Mixed end for European markets after volatile day

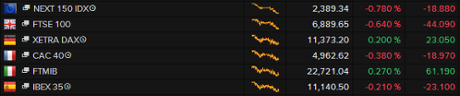

Weakness in the fixed income market, notably a plunge in German 10 year bond prices, as well as Federal Reserve chair Janet Yellen’s comments that equity valuations were “quite high” sent European markets tumbling in early trading. But with oil prices slipping back after European stocks rose, there was a revival in both equities and bonds. A rise in US markets also helped sentiment. German bond yields are currently slightly down on the day at 0.58%, while most markets ended in positive territory. An exception was the UK, which was also affected by election jitters as voters went to the polls in what appears to be the closest contest for decades. The final scores showed:

- The FTSE 100 lost 46.79 points or 0.67% to 6886.95 having fallen as low as 6810

- Germany’s Dax added 0.51% to 11,407.97

- France’s Cac closed down 0.29% at 4967.22

- Italy’s FTSE MIB rose 0.8% to 22,841.92

- Spain’s Ibex ended up 0.15% at 11,180.3

- The Athens market added 3.01% to 841.54 on hopes of a deal to avoid Greek default as talks with creditors were set to continue on Friday and over the weekend

On Wall Street the Dow Jones Industrial Average is currently up 113 points or 0.63% after better then expected weekly jobless claims.

On that note, it’s time to close up for the evening. Thanks for all your comments, and we’ll be back tomorrow.

Updated

Greece’s deputy prime minister has endorsed growing expressions of optimism in talks with the country’s creditors, saying enough “common ground” has been found to enable both sides to reach an agreement. Helena Smith writes:

Giannis Dragasakis said he hoped Monday’s meeting of eurogroup finance ministers would finally break ground by signalling that progress had been made. “I hope on Monday a sign of progress will be given and [they say] an agreement is visible,” the 68-year-old politician told the Guardian. “Talks, so far, have shown that there is common ground in changes and political measures and, therefore, I believe a deal is possible and in the interests of everyone.”

But Dragasakis, a former communist who has oversight of the leftist-led government’s economic policy, cautioned that the debt-stricken country’s desperate liquidity problem would also have to be eased.

The European Central Bank’s decision on Wednesday to loosen the noose by increasing emergency financial assistance to the nation’s banking system was unlikely to provide the breathing space needed for Athens to stay solvent and keep apace with debt repayments and public sector salaries and pensions. “Cooperation is required from all sides so that the cash flow problem is confronted,” he said.

Updated

Thursday was one of the busiest days for European stock markets in the last two years, according to data from BATS Global Markets. Almost €72bn of shares changed hands, they reported, twice the average for a typical day in May last year.

The average in April was just over £56bn.

French economist Thomas Piketty said a Grexit would be a catastrophe which would be the beginning of the end for the euro.

The author of the best-selling Capital in the 21st Century said in a report in Forbes:

It would be a catastrophe for the eurozone if Greece were pushed out. It would be the beginning of the end of the single currency. People every morning would be asking ‘who will be the next to leave?’ That would be the beginning of the end. And the governments of France and Germany have not prepared public opinion for such an eventuality; they would have to do that very quickly.

Full report here.

Markets have been volatile during the day, to say the least, with Germany’s Dax in positive territory after a recovery in German bonds and most other European markets edging higher. But the UK is still in the red amid general election jitters. Jasper Lawler at CMC Markets UK said:

European stock markets were left a little out of breath on Thursday as government bond markets pulled a full 180 degree turn from savage losses to a sizeable move higher. A fall in crude oil prices tempered the inflation fears that have caused a massive jump in bond yields this week.

The German bund was headed for its biggest two week drop since its inception as yields spiked across the UK, Europe and Asia but US jobless claims holding at 15 year lows took some of the sting out of oil prices as the dollar rallied.

The resulting fall in the euro helped European equities edge back towards positive territory led by the export-orientated German DAX index.

UK Election Day uncertainty has created hesitancy in markets rather than outright fear of the unknown. There’s hardly been a tidal wave of selling but seemingly an unwillingness to jump in with two feet to any stocks until the election result is known.

In the US the Dow Jones Industrial Average is up 81 points after better than expected weekly jobless claims, ahead of Friday’s non-farm payroll numbers.

