Sales of serviced industrial land plots by major developers in Thailand increased by 50% year-on-year in the fourth quarter of 2018, according to the property consultancy CBRE.

Of the total of 1,000 rai sold, 146 rai were in Thai-Chinese Rayong Industrial Park, where Amata Corp Plc has been developing sites specifically for Chinese manufacturers.

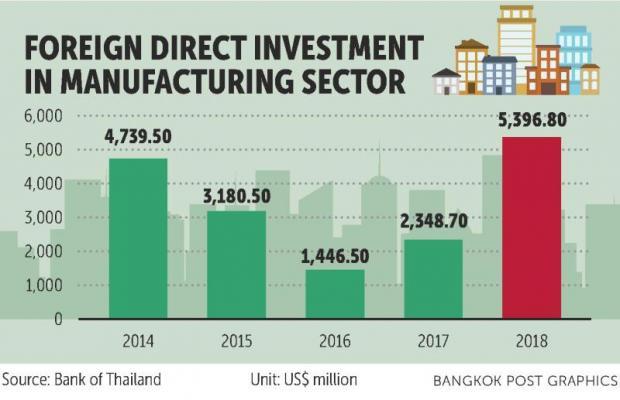

Rising demand for industrial sites reflects the sharp increase in foreign direct investment (FDI) in the manufacturing sector, which rose by 130% last year, according to the Bank of Thailand.

Many developers have reported demand from Chinese manufacturers who are looking to relocate to Thailand because the US-China trade war has resulted in "Made in China" products facing higher tariffs.

Vietnam has been the biggest beneficiary of Chinese manufactures relocating due to the trade war, but Thailand is also benefiting, according to CBRE.

Japan has been the largest source of FDI in manufacturing sector in Thailand since the late 1980s, but it may be overtaken by China in the future.

One company looking to tap into China's rise is CP Land, a property arm of Charoen Pokphand Group.

It has formed a joint venture with Guangxi Construction Engineering Group, one of China's largest construction companies, to set up CPGC Industrial Estate in Rayong on 3,068 rai.

CP Land is targeting Chinese investors in four sectors: smart electronics, medical hub products and services, digital and robotics.

"It is not just developers of serviced land in industrial estates that are gaining from China's growing role in the Thai economy," said Adam Bell, head of advisory and transaction services (industrial and logistics) with CBRE Thailand.

"Chinese e-commerce companies are going to drive the demand for modern logistics properties in Thailand."

For example, he said, joint ventures were announced last year between WHA, Thailand's biggest modern logistics property developer and China's two biggest e-commerce companies, Alibaba and JD.com, to build e-commerce fulfilment centres.

CBRE believes that e-commerce in Thailand is going to grow as rapidly as it has elsewhere in the world, with Chinese e-commerce companies significantly increasing demand for logistics properties, said Mr Bell.

"The ongoing trade war between the US and China will continue to benefit the Thai industrial land market as manufacturers relocate to Thailand," he said.