for Sept. 9.

The company will unveil its next-gen iPhone next week, which will reportedly feature major design upgrades for the first time in about five years.

Apple stock has handily outperformed the benchmark S&P 500 Index ($SPX) over the past five months. At the time of writing, the iPhone maker is trading up more than 40% versus its share price in early April.

iPhone 17 Launch Could Unlock Further Upside in Apple Stock

The iPhone 17 design overhaul could prove meaningfully positive for AAPL stock in the back half of 2025.

A fresh look could reignite consumer demand and help Apple neutralize intensifying competition from the likes of Samsung and Google (GOOGL), both of which have gained ground in premium smartphone segments.

The redesign may also shift investors’ focus, at least temporarily, from its perceived lag in artificial intelligence (AI) innovation.

With supply chain improvements and strong global rollout plans, the event could spark an upgrade cycle, lifting revenue, margins, and sentiment at a time when Apple shares need a renewed growth story.

MoffettNathanson Recommends Caution on AAPL Shares

Despite the aforementioned product launch event, MoffettNathanson continues to rate Apple stock at “Neutral” only. Its $225 price target on the iPhone market signals potential downside of over 5% from here.

According to the firm’s founder and senior analyst, Craig Moffett, “north of 30x next year earnings is still, in our view, too rich for any company with good but not-great earnings growth.”

In his latest research note, Moffett also cited Apple Intelligence being “mostly a dud” for his dovish stance on the tech behemoth.

Finally, while the company is leaning on discounts to mitigate market share losses in China, the strategy could pressure margins and weigh on AAPL shares in the near term.

Wall Street No Longer Sees Upside in Apple Shares

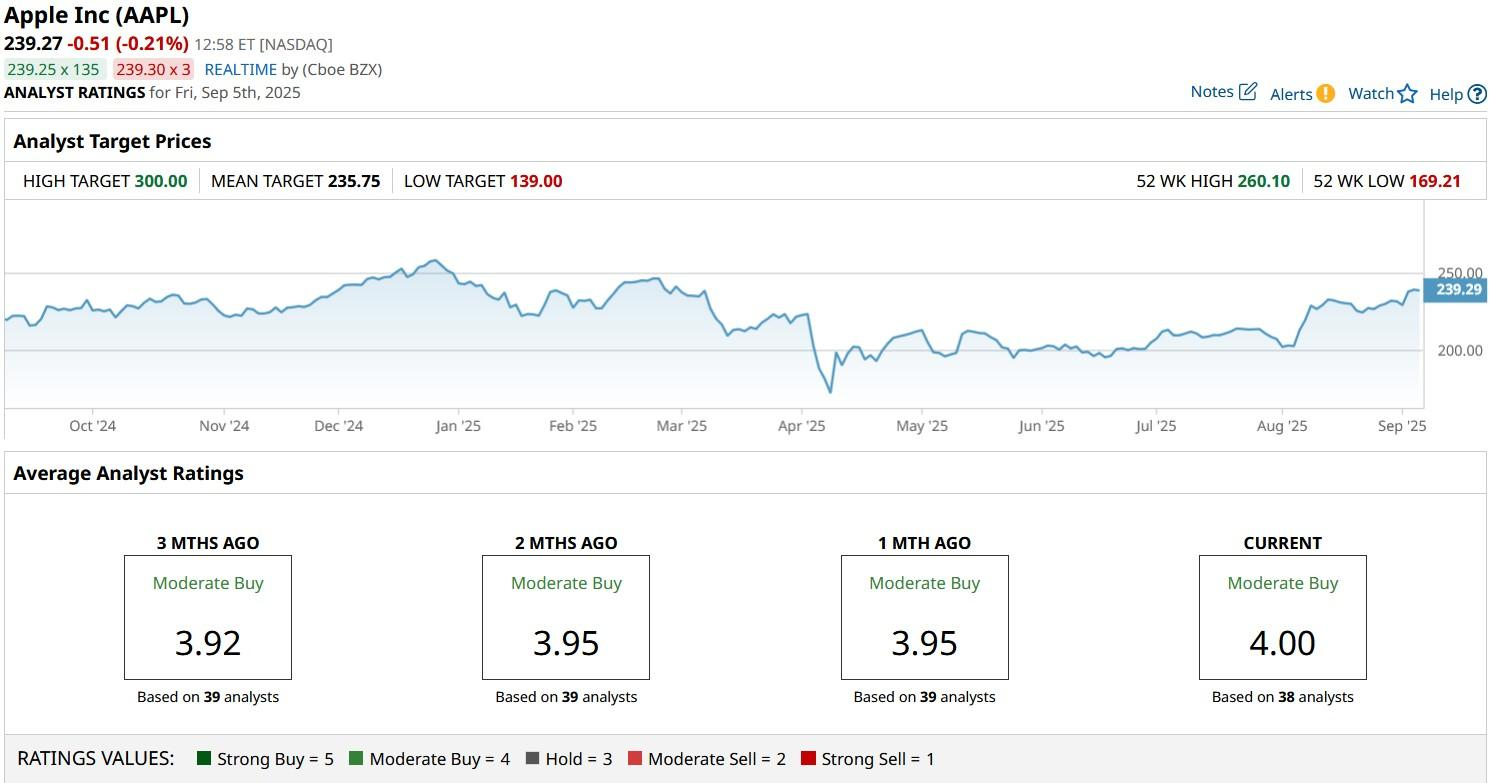

Investors should also note that other Wall Street analysts are not particularly bullish on Apple stock either.

While the consensus rating on AAPL shares currently sits at “Moderate Buy,” the mean target of $235 no longer indicates any further upside from here.