Influencer Sawyer Merritt has slammed investment firm Charles Schwab for voting against Tesla Inc. (NASDAQ:TSLA) CEO Elon Musk's trillion-dollar pay packet, threatening to move all of his assets to other brokerage firms.

Check out the current price of TSLA here.

We Are Ready To Move Shares, Merritt Says

Jason DeBolt, an influencer and Tesla investor, called out the firm on Monday for voting against the pay package, outlining that 6 of the firm's ETF funds voted against Tesla's recommendation. The funds, according to DeBolt, manage over 7 million Tesla shares.

"If Schwab's proxy voting policies don't reflect shareholder interests, my followers and I will move our collective tens of millions in $TSLA shares," DeBolt said. Quoting DeBolt's post, Merritt, too, called out Charles Schwab on Monday.

"I can't in good conscience stay with a brokerage that votes against this CEO Performance Award plan," Merritt said, adding that the package was "clearly in shareholders' best interests." He also noted that the Board's recommendations in the past have delivered "extraordinary returns."

Elon Musk's Pay Package Faces Opposition

Ahead of this month's Tesla shareholder meeting, Musk's pay package has been facing opposition. Recently, proxy advisory firms like International Shareholder Services (ISS) and Glass Lewis recommended investors vote against the pay package, which prompted Musk to call them "corporate terrorists" during Tesla's earnings call.

California Public Employees Retirement System (CalPERS), a fund holding over $2 billion in Tesla shares, also opposed the pay package, saying that the award would consolidate power. Musk's pay package also received criticism from investment firm Gerber Kawasaki's co-founder Ross Gerber, who called it "insanity" and questioned the Board's independence from Musk's influence.

Substantial Support For Pay Package

Meanwhile, the pay package has also received support from firms and industry experts, including ARK Invest CEO Cathie Wood, who predicted that the package would win "decisively" at the shareholder meeting. Wood also criticized the proxy advisory firms.

The package was also backed by TV host Jim Cramer, who said that Musk was actually worth the compensation award, "unlike so many other CEOs." Cramer had earlier also urged investors not to be "small-minded" and vote in favor of the package.

Meanwhile, the State Board of Administration (SBA), a Florida-based agency responsible for managing and investing the Florida Retirement System's (FRS) trust fund, also backed the package. The SBA owns over $1 billion in Tesla shares.

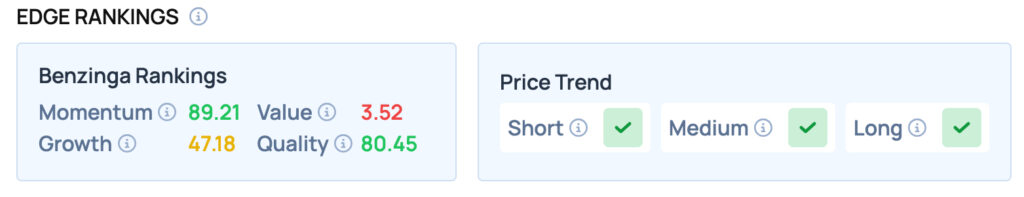

Tesla scores well on Momentum and Quality metrics, while offering satisfactory Growth, but poor Value. Tesla also has a favorable price trend in the Short, Medium and Long term. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Check out more of Benzinga's Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: Shutterstock