Shop prices rose far more than expected in January leaving experts to warn that claims inflation has peaked is “not borne out” by the latest numbers.

Beef, fish and fruit were among the food items to have significantly climbed in price over the last year, with high consumer demand for meat also contributing to the price rise.

Yoghurt, jam and honey were among the items which fell in price according to last week’s CPI data.

Shop inflation overall was 1.5% higher than a year earlier – a significant increase on December’s 0.7% and the three-month average of 0.9% – as high business energy costs and the hike to National Insurance fed through to prices, according to the British Retail Consortium (BRC) and NIQ.

Inflation on non-food items rose to 0.3% against a decline of 0.6% in December, with furniture, flooring, and health and beauty products particularly affected.

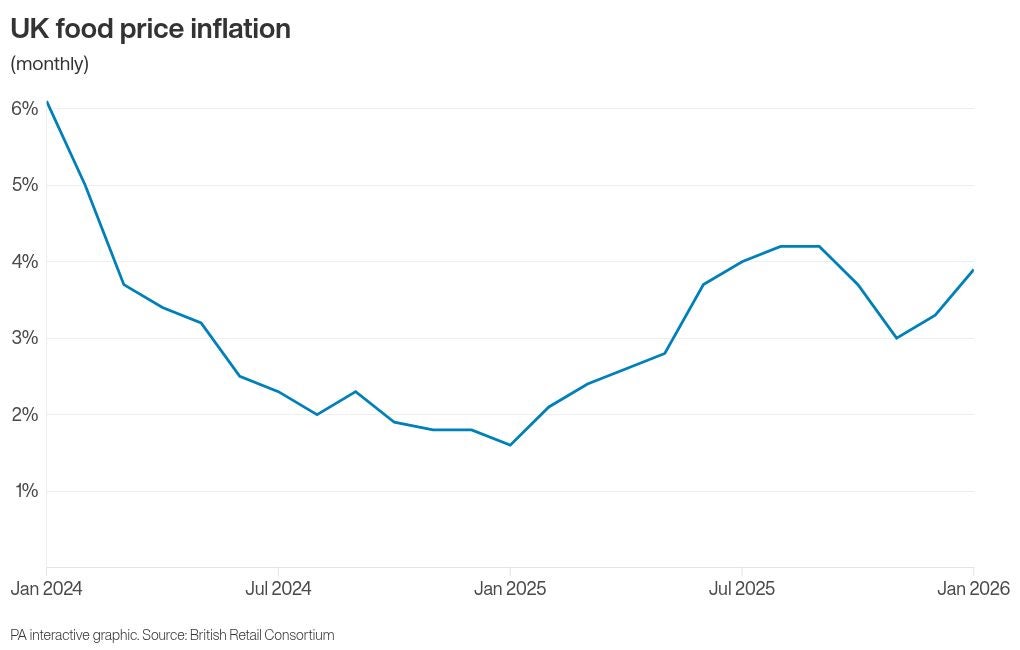

Food inflation increased to 3.9% from December’s growth of 3.3%, with fresh food prices up even further, 4.4% on a year ago, driven by weak supply and strong demand for meat, fish and fruit.

Helen Dickinson, chief executive of the BRC, said: “Any suggestion that inflation has peaked is simply not borne out by these figures. Shop price inflation jumped this month due to high business energy costs and the hike to National Insurance continuing to feed through to prices. Meat, fish and fruit were particularly affected, also reflecting weak supply and stronger demand, while non-food categories, including furniture, flooring, and health and beauty, all saw inflation rise.

“It is a challenging time for households. Retailers do what they can to keep prices down in a competitive market, but thin margins and rising costs of Government policy make it harder. Government must double down on costs in order to support households. A good place to look is the spiralling energy charges, especially non‑commodity levies, which are raising operating costs, squeezing margins and flowing through into retail prices.”

Mike Watkins, head of retailer and business insight at NIQ, said: “Shoppers are always cautious about spending in January and this will not be helped by the continuation of inflation.

“However, there are still savings to be made at the checkout as some non-food retailers are still on promotion and many food retailers continue to reduce prices on everyday items as a way to drive footfall.”

The most recent grocery inflation figures from Worldpanel earlier this month show an easing to 4.3%, down from November’s 4.7%.

Last week after official ONS inflation data, Harvir Dhillon, economist at the British Retail Consortium, said: “Headline inflation has been slow to fall from its summer peak and remains higher than at the start of the year. Within retail, this reflects the high costs currently buffeting businesses, including NI, labour costs, and packaging taxes, all of which have pushed up costs. Government must not be complacent about inflation; if incoming regulations, such as the Employment Rights Act, increase costs further, this will be felt by consumers – not only in higher prices, but from the knock-on impact to jobs, which have already fallen significantly over the past year.”

Additional reporting by PA

Asian shares track Wall Street gains as gold edges lower

Are meat eaters more likely to live to 100? Here’s what the science says

Nearly half of voters say the US worse off under first year of Trump, poll finds

Chancellor expected to unveil £300m pub support package after backlash

William Hill owner Evoke shuts shops after budget tax hit

Government signals tougher crackdown on junk food advertising to children