Prominent investment adviser Ross Gerber said Sunday he rejects gambling as a path to prosperity, renewing a message he's pushed to his large social-media following.

Ross Gerber Believes Gambling Is Not Wealth Building

"Gambling is not a way to build wealth. Investing for the long term, buying great companies and holding them, works. It just does," Gerber wrote on X.

Gerber's remarks follow his criticism Saturday of Robinhood Markets Inc.’s (NASDAQ:HOOD) push into sports outcome "event contracts." "It's absurd that people can bet on sports at a regulated financial firm and somehow this doesn't fall under state gambling guidelines," he posted, faulting what he views as a regulatory end run.

Are Prediction Markets The Future Of Investing?

Robinhood and partner Kalshi describe the products as federally regulated prediction markets, not traditional sports betting, and say they're offered through a Commodity Futures Trading Commission, aka CFTC-registered futures unit. The firm added NFL and college football markets this month.

Robinhood argues that prediction markets provide insight and "societal value" while complying with federal law. Massachusetts' top securities regulator opened a probe in March and gaming authorities in Nevada and New Jersey have challenged sports contracts in court.

The Regulatory Battle Over Investing In Sports Betting

Gerber has pressed the distinction between investing and speculation before. In March 2024, after a trader nearly wiped out a margin account during Tesla's 2022 swings, he cautioned, "Crazy risk-taking makes no sense. Gambling is not investing." He has frequently urged clients to avoid margin and concentrate on long-term holdings instead of short-term wagers.

The debate lands as prediction markets grow on mainstream platforms and retail participation remains elevated. Robinhood says prices in event contracts are set by market participants, not a sportsbook's odds, and that users can trade in and out before outcomes settle.

Price Action: HOOD shares closed lower by 1.26% to $107.94 on Monday, according to Benzinga Pro.

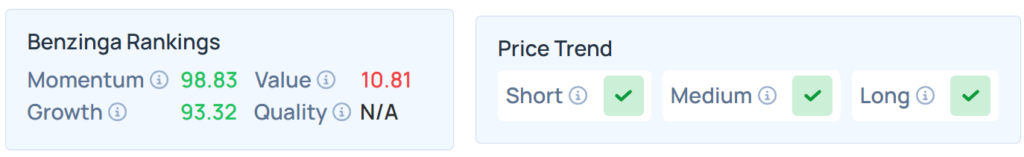

Benzinga Edge Stock Rankings show that Robinhood exhibits exceptional strength in specific areas. The stock boasts a Momentum score of 98.83 and a Growth score of 93.32, placing it in the top tier of all stocks analyzed. Check here to see how it performs on other key metrics.

Read Next:

Photo Courtesy: mr_tigga on Shutterstock.com