Anybody who encountered Sam Zell — be they one of his executives, a rival in a business deal, a foundation chief or a journalist — knew where they stood with him.

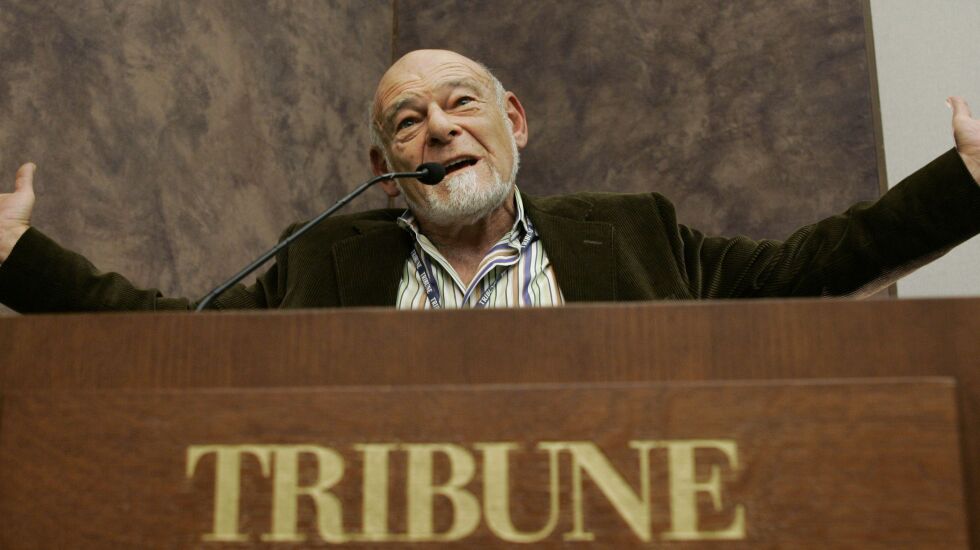

Mr. Zell was raspy-voiced and blunt, with little patience for cockeyed ideas or sentimentality. He exulted in his reputation for using salty language even in politically correct times. It made him popular on the speaking circuit, where attendees eagerly listened for his business insights and for the entertainment he might provide.

Mr. Zell died Thursday at home due to complications from a recent illness, said Equity Group Investments, where he was chairman. He was 81.

With a career lasting more than 60 years, Mr. Zell amassed one of the leading fortunes in Chicago business circles. It was centered on real estate, but expanded into many other fields, including transportation, energy, manufacturing and radio stations.

He had a penchant for taking over companies that needed a turnaround, or “dancing on the skeletons of other people’s mistakes,” as he wrote in a 1970s article. It carried the title “The Grave Dancer,” and the nickname became his calling card. In 2017, Mr. Zell published a book that played on his nature, called “Am I Being Too Subtle?”

Those close to him knew he had another mantra — don’t take yourself too seriously. Moreover, have some fun. He used to lead a group of friends called Zell’s Angels on motorcycle rides around the world. He was an avid skier of the toughest runs.

Around the office, he favored jeans and open-collared shirts long before the tech crowd made them hip.

“Sam lived life testing his limits and helping those around him do the same. He was a self-made entrepreneur, an industry creator and leader, a brilliant dealmaker, a generous philanthropist, and the head of a family he fiercely loved and protected,” said Scott Peppet, president of Chai Trust Co. and Mr. Zell’s son-in-law.

“He had an unapologetic passion for life, a brilliant mind, a contagious wit and a deep sense of civic responsibility and personal loyalty. All those who loved and learned from him will miss him terribly,” said Peppet.

In its announcement of Mr. Zell’s death, Equity Group said, “Beloved by family, friends, employees, and colleagues, Sam was an honest, straightforward, inspiring, creative, kind and brilliant man. He valued and embodied humor, loyalty and integrity. Above all, he achieved his own vision for his legacy: He was unfailingly a man of his word, or shem tov, the Hebrew term for a good name or reputability.”

Making history

Forbes has estimated Mr. Zell’s fortune at $5.2 billion. He popularized the concept of real estate investment trusts, or REITs, which allow people to invest in broad property holdings via stock ownership. Among the companies he founded was Equity Residential, an owner of apartment buildings that Mr. Zell started while a student at the University of Michigan.

Mr. Zell also was chairman of Equity LifeStyle Properties, which owns mobile home communities and parks and campgrounds for recreational vehicles. His portfolio at various times included Schwinn Bicycle Co. and mattress maker Serta.

He formerly owned Equity Office Properties Trust but sold it in 2007 for $39 billion. It was the biggest leveraged buyout in corporate history and widely regarded as the crowning deal of Zell’s career. He personally cleared about $1.1 billion.

Most of Mr. Zell’s deals were hits, but his reputation suffered after a high-profile failure — the same year as his Equity Office triumph. Mr. Zell struck a debt-fueled agreement to buy Tribune Co., then the owner of the Chicago Tribune, Los Angeles Times, other major papers and TV stations. He followed his playbook by cutting jobs and selling noncore assets, including the company’s Chicago Cubs.

But he made the move as the Great Recession and changing technology chomped at revenue, and Tribune declared bankruptcy just a year later. Even as the sale closed, Mr. Zell called it “the deal from hell.” The company’s failure cost him $315 million, and the bankruptcy led to a restructuring that cost about 4,200 jobs.

Over the years, Mr. Zell became irritated when reporters questioned him about the rare defeat. He preferred that they focus on the jobs he created throughout his business career.

In a 2012 interview with the Financial Times, he said his premise in buying Tribune was sound but was overwhelmed by a quick 30% drop in revenue that he said no business could have survived. Urging the interviewer to focus on other things, Mr. Zell said, “And I have a lot of other things in my life that I’m doing. This was a very important investment for us five years ago. It didn’t work out.”

Life on his own terms

Longtime business associates remembered Zell as roaring through life on his own terms, but with a devotion to philanthropy and to bringing others into the business world.

“Sam’s insatiable intellectual curiosity and passion for deal-making created some of the most dynamic companies in the public real estate industry,” Mark Parrell, Equity Residential’s CEO, said. “He was a generous philanthropist and an incredible mentor and friend and will be missed by all who were lucky enough to be part of his extraordinary world.”

Debra Cafaro, chairperson and CEO of Ventas, which owns health care facilities, said Mr. Zell’s “endorsement at key inflection points helped propel my career in real estate at a time when there were almost no women in the industry.”

Among Chicago’s monied A-listers, Mr. Zell’s annual birthday bashes were a celebrity-studded affair. He hired the Eagles, Jay Leno, Elton John and others to entertain guests.

For the New Year’s holiday, Mr. Zell used to send several hundred people a gift, a music box with custom figures and his recorded voice talking about an economic issue, often a warning against excesses. A 2012 gift satirized Ben Bernanke and the Federal Reserve for, in Mr. Zell’s view, keeping interest rates too low and printing too much money. Some of the gifts have become collectors’ items.

Mr. Zell was born Shmuel Zielonka in Chicago on Sept. 28, 1941, about four months after his parents landed in the United States from Poland, having escaped Nazi persecution of the Jews. His parents, Bernard and Rochelle Zielonka, shortened the family name to Zell.

In an interview posted online by Equity Group Investments, Mr. Zell said, “Growing up as the kid of an immigrant, things were a lot different in my house than they were at everybody else’s house. And so the little question in all of that wrapped together produced a different person than the average. And whatever else I might claim to be, I for sure claim to be different.”

His father was a jewelry dealer who dabbled in real estate. The family settled in Albany Park but moved to Highland Park, where Mr. Zell graduated from high school.

He showed his bent for entrepreneurship as a boy, buying Playboy magazines and selling them at a markup to friends. At the University of Michigan, he managed apartments in exchange for free room and board.

He got a law degree, but gravitated to real estate with fraternity brother Robert Lurie, who became a business partner and prominent investor in his own right. Lurie’s death from cancer in 1990 deeply affected Mr. Zell.

The Lurie and Zell names are attached to foundations for entrepreneurship at the University of Michigan and at the University of Pennsylvania’s Wharton School. Mr. Zell also supported programs at Northwestern University’s Kellogg School of Management and Reichman University in Israel.

Mr. Zell was active in business and in media engagements until his death. In the last few weeks, he criticized the Federal Reserve and work-from-home culture in his characteristic manner. He was quoted as saying the Federal Reserve “screwed up” by hiking interest rates and that working from home was “bulls---.”

Mr. Zell is survived by his third wife, Helen. She is executive director of the family foundation, which is active in arts and education. Survivors also include three children, two sisters and nine grandchildren.

Services have not been announced.