Short-selling firm Ningi Research has taken a short position on Grindr Inc. (NYSE:GRND), alleging the company is misleading investors with inflated metrics, hiding an SEC investigation, and suffering from a rapidly deteriorating product while insiders sell off hundreds of millions in stock.

Check out GRND stock price here.

Ningi Alleges GRND Of Inflating User Metrics

The report claims management’s aggressive monetization tactics have created a “short-term sugar high” in revenue that masks a collapsing user base and a “fundamentally broken business”.

At the core of the allegations is Grindr's key metric, Average Paying Users (APU).

Ningi's report, citing a former executive, reveals an undisclosed SEC investigation into the metric that began in late 2023 after a data engineer flagged a “material concern” with double-counting and was subsequently fired.

The firm alleges Grindr quietly redefined APU to count daily purchases rather than unique monthly users, allowing a single person buying a subscription on Monday and a “Boost” on Tuesday to be counted as two separate paying users.

Grindr’s App Is Inundated By Technical Glitches

This strategy of extraction has led to what the report calls the “Enshittification of Grindr,” turning the app into a glitch-ridden “toxic wasteland” that is alienating its users.

This decay was reportedly accelerated by a “self-inflicted brain drain,” where a union-busting Return-to-Office mandate triggered the mass resignation of approximately 80% of the engineering team. The result is a broken product plagued by fake profiles, bugs, and a flood of ads, causing downloads to fall 12% as competitors like Scruff surge.

Insiders Race For An Exit

While the user base revolts, insiders have been “racing for the exits,” dumping over $236 million in stock in the last twelve months alone.

Ningi highlights the most severe near-term threat as an unnoticed margin call risk. The two largest shareholders have pledged a combined 59% of the company’s total stock as collateral for personal loans.

With the stock already down significantly, a further drop could trigger a forced liquidation of shares, creating a “self-reinforcing death spiral” that could wipe out shareholders. Despite these deep-seated issues, Grindr trades at a significant premium to its peers, a valuation Ningi argues ignores the rot at its core.

Price Action

Grindr declined 0.26% on Tuesday and fell by 0.064% after-hours. The stock has declined 12.87% on a year-to-date basis, but it was up 33.79% over the year.

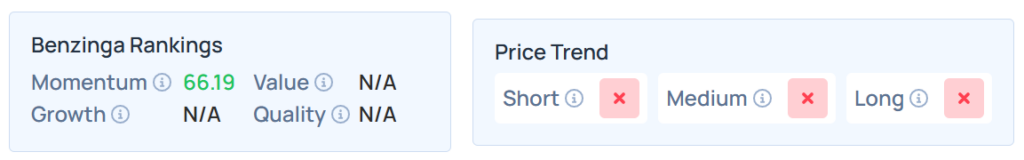

Benzinga’s Edge Stock Rankings indicate that GRND maintains a weaker price trend in the short, medium, and long terms. However, the stock’s momentum ranking was relatively decent at the 66.19th percentile. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose on Tuesday. The SPY was up 0.23% at $650.33, while the QQQ advanced 0.28% to $580.51, according to Benzinga Pro data.

On Tuesday, the futures of the S&P 500, Dow Jones, and Nasdaq 100 indices were trading mixed.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Tero Vesalainen / Shutterstock.com