On the situation in the bond markets, Hargreaves Lansdown senior analyst Laith Khalaf said:

The recent fall in gilt prices is a warning shot to bond investors. Even though yields are still exceptionally low, they aren’t as low as they were, and that has taken its toll on capital invested at the wrong time.

The sell-off is a reminder of the risk of investing in bonds at such low yields. This is heightened by the fact government bonds are seen as safe investments, and consequently feature in many pension funds and supposedly low-risk portfolios.

The European Council has just published the agenda for Monday’s eurogroup meeting - you remember, the one where everyone is now saying there will be no breakthrough.

The meeting will discuss Ireland as well as holding a thematic discussion on ensuring strong fiscal frameworks in the euro area member states. And, oh yes, Greece:

Ministers will continue the discussion on the situation in Greece. They will be briefed on the state of play in the ongoing discussions between the Greek authorities and the three institutions - the European Commission, the European Central Bank and the International Monetary Fund on the list of reforms that the Greek government is expected to complete under the current agreement. The reform list is a necessary step to complete the ongoing review and thus unlock the payment of the remaining tranche of financial assistance.

Updated

And now German 10 year bond yields are unchanged on the day after their earlier surge, back down to 0.60%.

Here’s an interview with Danae Stratou’s rival for the lead role in Common People:

Was @danaestratou, wife of @yanisvaroufakis, inspiration for Pulp's Common People? Or was it Katerina Kana? http://t.co/yHCjKmmYGa

— Bruno Waterfield (@BrunoBrussels) May 7, 2015

Updated

More from Schäuble, courtesy of Reuters:

- 07-May-2015 14:35:30 - GERMAN FINMIN SCHAEUBLE SAYS ON GREECE MY EXPECATIONS FOR EUROGROUP ON MONDAY ARE NOT HIGH

- 07-May-2015 14:37:31 - GERMAN FINMIN SCHAEUBLE SAYS WILL MEET WITH MY GREEK COLLEAGUE BEFORE THE EUROGROUP MEETING

- 07-May-2015 14:41:06 - GERMAN FINMIN SCHAEUBLE SAYS IF GREECE GETS HELP FROM RUSSIA THAT’S WONDERFUL BUT IT WILL NOT BE AS MUCH AS GREECE NEEEDS

Germany’s finance minister has doused any remaining optimism of a Greek breakthrough next Monday.

Encouragingly, though, Wolfgang Schäuble did indicate that relations between the two sides is a little better....

#Germany FinMin Schäuble says does not have high expectations for May 11 #Eurogroup mtng on #Greece; Atmosphere in talks is a bit better.

— Yannis Koutsomitis (@YanniKouts) May 7, 2015

Journalists of a certain age (ahem) have been humming away and tapping their shoes all morning, thanks to a fantastic rumour that Yanis Varoufakis’s wife may be the star of the 1995 Britpop classic, Common People.

That’s according to the Athens Voice.

It probably falls into the “too good to be true” category. But still......

One of pop culture’s enduring mysteries may have just been solved. Greek paper the Athens Voice has revealed that the wife of Yanis Varoufakis, the Greek Finance minister, could be the rich art student Jarvis Cocker wrote about in Pulp’s single ‘Common People’.

Danae Stratou studied at St. Martins College of Art and Design between 1983 and 1988, the same year Cocker enrolled in a film studies course there during a break from the band. He told NME in 2013 that he met the Greek girl in the song during ‘Crossover Fortnight’, when St Martins students switched into another discipline for two weeks.

In a later interview Cocker remembered a conversation with the Greek woman who “wanted to move to Hackney and live like ‘the common people’”. He used this as the basis for the song. But the identity of the woman has never been discovered, despite a search launched by BBC3.

Please be true! Was Greek finance minister's wife the mystery girl in Pulp's Common People? http://t.co/a6r5pI1NS6 pic.twitter.com/w2YAFp2c9T

— Ben Purvis (@purviso) May 7, 2015

Stratou’s CV confirms she was at St Martins at the right time.....but those in the know reckon it’s probably an urban myth. Hey ho.

@FMR_Brussels @v_dendrinou @xtophercook @tom_nuttall article calls this an "urban legend." Heard the subject now a recluse on a Greek island

— Matina Stevis (@MatinaStevis) May 7, 2015

@graemewearden Looks like Jarvis arrived (Sep 1988) after she graduated. And her major (sculpture) seems wrong.

— Paul Hannon (@PaulHannon29) May 7, 2015

Updated

The Greek stock market is continuing to rally. It’s now up over 4%, on optimism that an agreement can be reached before Greece hits the wall.

