An index tracking Saudi Arabian banking shares erased earlier losses and finished little changed after lenders reached settlements worth 16.7 billion riyals ($4.5 billion) with the kingdom’s tax authority over an Islamic levy.

The Tadawul Banks Index ended little changed after dropping as much as 3.1 percent at the open, with eight of its 12 members in retreat at the end of the session. The main Saudi equity gauge lost 0.3 percent, as a slump in oil prices last week added to the negative sentiment.

The Saudi tax authority had extended the 2.5 percent religious levy, known as the Zakat, by including items that were previously exempt while eliminating some deductions. The lenders had previously appealed against the extension.

Meanwhile, Brent crude, the kingdom’s biggest source of revenue, plummeted 11 percent last week to the lowest level in more than a year. The 120-day correlation between Saudi stocks and oil is at the highest level in more than two years.

Tax Pain

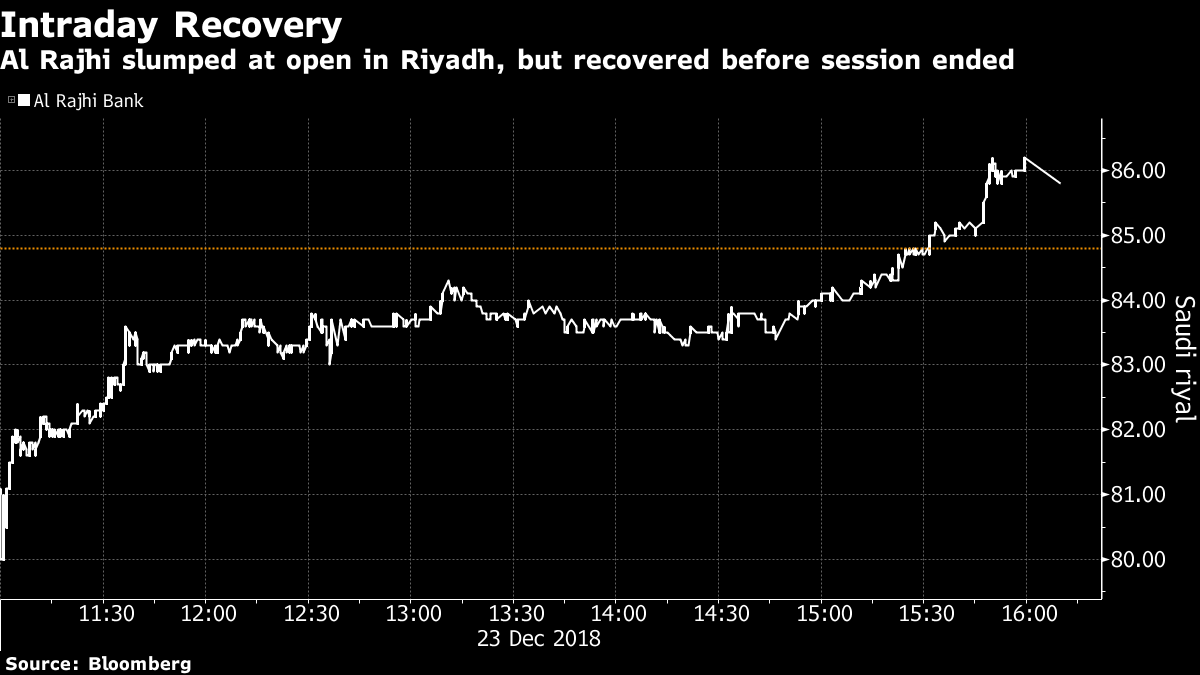

Al Rajhi Bank, the second-biggest Saudi lender by market capitalization, was hit with 5.41 billion riyals, the highest payment among its peers. The shares, which sank as much as 5.7 percent on Sunday, recovered in the final hour of the the session to climb 1.2 percent at close.

The settlement removes a cloud for Saudi banks that has been “hanging around for a while,” though the banks were expecting a much better outcome, said Edmond Christou, a Dubai-based analyst at Bloomberg Intelligence. He said Al Rajhi had provisioned for only 5.2 billion riyals in a worst-case scenario.

Banque Saudi Fransi and Samba Financial Group fell more than 2 percent.

The banking index is still up 27 percent for the year, almost four times as much as the broader benchmark for Saudi stocks.

To contact the reporter on this story: Filipe Pacheco in Dubai at fpacheco4@bloomberg.net

To contact the editors responsible for this story: Celeste Perri at cperri@bloomberg.net, Keith Campbell, Shaji Mathew

©2018 Bloomberg L.P.