/Ross%20Stores%2C%20Inc_%20outside%20sign%20by-%20Ken%20Wolter%20via%20Shutterstock.jpg)

Dublin, California-based Ross Stores, Inc. (ROST) is an operator of home fashion and off-price retail apparel stores. With a market cap of approximately $51 billion, Ross Stores offers apparel, accessories, footwear, and home fashion items through its outlets spread across various U.S. states.

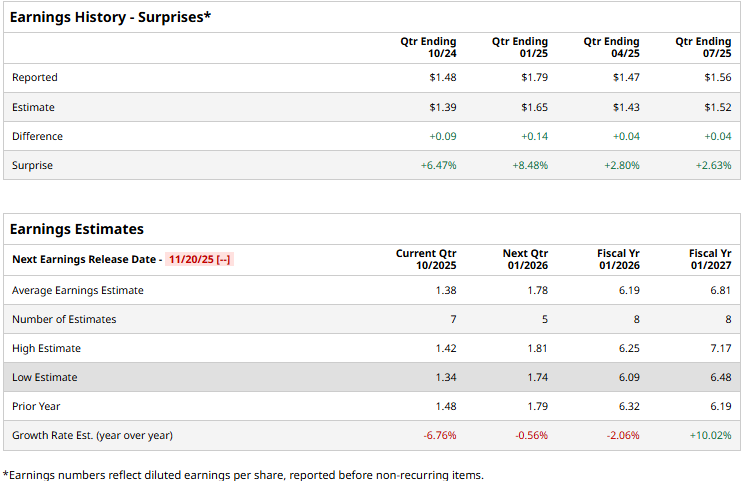

The apparel retailer is gearing up to announce its third-quarter results in the upcoming month. Ahead of the event, Ross Stores is expected to report a profit of $1.38 per share, down 6.8% from $1.48 per share reported in the year-ago quarter. On a more positive note, the company has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, analysts expect ROST to deliver an EPS of $6.19, down 2.1% from $6.32 reported in 2024. While in fiscal 2026, its earnings are expected to rebound 10% year-over-year to $6.81 per share.

ROST stock prices have gained 8.6% over the past 52 weeks, lagging behind the S&P 500 Index’s ($SPX) 16.9% gains and the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 18.7% returns over the same time frame.

Ross Stores’ stock prices gained 1.1% in the trading session following the release of its mixed Q2 results on Aug. 21. Given that most of the tariffs announced in early April were delayed by the government in Q2, the company’s sales and earnings didn’t take as big a hit as previously anticipated. The company’s topline for the quarter increased 4.6% year-over-year to $5.5 billion, coming mostly in line with Street expectations. Meanwhile, its EPS for the quarter dropped 1.9% year-over-year to $1.56, surpassing the consensus estimates by 2.6%.

However, the company’s performance can get severely impacted in the coming quarters, due to high tariffs imposed by the Trump administration on the Asian countries that manufacture and export textiles and garments to the US.

Analysts remain optimistic about the stock’s prospects. ROST has a consensus “Moderate Buy” rating overall. Of the 20 analysts covering the stock, opinions include 14 “Strong Buys” and six “Holds.” Its mean price target of $163.75 suggests a modest 4.5% upside potential from current price levels.