Salesforce (CRM) has been in the news a lot this week following a large companywide layoff.

The software giant will ax about 10% of its workforce, eating a cost of $1.4 billion to $2.1 billion in a streamlining effort.

It’s the latest Big Tech company to pare its workforce. Amazon (AMZN) recently upped its job-cut count to 18,000.

While the tech-job losses are piling up, that’s not the case for the broader economy, which added 223,000 jobs in December, beating economists’ expectations on Friday morning.

Salesforce stock recently made 52-week lows in December, down 60% from its highs. While trying to put together its third straight weekly gain, there are still concerns from a technical perspective.

Trading Salesforce Stock

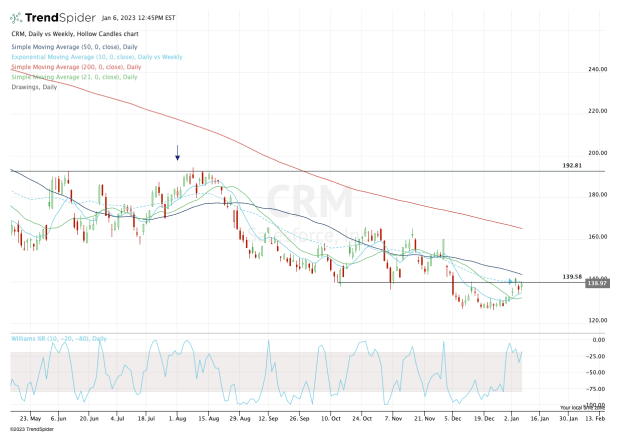

Chart courtesy of TrendSpider.com

The daily chart above highlights the stock’s struggle with the $140 area. Notice how that was strong support in October and November, then resistance in December.

All the clues were there for traders who did not have a bias and simply took the price action for what it was.

Now the stock is trying to reclaim this key pivot area, while also contending with its declining 10-week moving average.

If it clears this area, it’s a win for the bulls -- although it may be a short-term victory.

On the upside, it would put the 50-day moving average in play, followed by the gap-fill at $150.13. If the stock really turns on the bullish jets, the $160 to $165 area could be in play, along with the 200-day moving average.

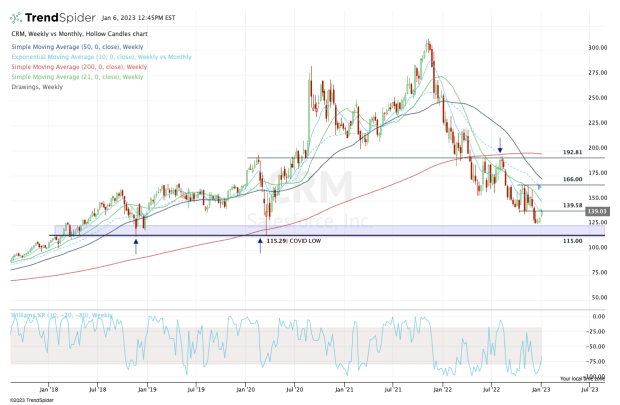

Chart courtesy of TrendSpider.com

Salesforce has already dipped into the mid-$120s once, but what long-term buyers are really looking for is the $115 to $120 area and preferably the lower end of that range.

The reason why is clear when we look at the weekly chart above.

The risk that these $115 buyers run is that Salesforce stock never falls that far and instead of just buying a 59% decline, they’ll get left out of the next bull run by waiting for a 63% decline (which would be the peak-to-trough fall from the all-time high down to $115).

That said, we’re in a bear market with a stock that’s in a clearly defined downtrend.

So it’s not unreasonable to wait for lower prices and it’s not unreasonable to think that Salesforce stock can break below $115.

But it’s the level that long-term buyers should keep an eye on going forward.