Royal Caribbean Cruises Ltd (NYSE:RCL) shares are trading higher Tuesday afternoon as record-breaking travel demand collides with renewed optimism for a Federal Reserve pivot. Here’s what investors need to know.

- RCL is among today’s top performers. Check the full analysis here.

What To Know: New data confirms a historic holiday rush, with CNN reporting that 81.8 million Americans are projected to travel for Thanksgiving, up 1.6 million from last year and marking the busiest travel period in 15 years.

While this surge underscores the resilience of the experience economy, the stock is also reacting to the skyrocketing 81% probability of a December rate cut. For a capital-intensive operator like Royal Caribbean, a reduction in the federal funds rate is financially beneficial.

Royal Caribbean carries significant debt servicing obligations resulting from pandemic-era liquidity measures and continuous fleet expansion. A rate cut reduces the cost of capital, allowing the company to refinance high-yield debt and significantly lower interest expenses, which directly accretes to earnings per share.

Furthermore, while Tuesday data indicates spending fatigue and cooling retail sales, a rate cut acts as a critical stabilizer for RCL's core revenue driver: the consumer.

By lowering borrowing costs on credit cards and home equity lines, the Fed would preserve the discretionary income necessary for middle-class families to continue prioritizing high-margin cruise bookings over goods.

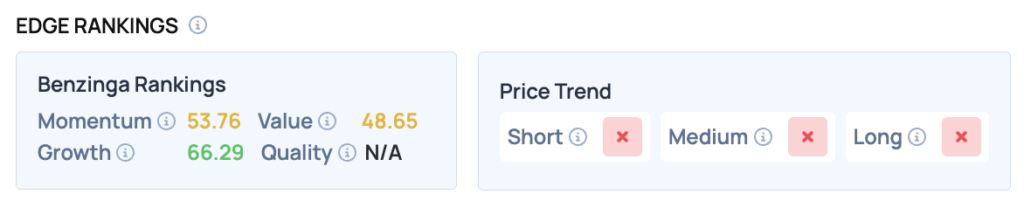

Benzinga Edge Rankings: Benzinga Edge data highlights Royal Caribbean's underlying potential, assigning the stock a robust Growth score of 66.29, outpacing its Momentum (53.76) and Value (48.65) metrics.

RCL Price Action: Royal Caribbean shares were up 5.22% at $268.92 at the time of publication on Tuesday, according to Benzinga Pro data.

Read Also: Carnival Stock Is Cruising Higher Tuesday: Here’s Why A December Rate Cut Could Be Huge

How To Buy RCL Stock

By now you're likely curious about how to participate in the market for Royal Caribbean – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock