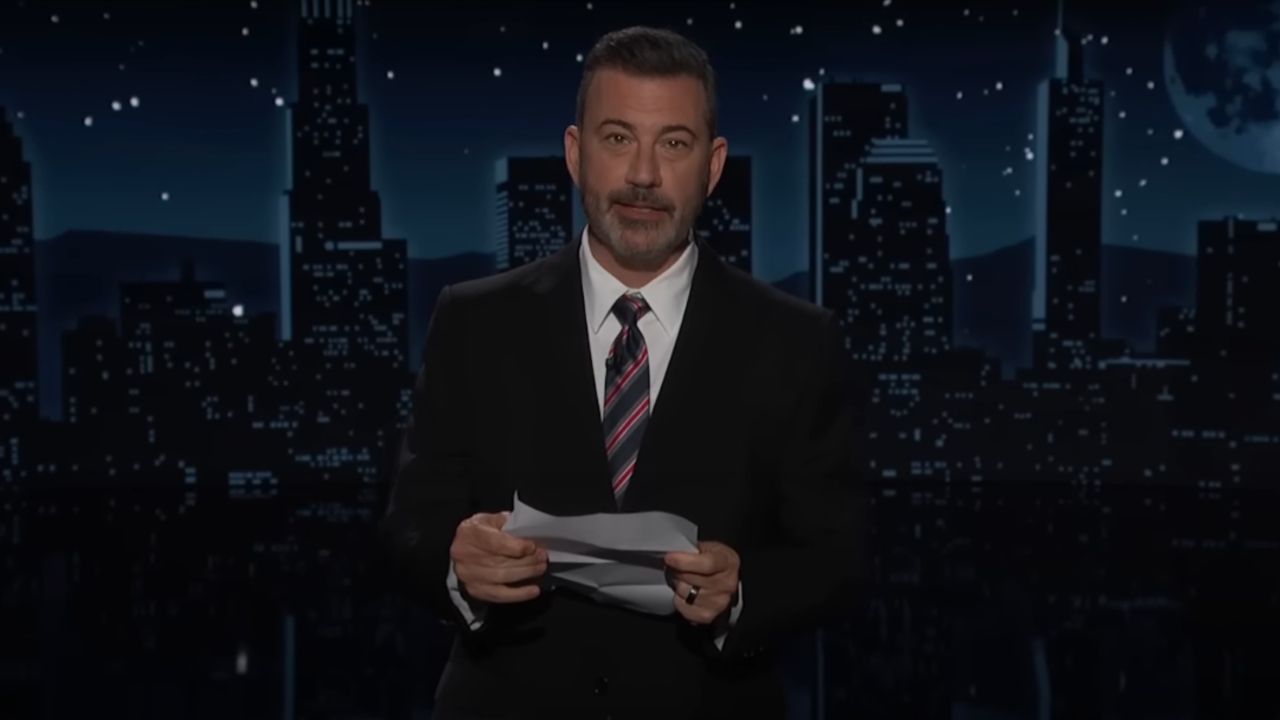

Jimmy Kimmel may be back on the air, but the fallout from his week-long suspension is still being felt. Disney, the parent company the talk show's network ABC, took the brunt of the criticism from those who spoke out against Kimmel being benched, with many threatening to cancel Disney+ over the decision. but it looks like PR isn’t the only casualty. The move appears to have cost stockholders money, and now those stockholders want answers.

According to a letter obtained first by Semaphor, lawyers for the American Federation of Teachers, Reporters Without Borders, and other groups who claim to be Disney stockholders are requesting the company to share documentation regarding the decision to suspend Jimmy Kimmel. The inquiry is looking for any evidence of mismanagement, wrongdoing, or potential breaches of the company’s fiduciary duty. The letter reads in part:

There is a credible basis to suspect that the Board and executives may have breached their fiduciary duties of loyalty, care, and good faith by placing improper political or affiliate considerations above the best interests of the Company and its stockholders.

Disney has seen a significant hit to its bottom line since the suspension of Jimmy Kimmel. According to Snopes, Disney’s market valuation dropped by $1.4 billion overnight following Kimmel’s suspension, and dropped by $6.4 billion in the period between Sept 17 and September 22. Disney’s stock, while it has been on the rebound recently, dropped from $117/share on September 17, the day Kimmel was suspended, to $112.25/share on September 23, the day Kimmel returned to the air.

The issue at hand is that Disney, as a publicly traded company, has a duty to do what’s best for its shareholders. The quote above specifically refers to the suggestion that Disney’s decision to suspend Kimmel may have come as a result of pressure from two major affiliate groups, Nexstar and Sinclair, or from pressure from FCC Chairman Brandan Carr, who made comments on a podcast some read as a threat if action wasn’t taken against Kimmel.

Nexstar and Sinclair still refused to air the show following the host's return. His return episode on Tuesday night had the highest ratings and viewership numbers Jimmy Kimmel Live! had seen in years, despite not being available in nearly a quarter of the United States.

There was allegedly a lot of internal conflict on the decision, with some reportedly asking Disney CEO Bob Iger not to suspend Kimmel. Many celebrities came out in public support of Kimmel, including many with strong ties to the Walt Disney Company.

While the drop in Disney’s value over the last week certainly indicates that Jimmy Kimmel’s suspension wasn’t good for business, there’s no way to know whether not doing so would have been worse. Even if the suspension was the “wrong” choice from a financial standpoint, as long as those who made the decision thought they were making the right call, they’re likely in the clear.

If, however, there is evidence in the documents that shareholders are looking for that Disney did bow to external pressures, it’s at least conceivable that stockholders could take action. Disney has yet to respond to the letter publicly. Disney’s next quarterly earnings call will likely take place in early November. While that‘s still several weeks away, there’s little indication that this topic will have died down by then. We can be sure Bob Iger will have something to say.