That’s despite Greek government spokesman Gabriel Sakellaridis insisting that Athens won’t roll over.

He told reporters that:

“There should not be an expectation on the part of institutions ... that the government will back down on everything....When you negotiate, there should be mutual concessions.

Pension cuts remain off limits, he added:

“We won’t go beyond the limits of our red lines. It’s clear that we cannot cut pensions.”

Updated

Back in Greece, prime minister Alexis Tsipras has been meeting with government cleaning ladies who have been rehired after a long battle.

Your perseverance gives us strength. #Greece pic.twitter.com/DM0XEKdafh

— Alexis Tsipras (@tsipras_eu) May 7, 2015

These cleaners were laid off as part of the previous administration’s austerity measures, but refused to go quietly. Instead, they picketed outside the finance ministry, protesting against the bailout programme -- and famously forcing Troika officials to flee down a fire escape.

PM Tsipras meets fired cleaners outside his office #Greece pic.twitter.com/sy2FmqudXa

— Derek Gatopoulos (@dgatopoulos) May 7, 2015

Tsipras had vowed to rehire them. And on Tuesday night, the Greek parliament passed legislation to overturn layoffs, and open the way to rehiring thousands of public sector staff.

It’s been a wild old day in the European equity markets.

Germany’s DAX has now bounced into positive territory, tracking the stomach-churning swings in the price of its government bonds.

But general election worries are still pushing down shares in London, where the FTSE 100 is down almost 1%:

Yanis Varoufakis: A deal is close

Thanks to the Wall Street Journal, we have details of Yanis Varoufakis’s comments in Brussels this lunchtime.

And the top line is that Greece’s finance chief has not given up hope of a deal.

Greece’s Finance Minister Yanis Varoufakis sees an agreement between Greece and its international creditors, which would unlock desperately needed aid for the debt-stricken state, being reached within the next few days, or weeks.

“I trust an agreement will be in the offing in the next few days, or weeks,” Varoufakis said Thursday, speaking at a business conference in Brussels.

His comments come as Greece’s leftist-led government is locked in negotiations with its international creditors — the International Monetary Fund, the European Central Bank and the European Commission — over its next slice of financial aid as part of a €245 billion rescue package.

The country’s next big hurdle is a €750 million loan repayment to the IMF due May 12, having made a smaller payment this week.

Varoufakis is still taking questions in Brussels. He insists that Greece both wants to repay the IMF, and will do so.

But he is adamant that the country’s previous aid programmes have been a failure -- particularly the first bailout agreed five years ago this month:

.@yanisvaroufakis: Greece shd never have been bailed out in 2010.

— Tom Nuttall (@tom_nuttall) May 7, 2015

As flagged up earlier, he also argued that Greece needs a bad bank to deal with non-performing loans and unclog the banking system.

And a legal “debt brake” could be imposed, to prevent future excessive borrowing, he added.

Varoufakis was also scathing about Greece’s creditors, saying that the sight of motorcades of Troika officials zooming around Athens was a “humiliation”.

Updated

Dramatic swings are taking place in the bond market.

After crashing this morning, German bunds are now rebounding -- pushing the yield on 10-year bunds back down to around 0.63%.

Today's intraday chart for 10-yr Bund yield. (Hint: the 10-yr Bund yield shouldn't do this kind of thing intraday.) pic.twitter.com/0h2FGow8BD

— Richard Barley (@RichardBarley1) May 7, 2015

Greece’s finance minister has also slapped down the suggestion that Greece has been rescued by countries who are even poorer.

The money didn’t go to us, he says, but to eurozone banks who held Greek debt.

asked about smaller, poorer EU countries bailing out Greece, @yanisvaroufakis sez almost all money actually went to banks.

— Tom Nuttall (@tom_nuttall) May 7, 2015

At #Brussels lunch, @yanisvaroufakis says 91% of bailout funding went to banks. #Greece

— Peter Spiegel (@SpiegelPeter) May 7, 2015

Yanis Varoufakis is also denying that he’s been sidelined from the bailout talks. We’re all pulling together in perfect harmony, the Greek finance minister tells reporters:

It's a leftie collectivist thing about whole government working together not sidelining, @yanisvaroufakis on his role

— Bruno Waterfield (@BrunoBrussels) May 7, 2015

"We work in perfect harmony," says @yanisvaroufakis of shakeup of #Greece bailout negotiating team

— Peter Spiegel (@SpiegelPeter) May 7, 2015

More from Brussels...

"It is a myth" that #Greece has not tabled serious reforms in bailout talks, says @yanisvaroufakis

— Peter Spiegel (@SpiegelPeter) May 7, 2015

Is wine being served at this lunch event? if so, please stop serving it https://t.co/GOZXmpsY62

— wolf piccoli (@wolfpiccoli) May 7, 2015

Greece’s finance minister, Yanis Varoufakis, is giving a speech in Brussels now.

It sounds like his now-traditional lecture on the failings of the past, along with an outline of a better future (if only creditors would agree...).

But he also claims that a deal could be close...

- GREEK FINANCE MINISTER VAROUFAKIS SAYS EXPECTS A DEAL ON FUDNING WITH CREDITORS WITHIN DAYS OR WEEKS

- VAROUFAKIS SAYS BAILOUT REFORM PROGRAMME HAS BEEN A FAILURE

- VAROUFAKIS SAYS WE NEED A BAD BANK TO UNCLOG BANKING SYSTEM AND A DEVELOPMENT BANK LINKED TO PRIVATISATION OF STATE ASSETS

- VAROUFAKIS SAYS GREECE IS READY TO INTRODUCE DEBT BREAK TO PREVENT FUTURE EXCESSIVE BORROWING

.@yanisvaroufakis: revamp of VAT in a way that doesn't jeopardise lifestyles of ppl on islands.

— Tom Nuttall (@tom_nuttall) May 7, 2015

.@yanisvaroufakis: what does reform package look like? Privatisations, not fire sales (state retains equity stake in impt assets)...

— Tom Nuttall (@tom_nuttall) May 7, 2015

At lunch speech in #Brussels, @yanisvaroufakis offers views on how to reach bailout deal. Sounds very similar to 3 months ago.

— Peter Spiegel (@SpiegelPeter) May 7, 2015

Updated

Greece and its creditors will continue to negotiate today, tomorrow, and over the weekend in the hope of making progress before Monday’s eurogroup meeting.

#BrusselsGroup talks for #Greece are going on and will continue during the weekend says EC spokesperson @MargSchinas

— EfiKoutsokosta (@Efkouts) May 7, 2015

The Athen stock market is bucking the trend today, and has risen by 2.5%.

And that’s because Greece remains hopeful of a bailout deal before it runs out of cash.

From Athens, Helena Smith reports:

For the first time in a very long time the Greek media has been hit by that rarest of bugs: optimism.

Encouraged by the “progress in talks” – voiced by the Greek prime minister Alexis Tsipras and EU commission president Jean-Claude Juncker last night - television pundits & newspaper headlines are suddenly talking of “a ray of hope” that might – just might - lead to a breakthrough after Monday’s Eurogroup meeting (of euro finance ministers).

Typical of the new mood is the headline in today’s Ethnos: “First Time Optimism” it screamed from its front page. “Message of convergence with a common statement from Tsipras/Juncker. Athens is hoping for a statement of progress from the Euro Group.

After the ECB’s decision to raise emergency financial assistance to Greek banks (by €2bn), the sense is that things are beginning to look up. “Two days of optimism in a row. Now that is something very new!” one pundit told Skai news this morning.

Full story: Markets fall as Britain votes

Here’s our full story on the selloff that has hit the markets as Britain holds its tightest election in decades.

And here’s a flavour:

London shares suffered a sharp sell-off on Thursday morning as voting got under way in the closest general election for decades.

Fears that Britain is set for a second successive hung parliament added to a global markets sell-off after Federal Reserve chair Janet Yellen warned share valuations could be dangerously high.

The leading FTSE 100 index tumbled by 121 points, or 1.7%, to 6813, as voters headed for the polls in what is expected to be one of the closest elections in years, with the major parties neck and neck in opinion polls.

According to preliminary results of the final Guardian/ICM campaign poll, Labour and the Conservatives were tied at 35% each. A YouGov poll in Scotland for the Times shows Sturgeon’s party – with which Miliband has ruled out any formal deal – enjoying 48% of support to Labour’s 28%, putting several key figures, including the Scottish Labour leader, Jim Murphy, in peril of losing their seats.

Andy McLevey at Interactive Investor said: “As UK voters go to the polls, uncertainty surrounding the outcome of the UK election is also preying on sentiment as cautious investors remain on the sidelines.”

Dafydd Davies at Charles Hanover Investments told Reuters: “Given the [market] rally we’ve had so far this year, you could not say the mood is too alarmist over the election outcome.

Updated

Worried that the selloff has hit your pension or ISA? Here’s the biggest fallers on the FTSE 100 today:

Ninety five of the 100 companies who make up the FTSE 100 has fallen this morning:

Updated

Today’s bond selloff is being fuelled by the fact the market has become quite illiquid. Investors have been piling into government bonds for many months, driving prices to record highs.

Which is fine, until everyone decides the party is over and tries to leave....

This bond market liquidity = rooftop bar analogy I did for @FTLex last yr is holding up OK... http://t.co/Omk1twJKRM pic.twitter.com/UTRRfF1kXI

— Joseph Cotterill (@jsphctrl) May 7, 2015

French government debt is also sliding, sending the yield (interest rate) on its 10-year bonds up over 1%.

Bund crash draws all attention, but French bonds tumble as well. 10yr French yield jumps >1% for 1st time sine Dec. pic.twitter.com/cHHY6qBYkT

— Holger Zschaepitz (@Schuldensuehner) May 7, 2015

German bonds routed as selloff gathers pace

The selloff in German government debt is turning into a full-blown rout today, sending fear rippling through the financial markets.

As prices fall, the yield on 10-year Bunds has jumped to 0.75%, from 0.6% last night. That’s the highest level since mid-December 2014.

Bund sell-off becomes disorderly. 10yr yield now 18bps higher at 0.76%. pic.twitter.com/dit9eQRijv

— Holger Zschaepitz (@Schuldensuehner) May 7, 2015

It’s quite a turnaround since mid-April when German 10-year yields fell to just 0.07%, meaning investors were accepting virtually no return on their investment. This sort of turnaround hasn’t been seen in decades:

So that rolling 2-wk Bund yield move that was +48 bps this morning, now +59 bps: way, way off the charts pic.twitter.com/ukp0qgk2ll

— Eric Burroughs (@ericbeebo) May 7, 2015

And the ripples are hitting shares too -- the FTSE 100 index has now shed 116 points, as bond fears and General Election angst prove a nasty cocktail.

Here’s another chart showing that the cost of buying protection against sterling volatility is its highest in several years:

#Sterling volatility overtakes Scottish Independence, Eurozone crisis #GE2015 http://t.co/Df2HOGXYM9 #forex pic.twitter.com/bMzaHTajZ3

— Ashraf Laidi (@alaidi) May 7, 2015

The UK election is hitting demand for the pound and British government debt [gilts], says David Madden, market analyst at IG.

Sterling will be subdued as voters go to the polls today, and with no clear outcome in the pipeline for today’s election dealers will be avoiding the pound like the plague.

Gilts have a gloomy outlook for today’s session too.

The yield, or interest rate, on 10-year gilts has risen from 1.99% to 2.08% this morning, meaning Britain would pay more to borrow in the markets.

Madden also blames the Greek crisis for the sea of red engulfing European markets:

Greece has repaid €200 million to the IMF, but the deal for Monday still hangs in the balance. The ECB has increased the emerging financing facility for Greek banks, and the market is viewing this as a sign of weakness. Even though the Greek banking system has no shortage of funds, the Athens administration is in a very different situation.

Even if Greece somehow manages to broker a deal by Monday, the indebted nation will have to make considerably larger repayments in the coming months and if the Greek government is having difficulty meeting Monday’s deadline what are the chances it will survive the summer deadlines?

Sterling volatility jumps

City traders are also bracing for sharp swings in the value of sterling when the election results come in.

The overnight cost of protecting against big swings in sterling’s exchange rate has jumped to its highest level since the 2008 financial crisis.

It’s above the previous recent high in September 2014, when the Scottish independence referendum was held.

This shows investors are seeking protection against the possibility of the pound either jumping or slumping overnight.

Nick Lawson, a managing director at Deutsche Bank in London, explains why the markets are cautious:

“The problem is that this the closest election we have seen for a very long time, and in many ways the process doesn’t really start until we know the result and whether we have a ‘working’ government.”

(via Reuters)

Pound weakens as Britain heads to the polls

The pound is coming under some pressure this morning amid general election uncertainty.

Sterling has dropped by almost half a percent, to $1.518 against the US dollar and €1.3436 against the euro.

