The renewed rally in U.S. equities has left volatility markets showing little concern that the good times will end any time soon. Recession models beg to differ.

Wells Fargo’s model -- which draws on the spread between three-month and 10-year Treasury yields as well as economic figures -- shows chances of a U.S. recession within 12 months jumped in December and climbed to just above 40 percent in January.

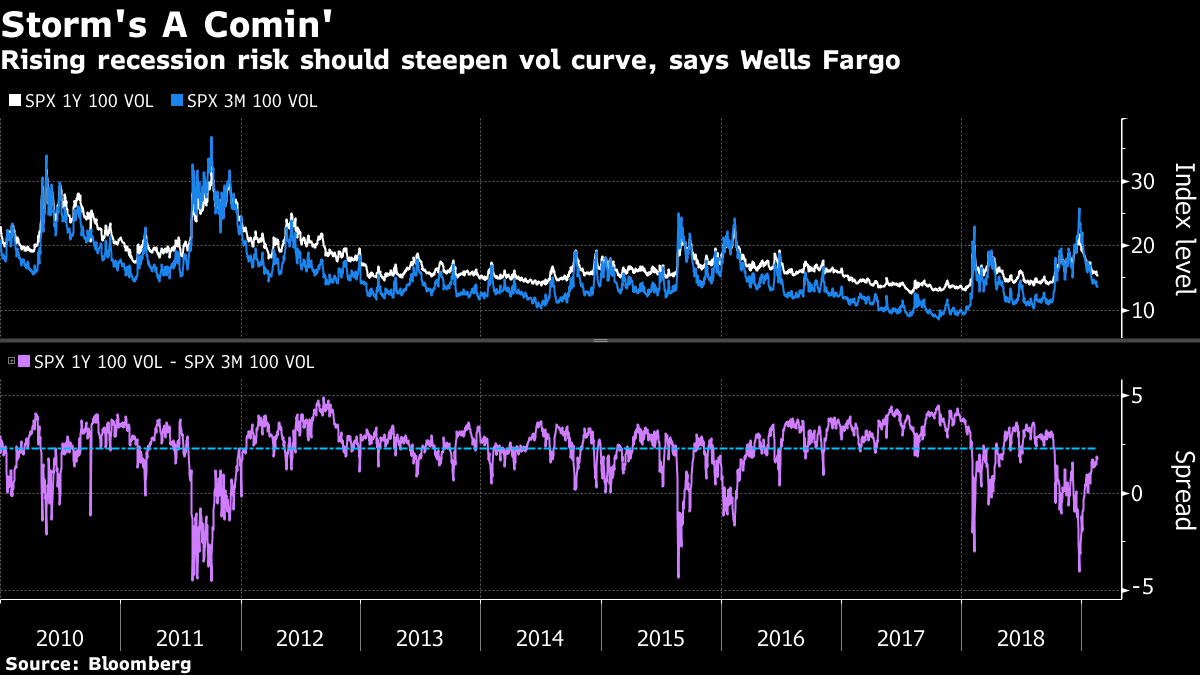

But as the likelihood of a downturn increases, there’s a disconnect with implied one-year equity volatility that’s trending below its average for the past year.

“Despite the increased recession probability, long-dated equity volatility is actually trading lower than in previous years,’’ Pravit Chintawongvanich, a Wells Fargo equity derivatives strategist, wrote in a note. He adds that this dynamic reflects issues with how the market is structured more than outright complacency in derivatives.

Still, the gap may have some ominous implications. A similar split was seen prior to the 2008 financial crisis.

“In 2007, 1-year vol traded at very low levels despite recession risk having increased rapidly in 2006,’’ Chintawongvanich wrote. “It was only when Bear Stearns started running into trouble in summer 2007 that 1-year vol rapidly repriced.’’

On the other hand, Wells Fargo’s recession model also points to occasions in the 1960s and 1990s when a dovish pivot from the Federal Reserve was able to prolong economic expansion even as warning signs cropped up. The corollary to 1966 is a particularly pertinent example of the central bank’s ability to stave off a recession, Chintawongvanich notes. That’s when U.S. labor markets remained strong; other parts of the economy deteriorated; the yield curve inverted; stocks sold off by more than 20 percent; and a Fed easing cycle commenced at the end of the year that warded off a recession.

But just because a near-term crisis may have been averted over the past few months, as the Fed moderated its outlook for raising interest rates, that doesn’t remove the need for vigilance.

Calm now -- with a reasonable possibility of an economic downturn before too long -- means the volatility term structure should be steeper, Chintawongvanich reckons. The spread between short- and longer-term volatility is in its lowest quarter of readings since 2010.

Equity enthusiasts are already in a precarious position, according to Chintawongvanich.

With earnings expectations continuing to come down, bulls are betting on investors accepting higher valuations as they take on more risk, he said, citing previous research that hedge funds and systematic strategies could increase their exposure to U.S. equities by as much as $50 billion per month after the December equity swoon.

To contact the reporter on this story: Luke Kawa in New York at lkawa@bloomberg.net

To contact the editors responsible for this story: Jeremy Herron at jherron8@bloomberg.net, Brendan Walsh, Dave Liedtka

©2019 Bloomberg L.P.