As the Federal EV Credit officially ended on Wednesday, October 1st, investors like Gerber Kawasaki's co-founder Ross Gerber and Deepwater Asset Management's investor Gene Munster weighed in on its impact on Tesla Inc. (NASDAQ:TSLA)

Check out the current price of TSLA here.

‘Winter Is Coming,' Ross Gerber Says

Taking to the social media platform X on Wednesday, the investor shared his thoughts in a post, acknowledging the positive effect of the sales rush preceding the end of the $7,500 credit. "Seeing a lot of new teslas on the road as the rush to cash in on the credits definitely helped the qtr in a big way," Gerber said.

However, the investor also noted that the sales rush wouldn't last following the end of the EV credit. "Sadly though, this is the end of the rush and winter is coming…" Gerber said.

Gene Munster Says Traditional Automakers Have ‘Read The Tea Leaves Wrong’

Meanwhile, Munster hailed the end of the EV credit as a positive factor in the long term for Elon Musk's EV giant in an interview with CNBC on Wednesday. Munster said that while there was a near-term advantage of the EV credit as people rushed to buy vehicles at a lesser price, the "sunsetting of this tax credit effectively has caused traditional automakers to slow their investments."

He also added that traditional automakers have "read the tea leaves wrong" with investing in EVs following the end of the tax credit, as a lack of investments would put them in an "awkward position" to scale up EVs.

Munster also acknowledged that first-time Tesla buyers, in conversation with Munster, have been "surprised" by the Full Self-Driving (FSD) system. He shared that Tesla has an EV production scale advantage when it comes to production, but conceded that the Robotaxi rollout has been slower than expected, with more interventions than previously predicted.

"I think we will have a moment. It's not gonna be linear, I think it's gonna be a breakout moment when it comes to the ability of these models to drive safely," Munster said.

GM, Ford Working On Extending EV Credit

The news comes as General Motors Co. (NYSE:GM) and Ford Motor Co. (NYSE:F) are both reportedly extending the EV incentives on their vehicles by making a down payment on units to their dealers to qualify the vehicles for the credit through the companies' financing arms.

Gavin Newsom Confirms Incentive Rollback, Trump’s Anti-EV Decisions

With the EV incentives ending, California Governor Gavin Newsom confirmed that the state wouldn’t be offering the planned state incentives on EVs through backfilling after the September 30 deadline. “We can’t make up for federal vandalism of those tax credits,” Newsom said, adding that California would instead focus on improving the charging infrastructure in the state to promote EV adoption.

Meanwhile, the ending of the EV credit is just one of multiple anti-EV decisions taken by President Donald Trump, which have hit Tesla and other EV makers. The administration also relaxed CAFE (Corporate Average Fuel Economy) norms, taking legal pressure off traditional automakers to adhere to fuel economy and emissions standards.

The relaxation has effectively made the sale of ZEV credits, a major source of revenue for EV makers, redundant. Selling ZEV credits also accounted for almost $2.8 billion in revenue for Tesla in 2024.

The EV giant also urged the Trump administration’s Environmental Protection Agency to reconsider the proposal to rescind the 2009 Endangerment Finding. Repealing the standards would “give a pass to engine and vehicle manufacturers for all measurement, control, and reporting of GHG emissions for any highway engine and vehicle," Tesla said.

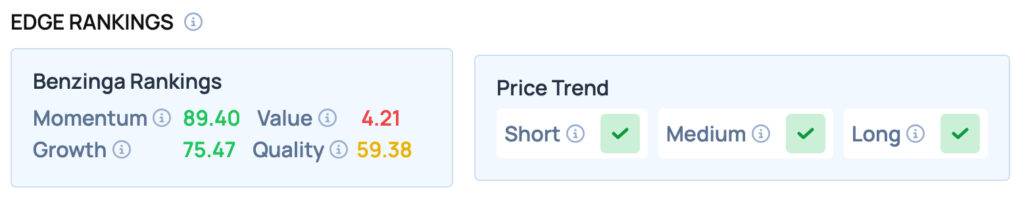

Tesla scores well on Momentum and Growth metrics, while offering satisfactory Quality, but poor Value. Tesla also offers a favorable price trend in the Short, Medium and Long term. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Photo Courtesy: Aliaksei Kaponia on Shutterstock.com

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next: