My focus is split – student loans and savings. I just updated you on my debt load after payments made this month. Now it’s time for a savings update.

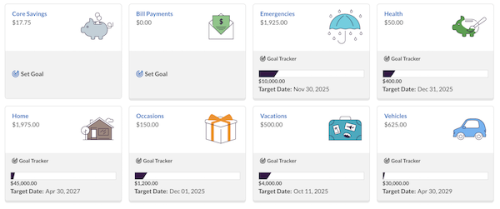

I currently have a total of $6,249 in my personal savings accounts. $807 is in my long standing personal savings account. And the rest is in my new Ally savings account assigned to all my savings buckets that I created when I created my budget. There was original (post house sale $4,000 more in savings. I will explain use when I get a May finance update together.)

*Note: before you come for me, this image only shows $6,049 as there is a $200 transfer pending.

How do you like Ally?

I am so grateful to the person in my comment about a high yield savings account who recommended Ally. I LOVE, LOVE, LOVE the buckets and related goal and date feature. And then seeing cumulative total is very motivating.

It’s been so easy to set up and use. And feels “far away” so I’m not at all tempted to look at it often let alone touch the money there.

My only complaint is that transfers take anywhere from 3-4 business days. While they take the money out of my account on day 1, they take 3-4 days to deposit it into my account. (Even if they listed it as Not Available). They do show the transfer as pending, but seems like a stretch to take that long to even record in my account.

I only have the single savings account. And I’ve already earned just over $17 in interest. And that’s in just over a month. Woot, woot!

Very motivating.

Future Plan

The plan remains the same, with a small hiccup of this unplanned stay in GA while Beauty and fiance recover from 4 wheeler accident.

I will continue to live with my parents, helping care for my mom (and dad as needed) until I am no longer needed. Things are working well with dad. I take care of day time care – feeding, bathing, and changes. And then cook several times a week for dad and I, eating leftovers in between. Dad handles evening care and is free to get out of the house during the day. We are both quite happy with this schedule.

And I’m able to work around mom’s schedule, and vice versa. I start at 4:30am daily. And we make it work. I am diligently saving and paying some extra to my student loans every month. But I think I am leaning slightly more to saving.

My siblings have stepped back in while I am here in GA.

The post Savings to Date – Ally Review appeared first on Blogging Away Debt.