That’s not a reason to panic; it’s not a major move, and it also follows a rise in sterling yesterday. But it does indicate that there is nervousness about the election.

This tweet shows how the pound has lost ground against almost all major currencies this morning:

GBPUSD giving up its gains from a strong services PMI figure yesterday. 2nd worst performer in the G10 today #GE2015 pic.twitter.com/Hrecfxk47b

— World First (@World_First) May 7, 2015

Syriza MP: No deal soon

Over in Greece, Syriza MP Costas Lapavitsas has warned that Greece could struggle to meet its financing demands without a deal soon.

Lapavitsas, an economics professor, also blamed the country’s creditors for taking a hard stance.

Greece crisis watcher Diane Shugart has the details:

#lapavitsas, economist on syriza's left platform, commenting on skai right now, cites media pressure on #greece to sign deal. >>

— Diane Shugart (@dianalizia) May 7, 2015

<<the issue is what we will sign. what will be asked of us [greece].

— Diane Shugart (@dianalizia) May 7, 2015

#lapavistas expresses reservations as he only sees a hostile mood towards #greece; creditors have hard stance, don't see how it will soften

— Diane Shugart (@dianalizia) May 7, 2015

#lapavitsas says what is important is for an agreement to be compatible with platform on which syriza was elected. #greece

— Diane Shugart (@dianalizia) May 7, 2015

#lapavitsas: we feel the responsibility heavily and will not accept things that are incompatible with our [#syriza] program. #greece

— Diane Shugart (@dianalizia) May 7, 2015

#lapavitsas: "the economy is in a difficult position but don't think this will be resolved monday." #greece

— Diane Shugart (@dianalizia) May 7, 2015

#lapavitsas sees work continuing at technical level through may and if fiscal problems seen, things will become complicated.

— Diane Shugart (@dianalizia) May 7, 2015

Lapavitsas also blames Greece’s creditors for the deadlock:

asked about "honorable compromise", #lapavitsas says govt has shown a willingness, it's the other side that is the problem.

— Diane Shugart (@dianalizia) May 7, 2015

#lapavitsas: if we're asked to sign things that are not compatible with our program, then there will be an issue of rupture.

— Diane Shugart (@dianalizia) May 7, 2015

#lapavitsas: 'rupture' can even mean making a choice of what you will pay and what you won't this month.

— Diane Shugart (@dianalizia) May 7, 2015

#lapavitsas: i believe we can weather this month too, but i just wanted to be clear on what 'rupture' means.

— Diane Shugart (@dianalizia) May 7, 2015

World markets have been dipping since peaking in late-April:

Market rout has wiped out almost $1.7trn from the value in global stock markets. pic.twitter.com/0GatVVakwX

— Holger Zschaepitz (@Schuldensuehner) May 7, 2015

The sharp sell-off in government bonds in recent days shows that investors have grown weary of paying such elevated prices for sovereign debt.

As the Financial Times explains:

Steven Major, global head of fixed income research at HSBC, said the bond sell-off was driven by investor fatigue, as well as burgeoning signs of inflation and higher issuance of eurozone bonds. “It’s a form of indigestion,” he said.

“There just isn’t the same appetite for bonds at ultra-low yields.”

Before investors became sated, they had driven the yields on many short-term eurozone bonds into negative territory, meaning they were paying for the privilege of lending to governments.

The FTSE 100 index is also being dragged down by supermarket chain Morrisons; its shares are down 6.6% after reporting that sales have continued to decline.

Like-for-like sales, excluding fuel, slipped by another 2.9% in the last three months as the firm continues to struggle.

The general election is also weighing on the London stock market, as Brits head to the polls for the tightest race in decades.

The FTSE 100 index fell over 50 points, or 0.7%, in early trading.

The prospect of a hung parliament, weeks of uncertainty, or an unstable minority government are all reasons to be cautious today:

As Mike van Dulken of Accendo Markets points out:

The softer open comes in the run up to the closest run UK election since World War 2.

UK election complexion and majority rejection sees FTSE 100 continue its correction direction

— Mike van Dulken (@Accendo_Mike) May 7, 2015

But as Ian Williams of Peel Hunt points out, Britain’s ballot boxes isn’t the only factor hitting shares:

As the UK goes to the polls, investors have plenty of other issues to focus on away from domestic politics.

Yesterday saw core sovereign bond yields continue to head higher; Brent oil prices hit a new peak for the year, as US crude stocks fell for the first time since January; and Fed Chair Yellen suggested that the current level of equity market valuations is “quite high” and poses “potential dangers”.

