It’s easy to get sucked into the excess noise from the investment media with fear mongering headlines like:

Dow Falls More than 500 Points

And to that I say...So the heck what!!!

The index is up over 6,000 points from the October 2023 lows. So, it’s not a big deal if we give back 500 points. Even giving back 2,000 points is kind of a snooze from these lofty levels.

What matters now is reading the economic and inflationary tea leaves to determine when the Fed will finally start lowering rates. That discussion will be at the center of today’s Reitmeister Total Return commentary.

Market Commentary

On the economic front we have a mixed bag of recent developments starting with the lower than expected Core PCE Price Index on Thursday. This is the Fed’s favored measure of inflation that continues to ebb lower with at 2.8% year over year. This is the 12th consecutive reading lower than the previous month which says the trend is our friend.

Next on Friday came a not so healthy 47.8 reading for ISM Manufacturing. That is under the all important 50 mark which denotes contraction. Not helping matters was the New Orders component falling month over month from 52.5 to 49.2. Meaning that the outlook has dimmed.

Then on Tuesday we found that ISM Services seems to be clipping along at a familiar pace. Even though a notch softer than expected at 52.6, it’s the improvement in the forward looking New Orders component at 56.1 that points to better readings ahead.

The best part of that report was the lowering of the Employment component from barely expansionary 50.5 into contraction territory at 48.0. Yes, I understand that doesn’t sound good on the surface, as it points to potential weakness in the jobs market. But really, it has been the strength of employment leading to sticky wage inflation that has kept inflation too high and the Fed not willing to lower rates.

Perhaps this weak ISM Services Employment reading is finally a sign of softening in employment that eases inflationary pressures there. That would probably be the last piece of the jigsaw puzzle to fall into place allowing the Fed to start lowering rates.

We will know more about employment on Wednesday from the ADP Employment Change report followed by the JOLTs Job Openings result. Most important will be the Government Employment Situation announcement on Friday morning where 195,000 jobs added is the expectation.

With that Friday jobs report will come an update on wage inflation which was a tad too “hot and sticky” last month. Hopefully we see more signs of easing this time around.

All in all, the economy is on good footing as can be seen by the +2.1% GDPNow estimate for Q1. Note this is down from +3.2% on Friday after the weaker than expected readings for ISM Manufacturing and Construction Spending.

This too sounds like a negative on the surface. But not really. That’s because a higher growth rate creates more inflationary pressures...and the longer it will take for the Fed to start cutting rates.

The Goldilocks GDP results we all want is more in the range of +1 to 2%. That’s because this is a level that speaks to modest growth and staves off recession while at the same time eases inflationary pressures.

No one is expecting this to lead to a rate cut at the next Fed meeting on March 20th. Powell put a very clear nail in that coffin at the previous press conference.

As we look out to the May 1st Fed meeting odds are on the rise again with 70% probability of a cut. Sorry to be a party-pooper, but that is not going to happen because the Fed is a slow and deliberate group. There is still too much sticky inflation in places like housing and employment to honestly consider cutting as early as May 1st.

Thus, my money currently rides on the June 12th meeting as potentially being the timing of the first rate cut. I am happy to get on board the May 1st bandwagon but will need to see much more impressive inflation readings closer to the Fed’s 2% target in the next several weeks.

Trading Plan

Even though I believe we are firmly implanted in a new long term bull market...the easy money has been from the bear market lows of late 2022. And a lot of those gains were predicated on the Fed ALREADY lowering rates which should bolster the economy and earnings growth.

With that being on hold...so too should further S&P 500 (SPY) gains be on hold. Thus, not a shock to me that stocks sold off mightily on Tuesday. Especially the over ripe tech stocks which as a group fell -2.5% on the session.

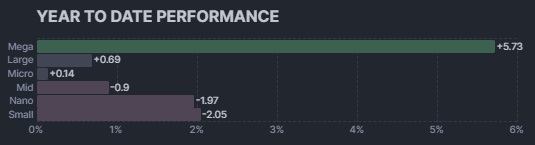

No...that doesn’t mean it’s time to run for cover. Just a healthy time for investors to rotate out of the overplayed 2023 winners and give others a chance to shine. Like small and mid caps which have spent a bit more time in the sun this past month:

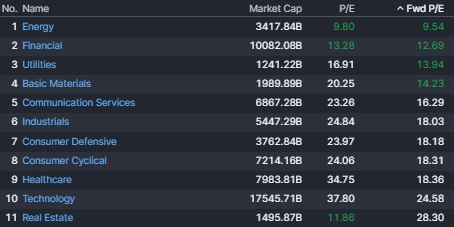

Value also should be in higher consideration with some of the sectors near the top of this Forward PE list getting more love.

Or simply, I believe that buying healthy growing companies at discounted prices is the best path forward.

Yes, I am a broken record on that front since I always think that makes the most sense. Gladly history is on my side when it comes to that approach.

However, there are times, like the big bull run we saw from November through end of February where the “in fashion” growth stocks take center stage. Now it is time for them to go back stage and let others have a chance in the limelight.

Which are my favorite growth stocks at a reasonable price now?

Read on below for the answer.

What To Do Next?

Discover my current portfolio of 12 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model. (Nearly 4X better than the S&P 500 going back to 1999)

This includes 5 under the radar small caps recently added with tremendous upside potential.

Plus I have 1 special ETF that is incredibly well positioned to outpace the market in the weeks and months ahead.

This is all based on my 44 years of investing experience seeing bull markets...bear markets...and everything between.

If you are curious to learn more, and want to see these lucky 13 hand selected trades, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

SPY shares rose $0.52 (+0.10%) in after-hours trading Tuesday. Year-to-date, SPY has gained 6.71%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

Should Stock Investors Be Scared by Recent Sell Off? StockNews.com