Salesforce Inc. (NYSE:CRM) posted better-than-expected results for the second quarter and raised its FY2026 guidance. However, the company issued third-quarter sales guidance with its midpoint below estimates.

Salesforce reported second-quarter revenue of $10.24 billion, beating the consensus estimate of $10.14 billion, according to Benzinga Pro. The company reported second-quarter adjusted earnings of $2.91 per share, beating analyst estimates of $2.78 per share.

Salesforce expects third-quarter revenue to be in the range of $10.24 billion to $10.29 billion, versus estimates of $10.29 billion.

Salesforce also raised its fiscal-year 2026 revenue guidance to a range of $41.1 billion to $41.3 billion versus estimates of $41.2 billion. The company raised its full-year adjusted earnings guidance to $11.33 and $11.37 per share versus estimates of $11.31 per share.

"These results reflect the success of our customers — like Pfizer, Marriott, and the U.S. Army — who are transforming into agentic enterprises, where humans and AI agents work side by side to reimagine workflows, accelerate productivity and deliver customer success," said Marc Benioff, chair and CEO of Salesforce.

Salesforce shares fell 5% to trade at $243.60 on Thursday.

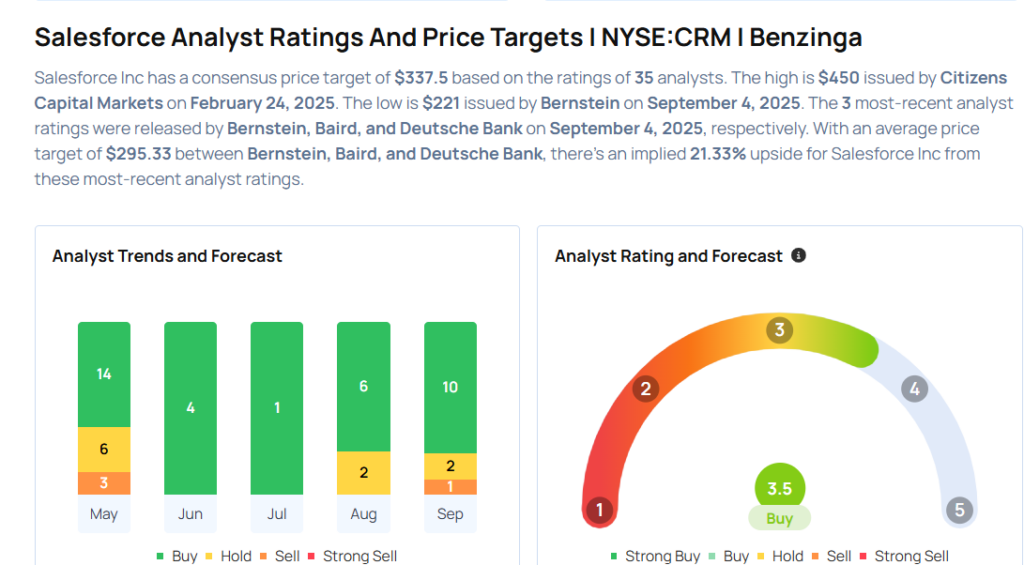

These analysts made changes to their price targets on Salesforce following earnings announcement.

- Piper Sandler analyst Brent Bracelin maintained Salesforce with an Overweight rating and lowered the price target from $335 to $315.

- JP Morgan analyst Mark Murphy maintained the stock with an Overweight rating and lowered the price target from $380 to $365.

- Canaccord Genuity analyst David Hynes maintained Salesforce with a Buy and cut the price target from $350 to $300.

- Keybanc analyst Jackson Ader maintained Salesforce with an Overweight rating and lowered the price target from $440 to $400.

- Wells Fargo analyst Michael Turrin maintained Salesforce with an Equal-Weight rating and lowered the price target from $275 to $265.

- RBC Capital analyst Rishi Jaluria maintained Salesforce with a Sector Perform and lowered the price target from $275 to $250.

- BMO Capital analyst Keith Bachman maintained the stock with an Outperform rating and lowered the price target from $335 to $280.

- Wedbush analyst Daniel Ives maintained Salesforce with an Outperform rating and lowered the price target from $425 to $375.

- Baird analyst Rob Oliver maintained the stock with an Outperform rating and lowered the price target from $365 to $325.

- Bernstein analyst Mark Moerdler maintained Salesforce with an Underperform rating and lowered the price target from $255 to $221.

Considering buying CRM stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock