/EV%20charging%202%20by%20UniqueMotionGraphics%20via%20iStock.jpg)

Electric vehicle (EV) stocks have been volatile in 2025, driven by clean energy policy changes. While giants like Tesla (TSLA) and Rivian (RIVN) often dominate the headlines, some smaller EV players have become prime targets for short sellers looking to profit from their struggles. However, high short interest can sometimes have the opposite effect, fueling powerful rallies when traders rush to cover their bets.

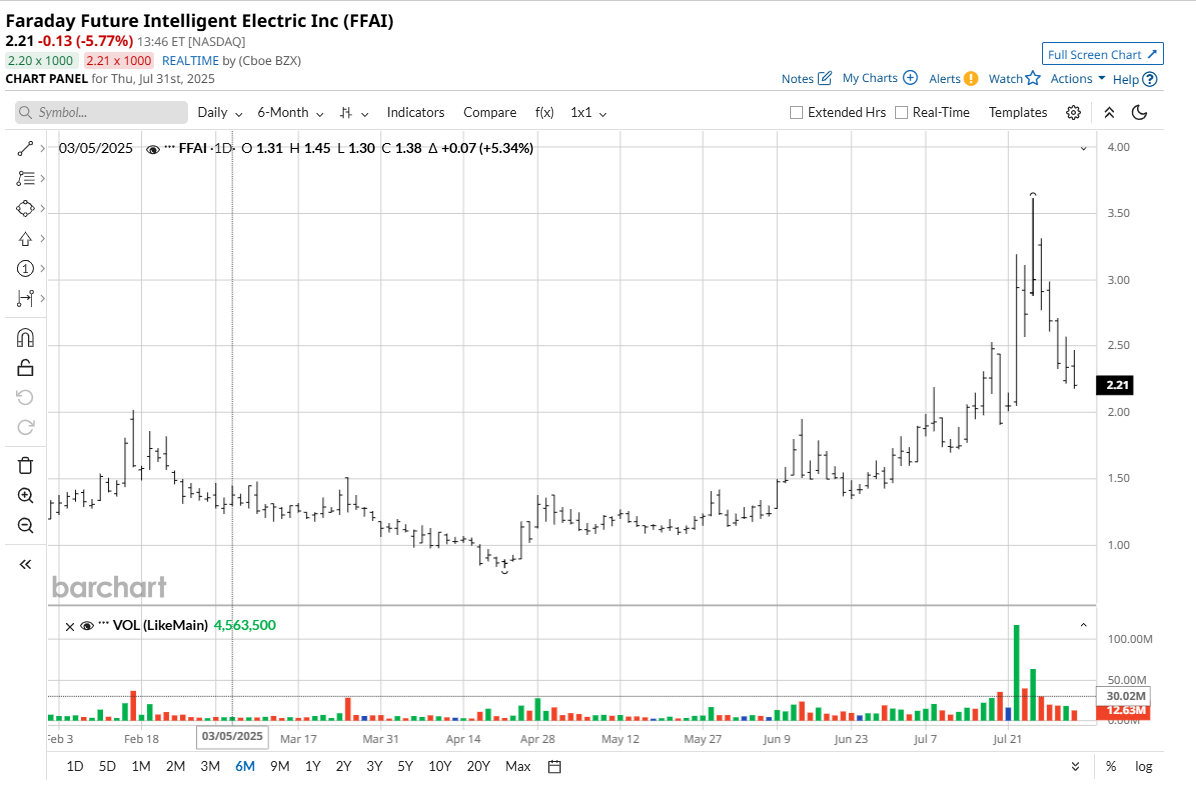

One of the latest examples is Faraday Future Intelligent Electric (FFAI). The stock surged to a new six‑month high on July 24 after a burst of buying activity sent short sellers scrambling. With more than a quarter of its float sold short, Faraday’s recent rally has been amplified by meme-style trading momentum. Here’s why FFAI’s short squeeze is turning heads and what it could mean for investors watching this embattled EV stock.

About Faraday Future Stock

Founded in 2014 and based in California, Faraday Future designs and builds electric vehicles. The company currently has a relatively small market cap of $228 million.

Last week, shares of Faraday Future Intelligent Electric surged dramatically amid a wave of retail “meme” trading, jumping 44% in a single day. Despite this gain, FFAI stock remains down 6.6% year to date, as production delays and cash-burn concerns continue to weigh on investor confidence.

Financial Overview

Despite its innovative tech, the company is not generating any meaningful revenue yet. In Q1 2025, Faraday reported minor revenue of $300,000 million from two FF 91 vehicle deliveries and a net loss of $43.8 million. The balance sheet remains lean. Unrestricted cash was only $9.5 million as of March 31. Total net assets were $139.8 million, reflecting recent funding.

To shore up liquidity, Faraday announced in July 2025 a $105 million financing package consisting mostly of 5-year convertible notes and warrants. Existing institutional backers, notably Master Investment Group, participated in the initial closing of $82 million. This deal should substantially increase cash on hand.

Deliveries remain very low. Faraday delivered 10 FF 91s in 2023 and only four in 2024, generating modest lease revenue. In Q1 2025, it delivered two units, one in California and one in New York. No public data exists yet for Q2 deliveries.

The Bottom Line

Despite the hype, Faraday Future faces major risks. Financials remain weak, with minimal revenue and few cars delivered. The company has received multiple Nasdaq delisting warnings due to its low share price and missed filings. Its 10-Q includes a “going concern” warning. In 2025, Faraday also received a Wells Notice from the SEC tied to its special purpose acquisition company (SPAC) merger.

While meme momentum and product announcements fuel volatility, the business remains unproven. Investors must weigh speculative upside against serious threats.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.