Updated

Eurozone bonds are still fairly close to their record high levels (reminder, prices fall when yields rise), but the scale of the sell-off is quite startling.

Anyone who piled into German bunds this year is now facing a loss.

The German 10-year government bond #yield has risen an average of 7 basis points per day for the last seven days. pic.twitter.com/5P8SNF8aWk

— jeroen blokland (@jsblokland) May 7, 2015

European markets hit two-month low

European stock markets have hit their lowest levels in two months, as the bond rout hits confidence.

The German, French, UK, Spanish and Italian markets are all in the red, following losses in Asia over night.

Here’s the early damage.

This comes after the world’s most powerful central banker, Janet Yellen, warned that share valuations are “generally quite high”.

As we wrote last night:

“There are potential dangers there,” she said, in remarks reminiscent of her predecessor Alan Greenspan’s infamous 1996 warning that some investors were showing, “irrational exuberance”.

Bond sell-off deepens

The slide in eurozone government bonds is continuing this morning, driving up borrowing costs to the highest levels of the year.

The yields, or interest rates, on German, French, Italian and Spanish sovereign debt has all risen again, as traders continue to push prices down from recent record highs.

Bund sell-off continues. 10yr German govt bond yields jump to 0.66%, hit fresh high for 2015. pic.twitter.com/5KEoszrCXW

— Holger Zschaepitz (@Schuldensuehner) May 7, 2015

ITALIAN 10-YEAR BOND YIELDS RISE OVER 2 PERCENT FOR FIRST TIME SINCE DEC 2014 #italy #finance #news

— FxWirebeat (@FxWirebeat) May 7, 2015

Government bonds have been weakening for days, with several factors being blamed.

One is the recent rise in the oil price; if that pushes eurozone inflation higher, it could encourage the European Central Bank to slow its bond-buying quantitative easing scheme.

That theory has also helped to push the euro higher:

The euro and 10-year German bond yield. Closely correlated: pic.twitter.com/5TInSU5kKH

— Jamie McGeever (@ReutersJamie) May 7, 2015

Federal Reserve chair Janet Yellen threw more fuel on the fire yesterday, warning that bond yields could jump sharply once the Fed raises interest rates.

Yellen’s comments could hit sentiment hard, as Stan Shamu of IG Index explains:

Bond market weakness has been a key theme across the US and European markets. This has now clearly started having an impact on equities with confidence being sapped out of the market.

Introduction: Greek referendum talk swirls

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

Coming up today.... the Greek bailout deadlock continues to dominate the eurozone, with speculation swirling that a referendum may be called.

Last night the European Central Bank agreed to give Greece’s banking sector another €2bn of emergency liquidity, but that’s only a temporary fix to its banks’ problems. The next Red Letter Day is May 11, when eurozone finance ministers meet.

Yesterday, though, a string of ministers appeared to rule out a quick deal -- even though Greece must find around €800m to repay the IMF on May 12.

Unless the creditors cave in, Greece will surely have to compromise on issues such as labour market reforms to get a deal; despite the pre-election promises made by PM Alexis Tsipras.

MPs from the governing Syriza party is due to meet tomorrow to discuss the situation, as the Kathimerini newspaper explains:

The meeting will take place amid increasing calls from SYRIZA MPs and members for any deal to be put to a referendum.

Prime Minister Alexis Tsipras may take part in Friday’s gathering, giving him a chance to get a taste of the mood within his party. It is not yet clear if a central committee meeting will be held over the weekend or if Tsipras will wait for further progress to be made in the talks before the party body convenes.

"There is a strong feeling within #Syriza that there should be a referendum on the final agreement with creditors" http://t.co/arsQ4ae5Ia

— Jarno Hartikainen (@JarnoHa) May 7, 2015

reading the headlines on #greece is like plucking a damn daisy: we're near a deal, we're nowhere near a deal, we're near a deal...

— Diane Shugart (@dianalizia) May 7, 2015

It could be a quiet, nervy day in the City too as investors brace for the results of today’s general election; the tightest in decades.

Final @guardian #GE2015 forecast: Cameron is unlikely to have the numbers to continue as PM http://t.co/0uE4TDYmvd pic.twitter.com/KMfV456LoN

— Alberto Nardelli (@AlbertoNardelli) May 7, 2015

Here’s our General Election liveblog: