Shares of Sharps Technology Inc (NASDAQ:STSS) have surged 130% over the past five trading sessions. The company this week unveiled a strategic plan to raise over $400 million through a private placement to establish a digital asset treasury focused on Solana (CRYPTO: SOL).

What To Know: The transaction, structured at $6.50 per unit, is backed by prominent firms including ParaFi, Pantera, FalconX and Republic Digital. As part of the initiative, Sharps has signed a letter of intent with the Solana Foundation, which agreed to sell the company $50 million worth of SOL at a discount.

Proceeds will be used to purchase SOL, build out treasury operations and for general corporate purposes. Sharps this week also appointed Alice Zhang as Chief Investment Officer and James Zhang as a strategic advisor.

Adding to the bullish momentum, company insiders recently purchased a combined 840,000 shares at prices ranging from $6.41 to $8.06, signaling strong internal confidence in the new direction.

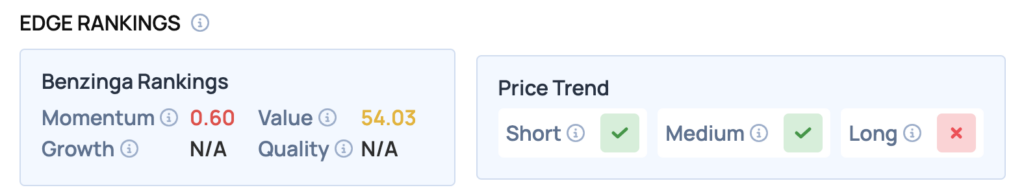

Price Action: According to data from Benzinga Pro, STSS shares are trading higher by 3.4% to $15.35 Thursday morning. The stock has a 52-week high of $2,145.02 and a 52-week low of $3.36.

Read Also: Shiba Inu Burn Rate Soars 508%: What Is Going On?

How To Buy STSS Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Sharps Technology’s case, it is in the Health Care sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock