/RTX%20Corp%20logo%20on%20phone-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $269.9 billion, RTX Corporation (RTX) is a global aerospace and defense company serving commercial, military, and government customers through its three operating segments: Collins Aerospace, Pratt & Whitney, and Raytheon.

Shares of the Arlington, Virginia-based company have significantly outperformed the broader market over the past 52 weeks. RTX stock has jumped 56.5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 16.1%. Moreover, shares of the company are up 9.5% on a YTD basis, compared to SPX’s 1.9% rise.

Focusing more closely, shares of the aerospace and defense company has outpaced the State Street Industrial Select Sector SPDR ETF’s (XLI) 18.8% return over the past 52 weeks.

Shares of RTX rose 3.7% on Jan. 27 after the company reported Q4 2025 adjusted EPS of $1.55 and revenue of $24.24 billion, both topped forecasts. Investors were encouraged by sharply higher cash generation, with free cash flow of $3.2 billion and full-year 2025 free cash flow of $7.9 billion, up $3.4 billion year-over-year. The rally was further supported by a strong 2026 outlook, including adjusted EPS guidance of $6.60 - $6.80 and free cash flow of $8.25 billion - $8.75 billion.

For the fiscal year ending in December 2026, analysts expect RTX’s adjusted EPS to grow 6% year-over-year to $6.67. The company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

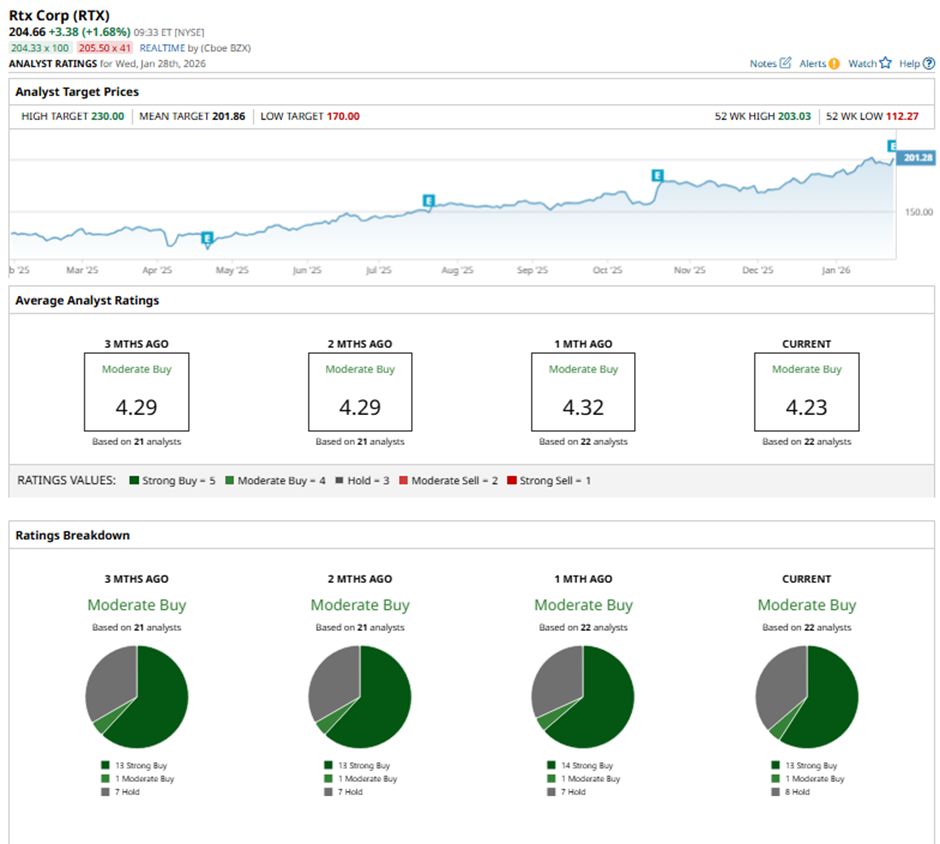

Among the 22 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 13 “Strong Buy” ratings, one “Moderate Buy,” and eight “Holds.”

On Jan. 28, UBS analyst Gavin Parsons raised RTX’s price target to $208 while maintaining a “Neutral” rating.

As of writing, the stock is trading above the mean price target of $201.86. The Street-high price target of $230 suggests a 12.4% potential upside.